Food Amino Acids Market Size Worth USD 21.2 Billion by 2035 | CAGR 8.00%

Discover insights into the global Food Amino Acids Market, valued at USD 9.1 Billion in 2024 and projected to reach USD 21.2 Billion by 2035, growing at a CAGR of 8.00% from 2025 to 2035.

Food Amino Acids Market Set to Reach USD 21.2 Billion by 2035, Growing at a CAGR of 8.00%

According to Vantage Market Research, the Global Food Amino Acids Market is on a robust expansion path as amino acids gain broader acceptance across food fortification, nutraceuticals, infant nutrition, and convenience food applications. The 2024 base year marks the sector at USD 9.1 billion, with VMR forecasting a rise to USD 21.2 billion by 2035 at a compound annual growth rate (CAGR) of 8.00% (2025–2035). Rising demand for plant-based protein solutions, increased fortification of processed foods, and advances in cost-effective fermentation production are central to this outlook.

Our comprehensive Food Amino Acids Market report is ready with the latest trends, growth opportunities, and strategic analysis. View Sample Report PDF.

Key Takeaways

- 2024 Market Size: USD 9.1 billion

- 2035 Forecast: USD 21.2 billion.

- CAGR (2025–2035): 8.00%.

- Plant-based amino acids commanded 69.5% revenue share in 2024.

- Asia Pacific largest by value in 2024; Europe expected to grow fastest over 2025–2035.

- Representative Companies (VMR list): Ajinomoto Co., Kyowa Hakko Kirin, Sigma-Aldrich (Merck), Prinova Group, Daesang, Evonik, AMINO GmbH, Taiwan Amino Acids Co., and others.

Premium Insights

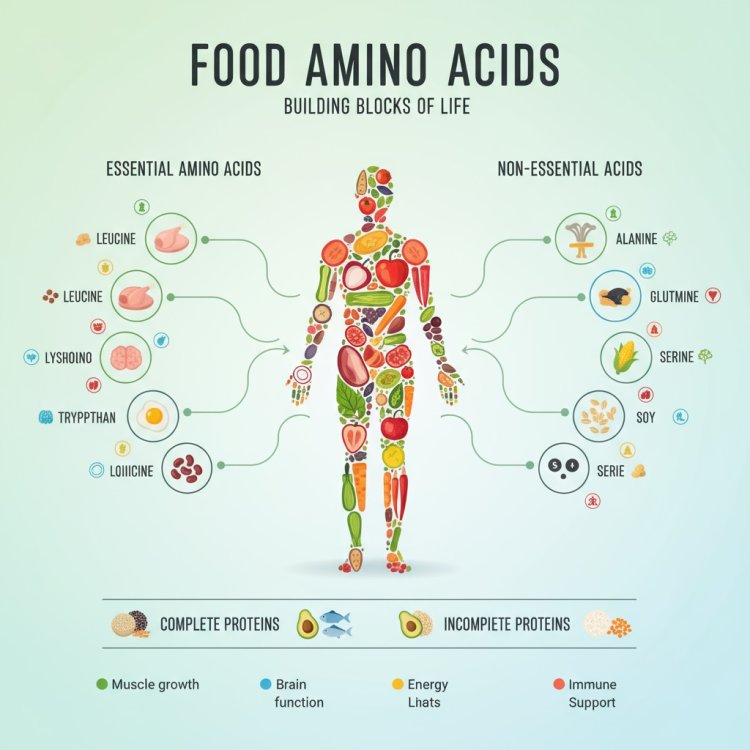

Amino acids are moving from niche specialty ingredients to mainstream food-system building blocks. Glutamic acid’s role as a natural flavor enhancer keeps it dominant, while branched-chain amino acids (BCAAs) and conditionally essential amino acids expand in sports, clinical nutrition, and recovery formulations. Plant-based sourcing has rapidly scaled—soy, corn, wheat, and fermentation platforms deliver cost-effective and traceable supply. Fermentation process improvements and lower production costs make amino acids more accessible for fortification of convenience foods and beverages. Industry players are responding with application-ready blends and clean-label positioning to meet consumer and regulatory demand.

VMR reports the Food Amino Acids Market at USD 9.1 billion in 2024, with projections to reach USD 21.2 billion by 2035, reflecting an 8.00% CAGR across 2025–2035. This projection incorporates rising use in nutraceuticals, infant formula enrichment, and functional beverage fortification. Asia Pacific’s large population base and growing processed food consumption underpin significant volume demand, while Europe’s regulatory environment and premiumization drive faster percentage growth. Technology-led production efficiencies (fermentation scale-ups, downstream purification) support broader commercialization and margin improvement.

