Biopesticides Market Analysis 2025-2030: Trends, Growth, Segmentation & Future Outlook

Discover the growth trends, market drivers, and future projections of the biopesticides industry. Learn about key product segments, regional dynamics, and innovations shaping the market from 2025 to 2030.

Explore the Biopesticides Industry: Key Drivers, Market Segmentation, and Regional Dynamics

Biopesticides are pest control agents derived from natural organisms such as plants, animals, bacteria, and minerals. They provide a natural, eco-friendly, and sustainable alternative to synthetic chemical pesticides. Biopesticides can be classified into three major classes: microbial pesticides, biochemical pesticides, and plant-incorporated protectants. Microbial pesticides contain living microbes, such as bacteria, fungi, or viruses, and work by infecting or hindering the growth of pests. In contrast, the category of biochemical pesticides encompasses natural materials like pheromones, plant extracts, and minerals that interfere with pest behavior or physiology. These compounds produce pest-resistant proteins due to plant genetic modifications (plant-incorporated protectants). Biopesticides have gained considerably in conventional and organic farming as global climate concerns increase about synthetic chemicals' negative environmental and health impacts. They offer a promising answer in place of chemical residues, reducing pest resistance and introducing biodiversity in agricultural ecosystems.

There are three main types of biopesticides:

- Microbial Pesticides: Bacteria, fungi, or viruses used to manage pests.

- Biopesticides: Defense chemicals, like plants or pheromones, for gut health.

- Plant-incorporated protectants (PIPs) refer to the materials produced by genetically modified plants that protect against pests.

Overview of the Biopesticides Market

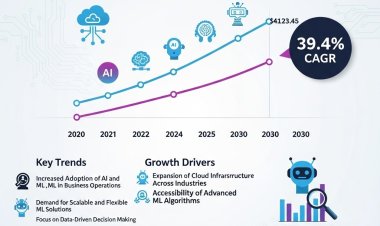

The Biopesticides Market has seen exponential growth in recent years, driven by growing demand due to environmental determination, increasing demands for organic food, and various regulatory measures for chemical pesticides. In 2022, the biopesticides market was valued at $5.75 billion and is projected to reach $17.57 billion by 2030, at a CAGR of 15.00% from 2023 to 2030. Several factors have driven this strong market growth. However, the growth in the biopesticide market is primarily attributed to one such factor, which includes the increasing demand for organic food (due to health-conscious consumers and growing concerns related to pesticide residues in food). Second, due to government regulations and a ban on harmful synthetic pesticides, the increasing adoption of biopesticides in North America and Europe has also boosted the market.

Get Access to A Sample Report with List of TOC, Charts, Figures @ https://www.vantagemarketresearch.com/biopesticides-market-1854/request-sample

Moreover, the growing problem of pest resistance to conventional chemical pesticides has made biopesticides very appealing alternatives. Synthetic chemicals face rising pests' immunity against them and the need for integrated pest control, which can yield the best results in sustainability. Biopesticides provide a more targeted and environmentally preferable solution, reducing the chances of resistance.

Other emerging trends in the biopesticides market are related to microbial innovations, such as the formation of microbial consortia and CRISPR-edited strains that improve pest control efficacy. Furthermore, implementing digital technologies into farming, like AI-enabled precision application tools, is also projected to fuel the market growth. The collaboration of agribusinesses, start-ups, and academic institutions is encouraging innovations and advancing research in the biopesticides space, further boosting the expansion of this market.

Segmentation Insights

The global biopesticides market can be broken down into various sections based on the information they afford regarding the changing dynamics of the global market.

Crop Type:

Based on crop type, fruits, and vegetables dominate the biopesticides market. Fruits and vegetables hold a segmental share of around 40%, primarily attributed to the growing demand for residue-free and organic produce. Cereal and grain crops, including corn and wheat, are steadily adopting value chain strategies as they are the highest volume crops traded globally and must adhere to wheat export compliance standards. Oilseeds and pulses are also an important segment, and bioherbicides are growing for crops such as soybeans and canola.

By Crop Type

- Cereal & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Other Crop Types

Formulation Type:

Liquid and dry are the two forms of biopesticide available; the liquid form accounts for most of the biopesticide market share (65%). Liquid formulations are favored for the ease of application and compatibility with current spray systems. In contrast, dry formulations are primarily used in seed treatment and have better storage stability.

By Formulation Type

- Liquid Formulation

- Dry Formulation

Source:

The source of the product can segment the biopesticides market. Microbial pesticides, with Bacillus spp, represent the largest share (50%) . Trichoderma fungus is the most commonly used microorganism, and it is also the most commonly used pest control agent. Biochemical pesticides, such as neem oil and pheromones, are also becoming popular as they are effective yet environmentally friendly.

By Source

- Microbial Pesticides

- Biochemical Pesticides

- Plant-Incorporated Protectants

By Application:

The treatments are available in foliar spray, seed treatment, and soil treatment, among other methods. Foliar spray is the most widely used, representing 45% of the market share, because it delivers immediate pest control. A growing number of growers are preferring this approach to receiving early-stage protection against pests and diseases.

By Mode of Application

- Seed Treatment

- Soil Treatment

- Foliar Spray

- Other Modes of Application

By Product:

Biopesticides encompass products such as bioinsecticides, bio fungicides, bioherbicides, bionematicides, and other products like plant growth regulators. The market is mostly composed of bioinsecticides, especially those targeting insects such as lepidoptera and aphids. The fastest-growing segment is bionematicides due to the growing focus on soil health and nematode control.

