Medical Plastics Market to Reach $115.5B by 2035 | 7.30% CAGR

Explore the global medical plastics market, valued at USD 53.3 billion in 2024 and projected to grow to USD 115.5 billion by 2035, with a Compound Annual Growth Rate (CAGR) of 7.30%.

Medical Plastics Market Projected to Reach USD 115.5 Billion by 2035 Amid Rising Demand for Advanced Healthcare Solutions

The global Medical Plastics Market, a cornerstone of modern healthcare systems, is experiencing rapid expansion. Medical plastics are essential for producing surgical instruments, drug delivery devices, diagnostic tools, implants, and medical packaging due to their versatility, durability, and biocompatibility. In 2024, the market was valued at USD 53.3 billion and is forecasted to reach USD 115.5 billion by 2035, growing at a CAGR of 7.3% between 2025 and 2035.

Our comprehensive Medical Plastics Market report is ready with the latest trends, growth opportunities, and strategic analysis. View Sample Report PDF.

Key Takeaways

- In 2024, North America dominated with 38.4% of global revenue, supported by advanced healthcare systems and high demand for disposable medical devices.

- Asia-Pacific is expected to register the fastest growth rate over the forecast period, fueled by expanding healthcare infrastructure and increasing medical tourism.

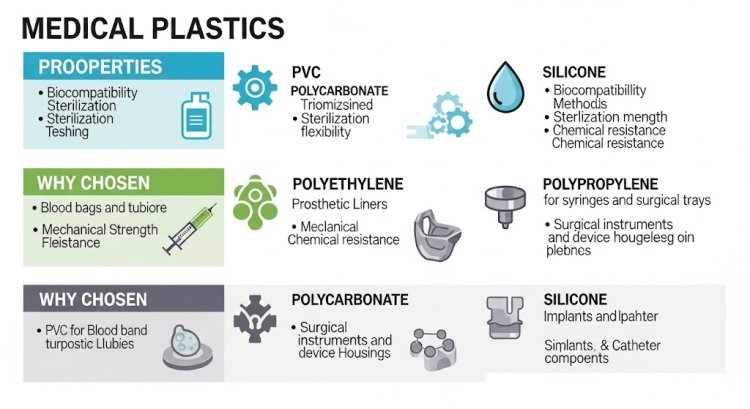

- Polyvinyl Chloride (PVC) held the largest material share, widely used in IV containers, tubing, and blood bags.

- By application, medical disposables represented the largest segment, driven by the global shift toward single-use devices and infection prevention.