The Food Amino Acids market is fragmented but increasingly consolidated among vertically integrated players with fermentation, purification, and application-development capabilities. Key characteristics include dependency on agricultural feedstocks, high-quality control and regulatory compliance, and the importance of production economics (fermentation yield, downstream costs). Product differentiation stems from degree of purity (food vs. pharma grade), source (plant vs. animal vs. synthetic), and functional positioning (flavor enhancers, nutritional fortifiers, performance nutrition). Strategic M&A, JV’s, and contract manufacturing relationships address capacity, geographic access, and specialty product development.

For Food Amino Acids Market Research Report and updates detailed: View Full Report Now!

Type Insights

The food amino acids market is segmented by type into glutamic acid, lysine, tryptophan, methionine, and others. Glutamic acid dominates due to its extensive use as a flavor enhancer in processed foods, while lysine and methionine are widely applied in nutritional supplements and animal feed. Specialty amino acids like tryptophan are gaining traction in dietary supplements for mood regulation and sleep health. The demand across categories is driven by rising health consciousness, protein fortification trends, and growing functional food consumption.

Application Insights

Applications of food amino acids span dietary supplements, food fortification, infant formula, beverages, bakery and confectionery, and animal feed. Dietary supplements remain the leading application area as consumers increasingly prioritize health, immunity, and fitness. Food fortification is expanding rapidly, particularly in emerging economies with high nutritional deficiencies. The bakery and confectionery sector also leverages amino acids for enhancing product quality and taste. Growing demand for infant nutrition and specialized diets further fuels the application scope across diverse end-use industries.

Source Insights

Food amino acids are derived from plant-based, animal-based, and synthetic sources. Plant-based sources, such as soy and pea, are gaining rapid adoption due to rising veganism and consumer preference for sustainable and clean-label products. Animal-derived sources remain relevant in sports nutrition and clinical applications due to high bioavailability. Synthetic sources are expanding due to advancements in fermentation and biotechnology, enabling cost efficiency and high purity levels. Overall, source diversification is driven by lifestyle shifts and technological innovation in amino acid production.

Regional Insights

North America in Food Amino Acids Market Trends

North America is a mature, high-value market driven by sports nutrition, dietary supplements, and fortified foods. Brands emphasize evidence-backed claims, clean-label sourcing, and traceability; these expectations push suppliers to supply technical documentation and certifications. The U.S. is notable for high per-capita consumption of nutraceuticals and forleading R&D in formulation and processing. Imports supplement regional production to meet demand for specialty amino acids and pharma-grade products.

Europe in Market Food Amino Acids Trends

Europe’s market growth is characterized by regulatory stringency and premiumization. Strong food-safety frameworks and consumer skepticism demand high transparency in ingredient sourcing. Plant-based protein trends and functional foods support amino acid fortification in ready meals and infant nutrition. Europe is forecast to grow fastest percentage-wise from 2025–2035 as manufacturers invest in clean-label and clinically validated formulations, and as plant-sourced production scales to meet sustainability goals.

Asia Pacific in Food Amino Acids Market Trends

Asia Pacific is the largest regional market in 2024, driven by population scale, rapid urbanization, and growing processed-food consumption. China, India, Japan, and Southeast Asia are major demand centers for fortified staples, infant formula, and emerging functional beverage categories. Local feedstock availability (corn, wheat, soy) and proximity to fermentation manufacturing capacity support competitive plant-based amino acid production, making APAC the market backbone for global supply and volume growth.

Latin America in Food Amino Acids Market Trends

Latin America is expanding as processors modernize and fortification programs gain traction. Agricultural feedstock abundance supports local production, while rising incomes and urban retail networks enhance demand for fortified convenience products. Export opportunities to North America and Europe for certain ingredients stimulate investment. However, macroeconomic volatility and infrastructure gaps moderate pace; strategic partnerships and contract manufacturing help international firms scale in region.

Middle East & Africa in Food Amino Acids Market Trends

MEA remains an emerging market relying on imports and selective local production. Growth is centered in urban hubs and GCC markets, driven by demand for fortified foods, sports nutrition, and maternal/child health products. Regulatory heterogeneity and logistical costs are challenges, but increasing healthcare awareness, demographic shifts, and improvements in cold chain and distribution are creating new routes to market for amino acid-based formulations.

Competitive Landscape

Vantage Market Research lists prominent players including Ajinomoto Co., Kyowa Hakko Kirin Co., Sigma-Aldrich (Merck), Prinova Group, Daesang Corporation, Evonik Industries, AMINO GmbH, Bill Barr & Company, IRIS Biotech, Taiwan Amino Acids Co. Ltd., among others. These firms combine fermentation expertise, purification technology, and global distribution networks; many offer application support for fortified food and supplement formulations. Strategic collaboration, capacity expansion, and product differentiation through clinical validation are common competitive moves.