By Product

- Bio Insecticides

- Bio Fungicides

- Bio Herbicides

- Bionematicides

- Others (including Plant Growth Regulators)

Region:

Geographically, North America accounted for the highest market share (35%) due to the U.S. being a significant player in organic farming and biopesticides. India and China are among those fuelling significant growth in the Asia-Pacific region, which is witnessing rapid adoption of biopesticides.

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Don’t miss out on this exclusive opportunity, enjoy a 25-35% discount @ https://www.vantagemarketresearch.com/buy-now/biopesticides-market-1854/0

Market Dynamics

The biopesticides market dynamics play a meaningful role depending on how the market is growing and what challenges it faces.

Growth Drivers:

The worldwide market is mainly driven by the increasing demand for organic food, where consumers are looking for healthier and pesticide-free crops. Retail sales of organic foods in the United States have undergone sustained growth of over 12 percent a year. Furthermore, financial incentives from the government and government imposition for sustainable farming practices are expected to drive the growth of biopesticides. Governments worldwide offer incentives for adopting eco-friendly pest control methods to promote environmental sustainability.

Restraints:

While the growth prospects are positive, the biopesticides market is also not devoid of challenges. However, compared to conventional chemical pesticides, biopesticides are often viewed as less effective, which is a major restraint for the market. In some cases, farmers might be reluctant to adopt biopesticides because they have a slower action and worse effectiveness. Moreover, biopesticides may be more expensive to produce, which also drives up costs for farmers.

Opportunities:

The biopesticides industry has a lot of potential in emerging markets. The demand for biopesticides is anticipated to rise sharply in countries such as India, where government policies promote bio-agriculture and motivate sustainable agriculture with incentives. Innovations in products, like nanoencapsulation technology that enhances efficacy and the creation of new microbial strains, are expected to aid further expansion in the market.

Challenges:

Regulatory delays pose a challenge in the biopesticides market because the approval process takes a long time for new products to enter the market, especially in regions such as Africa and Latin America. In addition, some microbial products require temperature-controlled storage and transport, which presents more logistical barriers that can impact the supply chain.

Purchase This Premium Report Now @ https://www.vantagemarketresearch.com/buy-now/biopesticides-market-1854/0

Price Segment Analysis

The biopesticides market is segmented by price into premium, mid-tier, and value products. Enhancements in the stability profile, broad spectrum of control, and multiplicity of pest species targets are often typical of premium biopesticide products. These products tend to be more expensive but are worth the investment, as the latest technology and scientific research back them.

By contrast, the value segment has increased in emerging markets, where more cost-effective botanicals and biopesticide solutions are flexible. In countries like India, consumers and farmers are turning to less expensive biopesticides made from naturally derived plant extracts. In regions like Europe and North America, consumers spend more on premium biopesticide products that focus on product quality and gravitate towards pricier products, particularly within the organic farming sector.

Regional Market Dynamics

The biopesticides market is exhibiting diverse dynamics in several regions. Microbial-based products from firms offering biological solutions, such as Bayer and Corteva, are major players in North America from a competition standpoint, as is an upstart company such as Certis USA. Its established organic agricultural sector retains growth momentum, with a rising uptake of biopesticides for crop protection.

Europe is also a significant market, with companies like BASF and Syngenta betting on advanced biopesticide technologies such as RNA interference (RNAi) and pheromone-based solutions. The market's growth is also driven by Europe's strong sustainability focus and regulatory support for eco-friendly farming practices.

While this market is well-established in regions such as North America and Europe, the Asia-Pacific region holds huge growth potential, particularly in countries such as India and China. As more of these nations seek biopesticides to address the issues posed by traditional pesticide use and facilitate sustainable agriculture, India, especially, is attracting more land under organic cultivation, which is attracting the biopesticides market.

Read Full Research Report Here @ https://www.vantagemarketresearch.com/industry-report/biopesticides-market-1854

Competitive Landscape

Biopesticides Market Overview: Biopesticides Market Dynamics & Competitive Landscape. Major companies like Bayer AG, BASF SE, Syngenta, and Corteva hold a significant market share with their innovative biopesticide products. Typically leading in product innovation, these companies have pioneered RNAi technologies and platforms using AI for precision agricultural applications.

GreenLight Biosciences has developed Calantha™, a product based on RNAi targeting the Colorado potato beetle. This is among the latest innovations in the market, while Trace Genomics' soil microbiome analysis platform systems guide optimal biopesticide applications. Similarly, partnerships between major players, like Corteva and Symborg, are propelling innovation and increasing biopesticide options.

Companies List:

- Certis USA LLC

- Syngenta International AG

- Nufarm Ltd

- Bayer AG

- Novozymes A/S

- Gujarat State Fertilizers & Chemicals Ltd.

- FMC Corporation

- Agri Life

- Symborg S.L.

- Biotech International Limited

- T. Stanes & Company Limited

- Summit Chemical Inc.

- BioSafe Systems LLC

Immediate Access to Exclusive PDF Sample Copy

Future Market Trends

Various trends will help shape the future of the biopesticides market. Genetic engineering technologies like CRISPR also open up more effective microbial-based pest control solutions. Sustainability is also increasing the corporate agenda, with firms gearing up for carbon-neutral production processes.

The Asia-Pacific region will emerge as a prominent biopesticide consumer market, especially in India, in light of the country's ambitious plans to expand its organic farming sector. North America continues to be a dominant market, which is increasingly concentrated on precision farming and AI applications in biopesticide applications.

Conclusion and Future Outlook

The biopesticides market has been witnessing exponential growth, propelled by a growing demand for organic food, supporting regulatory environment for sustainable farming practices, and advancements in microbial technologies. India and China hold great growth potential as the market continues to expand at a relatively strong pace. By 2030, biopesticides will undoubtedly capture a significant share of the world pesticide market and render farming an ecologically more sound and sustainable activity.