Premium Insights

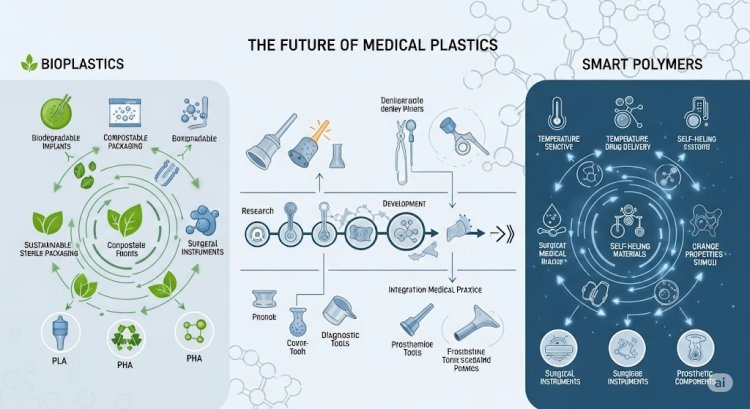

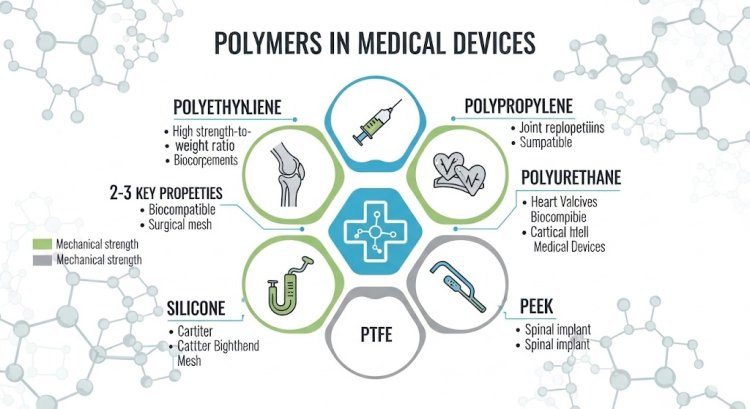

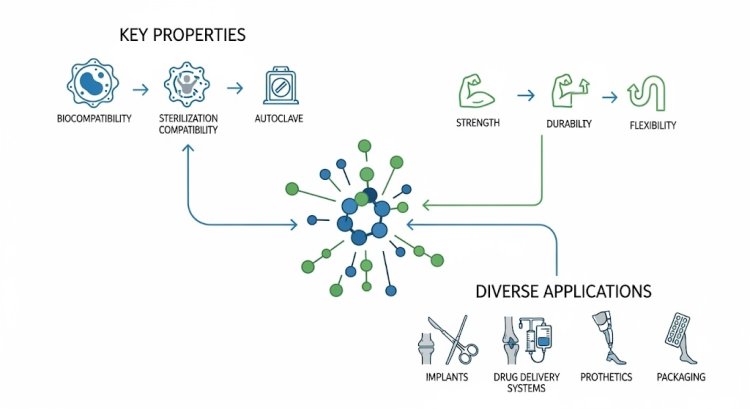

The medical plastics industry is undergoing strong growth, driven by increasing demand for safe, lightweight, and cost-efficient materials across healthcare applications. From syringes, catheters, and surgical gloves to 3D-printed implants, plastics are replacing traditional materials like metals and glass. Post-pandemic healthcare has further accelerated the adoption of single-use devices for infection control. Sustainability remains a key challenge, but innovations in biodegradable and recyclable medical plastics are reshaping the industry. Advancements in medical-grade polymers designed for implants, drug delivery systems, and minimally invasive surgeries are expected to unlock significant opportunities over the next decade.

For Medical Plastics Market Research Report and updates detailed: View Full Report Now!

Key Market Trends & Insights

- 3D Printing Growth: Expanding role of medical plastics in additive manufacturing for implants, prosthetics, and surgical models.

- Biocompatible Materials: Rising adoption of antimicrobial and bioresorbable plastics in implants and medical tools.

- Sustainability Focus: Growing demand for eco-friendly, recyclable medical plastics to reduce environmental burden.

- Aging Population Impact: Higher demand for devices supporting chronic disease management and elderly care.

The global Medical Plastics Market is valued at USD 53.3 Billion in 2024 and is projected to reach a value of USD 115.5 Billion by 2035 at a CAGR (Compound Annual Growth Rate) of 7.30% between 2025 and 2035.

The medical plastics market is moderately consolidated, with a mix of global chemical producers and specialized polymer manufacturers driving competition. Large multinational players dominate due to their extensive product portfolios, advanced R&D capabilities, and strong regulatory compliance, while regional firms focus on cost-effective and niche applications. The industry is highly regulated, requiring stringent quality standards, certifications, and biocompatibility testing for medical-grade polymers.

By Product Type

- Polyvinyl Chloride (PVC) (37.6%) – Widely used in IV containers, tubing, and blood bags for its flexibility and low cost.

- Polypropylene (PP) (26.5%) – Durable and chemical-resistant, ideal for syringes, medical trays, and containers.

- Polyethylene (PE) (18.5%) – Strong and safe, mainly used in medical packaging films, bottles, and disposables.

- Polystyrene (PS) (12.1%) – Clear and rigid, used in diagnostic kits, petri dishes, and labware.

- Engineering Plastics (5.3%) – High-strength polymers used in surgical tools and advanced medical devices.

- Silicone – Biocompatible material used for catheters, implants, and prosthetics.

- Other Product Types – Specialty polymers for antimicrobial devices and niche medical applications

By Application

- Medical Packaging – Ensures sterility and safe transport of drugs and devices.

- Medical Devices & Equipment – Used in surgical instruments, implants, and diagnostic tools.

- Disposables – Largest share, covering syringes, gloves, and catheters.

- Drug Delivery Systems – Applied in inhalers, IV sets, and implantable devices.

- Other Applications – Includes prosthetics, 3D printing, and custom medical solutions.

Regional Insights

North America Medical Plastics Market Trends

North America remains the leading market for medical plastics, accounting for the largest revenue share in 2024. The region’s dominance is driven by advanced healthcare infrastructure, high per capita healthcare spending, and strong demand for medical disposables and diagnostic devices. The presence of leading medical device manufacturers in the U.S. and Canada, coupled with strict regulatory compliance for quality and safety, continues to fuel adoption. Additionally, increasing investments in research and development of biocompatible and recyclable polymers further support market growth in the region.

Europe Medical Plastics Market Trends

Europe is experiencing steady growth in the medical plastics market, with a strong emphasis on sustainable medical devices and packaging solutions. The region benefits from strict environmental regulations set by the European Union, encouraging the adoption of recyclable and eco-friendly medical plastics. Countries such as Germany, France, and the UK are at the forefront of innovation, particularly in medical-grade polymers for implants and advanced surgical tools. Rising demand for home healthcare devices and minimally invasive surgical solutions also contributes to the regional expansion.

Asia-Pacific Medical Plastics Market Trends

Asia-Pacific is projected to be the fastest-growing region in the medical plastics market over the forecast period. Rapid healthcare reforms, expanding hospital infrastructure, and government initiatives in China, India, and Southeast Asia are major growth drivers. Rising medical tourism, increasing population, and growing prevalence of chronic diseases are boosting demand for medical devices and disposable healthcare products. Additionally, the region is witnessing significant investments in local manufacturing of cost-effective medical plastics, making it a hub for both domestic consumption and exports.