Recent Developments

- Evonik — Production & Expansion (2024): Evonik completed expansions and enhancements in its amino acids portfolio and showcased an expanded methionine production footprint (notably modernization and expansion in Singapore and the integration of a Mobile, Alabama production hub), reinforcing supply security and sustainability for feed and food applications. This step underscores industry investments in regional capacity and lower-emissions production.

- Ajinomoto — Sports & Application Momentum (2024): Ajinomoto provided comprehensive amino-acid nutritional support to TEAM JAPAN at the Paris 2024 Olympic and Paralympic Games, supplying specialized amino acid sachets and on-site nutritional support—illustrating the premium positioning and consumer awareness boost that sports applications can deliver to amino-acid brands.

Food Amino Acids Industry Scope

According to Vantage Market Research, the report provides a thorough analysis including historical data (2021–2023), 2024 base-year revenue, and forecasts to 2035. Segmentation includes By Type (Glutamic Acid, Lysine, Tryptophan, Methionine, Phenylalanine, Others); By Application (Infant Formula, Nutraceuticals & Dietary Supplements, Food Fortification, Convenience Food, Others); By Source (Plant-Based, Animal-Based, Synthetic); and By Region (North America, Europe, Asia Pacific, Latin America, MEA). Deliverables include competitive benchmarking, company profiles, regional opportunities, and customizable data cuts.

Market Dynamics

Driver

Rising consumer demand for protein enrichment and functional nutrition drives amino acid incorporation into foods and supplements. Amino acids improve protein quality, enable nutritional claims, and support sports/recovery positioning. Advances in fermentation and downstream purification lower costs, enabling broader fortification across convenience foods and beverages. Plant-based trends and infant-formula fortification needs further push demand, making amino acids an essential tool for formulators seeking nutrition density and differentiated product claims.

Restraint

Price sensitivity and raw-material supply volatility can restrain adoption, particularly in price-conscious markets. Some specialty amino acids require complex downstream purification increasing cost and limiting their use to premium applications. Regulatory requirements for novel ingredients, labeling, and permissible claims vary across jurisdictions, complicating multi-country product rollouts. Additionally, perception issues around “added” nutrients in whole foods segments can temper consumer acceptance if products are not clearly positioned and substantiated.

Opportunity

Opportunities lie in tailored amino-acid blends for sports recovery, clinical nutrition, and infant formulas as well as in fortifying plant-based proteins to improve amino-acid completeness. Technology upgrades—improved fermentation strains, downstream separation, and bio-engineering—reduce costs and broaden product portfolios. Emerging markets with growing disposable incomes present massive scale potential for fortified staples. Co-development partnerships with food brands to create application-ready premixes can accelerate adoption and command higher margins.

Challenges

Key challenges include maintaining consistent quality across global supply chains, meeting diverse regulatory regimes, and scaling specialty amino-acid production affordably. Translating lab-scale formulations to industrial realities without sacrificing sensory quality or stability involves significant R&D and capital. Competitive pressures from synthetic alternatives and other protein fortification strategies (e.g., concentrates, isolates) require clear value propositions. Ensuring sustainability, reducing environmental footprints of fermentation and purification, and achieving transparent traceability are additional hurdles for market incumbents.

Global Food Amino Acids Market Report Segmentation

- By Type: Glutamic Acid; Lysine; Tryptophan; Methionine; Phenylalanine; Others.

- By Application: Infant Formula; Nutraceuticals & Dietary Supplements; Food Fortification; Convenience Food; Others.

- By Source: Plant-Based; Animal-Based; Synthetic.

- By Region: North America; Europe; Asia Pacific; Latin America; Middle East & Africa.

Frequently Asked Questions

Q1. What was the Food Amino Acids market size in 2024?

A: USD 9.1 billion (Vantage Market Research).

Q2. What is the revenue forecast for 2035 and the CAGR for 2025–2035?

A: Forecast of USD 21.2 billion by 2035; 8.00% CAGR (2025–2035).

Q3. Which amino acid type contributed the largest share in 2024?

A: Glutamic Acid (~40.2% revenue share in 2024).

Q4. Which application shows the most rapid growth?

A: Nutraceuticals & Dietary Supplements (noted as fastest-growing application; ~28.5% in 2024).

Q5. Which region leads the market?

A: Asia Pacific led in 2024; Europe is expected to grow at the fastest rate over 2025–2035.