Latin America Medical Plastics Market Trends

Latin America and the Middle East & Africa represent emerging markets for medical plastics, supported by rising healthcare investments and modernization efforts. Countries like Brazil, Mexico, South Africa, and the UAE are increasingly adopting medical disposables and advanced diagnostic tools to meet growing healthcare needs. Government-led initiatives to strengthen healthcare infrastructure, coupled with rising private sector participation, are expanding access to modern medical devices. While adoption is slower compared to developed regions, improving affordability and awareness are expected to drive long-term growth.

Middle East & Africa Medical Plastics Market Trends

The Middle East & Africa medical plastics market is still in the early stages but shows promising growth potential, supported by rising government investments in healthcare infrastructure and the increasing prevalence of chronic diseases. Countries like the UAE and Saudi Arabia are driving demand with large-scale hospital projects and medical device imports, while South Africa stands out as a key hub for regional adoption. Although limited local manufacturing capacity and dependency on imports pose challenges, growing demand for medical disposables, diagnostic tools, and sustainable healthcare solutions is expected to accelerate market expansion across the region.

Competitive Landscape

The medical plastics market is characterized by strong competition among global chemical giants, polymer manufacturers, and specialized material suppliers. Leading companies such as BASF SE, Dow Inc., SABIC, Evonik Industries, Celanese Corporation, Arkema, and Eastman Chemical are investing heavily in the development of high-performance, medical-grade polymers that meet stringent regulatory standards.

Key Medical Plastics Market Companies

- BASF SE

- Dow Inc.

- SABIC

- Evonik Industries AG

- Celanese Corporation

- Arkema SA

- DSM

- Solvay S.A.

- Eastman Chemical Company

- Lubrizol Corporation

Recent Developments

- September 2022: Celanese Corporation announced the launch of a new range of medical-grade polymers, which are designed for use in medical devices and equipment. The new range of polymers is expected to offer excellent mechanical properties and biocompatibility.

- August 2022: Dow Chemical Company announced its plans to expand its Medical Plastics production capacity at its facility in Texas to meet the growing demand for medical packaging materials.

Market Dynamics

Driver

The primary driver of the medical plastics market is the rising demand for disposable medical devices and diagnostic tools, which are essential for infection prevention and cost-effective healthcare delivery. Growing awareness of hygiene standards post-pandemic, coupled with increasing use of plastics in surgical instruments, implants, and drug delivery systems, continues to push adoption. In addition, advancements in healthcare technology and the aging global population are fueling demand for innovative, lightweight, and biocompatible materials in the medical sector.

Restraint

A key restraint for the medical plastics market is the growing concern over plastic waste and its environmental impact. Stringent disposal regulations and sustainability pressures are creating challenges for manufacturers, particularly in regions with strict environmental laws such as Europe. High costs associated with developing eco-friendly and recyclable medical plastics also limit widespread adoption, especially in price-sensitive emerging markets.

Opportunity

The market offers significant opportunities through the development of biodegradable, bio-based, and recyclable medical plastics that align with global sustainability goals. Increasing investment in advanced polymers for 3D printing, minimally invasive surgeries, and customized implants is opening new growth avenues. Furthermore, rising healthcare investments in emerging economies such as China, India, and Brazil are creating lucrative opportunities for both global players and regional manufacturers to expand their presence.

Challenge

One of the major challenges in the medical plastics market is navigating complex regulatory requirements for material approval and compliance. The need for rigorous testing, certifications, and adherence to strict safety standards often increases costs and delays product launches. Additionally, volatility in raw material prices and supply chain disruptions can affect production efficiency, while dependence on imports in certain regions adds to market vulnerability.

Global Medical Plastics Market Report Segmentation

By Product Type

- Polyvinyl Chloride (PVC) (37.6%)

- Polypropylene (PP) (26.5%)

- Polyethylene (PE) (18.5%)

- Polystyrene (PS) (12.1%)

- Engineering Plastics (5.3%)

- Silicone

- Other Product Types

By Application

- Medical Packaging

- Medical Devices & Equipment

- Disposables

- Drug Delivery Systems

- Other Applications

Frequently Asked Questions

Q1. What is the global Medical Plastics Market worth in 2024?

The market is valued at USD 53.3 billion.

Q2. What is the forecasted market size for Medical Plastics by 2035?

The market is projected to reach USD 115.5 billion.

Q3. What is the CAGR of the Medical Plastics Market?

The market is expected to grow at a CAGR of 7.3% between 2025 and 2035.

Q4. Which region leads the Medical Plastics Market?

North America leads with a 38.4% share in 2024.

Q5. Which segment holds the largest share by application?

Medical disposables dominate the market due to rising demand for single-use devices.