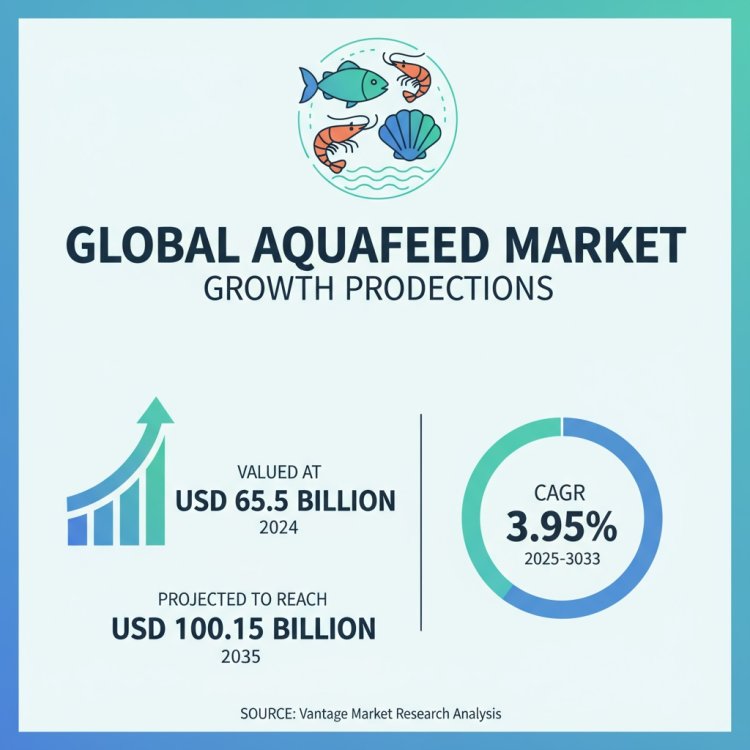

Global Aquafeed Market Size, Share & Growth Forecast (2025–2035) | CAGR 3.95%

Discover the global Aquafeed Market valued at USD 65.5 Billion in 2024 and projected to reach USD 100.15 Billion by 2035, growing at a CAGR of 3.95% from 2025–2035. Explore trends, drivers, and insights shaping aquafeed industry growth.

Global Aquafeed Market Set to Expand from USD 62.2 Billion in 2024 to USD 111.7 Billion by 2035

The Global Aquafeed Market is on a strong growth trajectory, driven by rising seafood demand, aquaculture expansion, and sustainable feed innovation. According to Vantage Market Research, the market reached USD 65.5 billion in 2024, and is expected to soar to USD 100.15 billion by 2035, achieving a compelling 3.95% CAGR across 2025–2035. This expansion underscores the strategic importance of aquafeed formulations—enriched with essential nutrients, functional additives, and sustainable ingredients—in supporting responsible and efficient aquaculture worldwide.

Our comprehensive Aquafeed Market report is ready with the latest trends, growth opportunities, and strategic analysis. View Sample Report PDF.

Key Takeaways

- Market Value: USD 65.5 billion in 2024; forecast to reach USD 100.15 billion by 2035 at 3.95% CAGR.

- Segmentation: Covers Product Type, Species, Function/Lifecycle, and Region.

- Leading Region: Asia Pacific dominates current market share and growth potential.

- Recent Development: In May 2024, five global aquaculture companies committed to testing F3 Krill Replacement innovations—a milestone in sustainable feed practices.

Premium Insights

Vantage Market Research estimates the Aquafeed Market at USD 65.5 billion (2024) and predicts it will reach USD 100.15 billion by 2035, with a steady 3.95% CAGR over the forecast period. The study segments the market by Product Type (e.g., fishmeal, fish oil, soybean, corn, additives), Species (fish, crustaceans, mollusks), Function/Lifecycle Stage, and Region.

Aquafeed innovation is being shaped by the shift toward functional and sustainable feeds—enriched with probiotics, immune-boosting additives, and plant-based ingredients. Rising aquaculture production, diversification of cultured species, and consumer demand for healthy seafood continue to elevate premium and species-specific feed formulations.

Market Size & Forecast

- 2024 Size: USD 65.5 billion

- 2035 Forecast: USD 100.15 billion

- CAGR (2025–2035): 3.95%

The aquafeed landscape is marked by both global multinationals and regional specialists. Key players—such as Cargill, ADM, Alltech, BioMar, Skretting, and Purina—compete on feed innovation, sustainability, and distribution reach. Emerging innovations like krill replacements and functional feeds are enabling smaller players to carve niche advantages.

For Aquafeed Market Research Report and updates detailed: View Full Report Now!

Ingredient Insights

Animal feed additives are classified by ingredients such as amino acids, vitamins, minerals, and enzymes. Amino acids like lysine and methionine are crucial for protein synthesis, while vitamins and minerals boost immunity and bone health. Enzymes improve nutrient absorption and reduce feed costs. Demand for these ingredients is driven by the rising focus on animal productivity, sustainable feed solutions, and reducing nutritional gaps in livestock diets, supporting healthier animals and improving overall meat, dairy, and egg production efficiency.

Additives Insights

Additives include nutritional, sensory, technological, and zootechnical additives. Nutritional additives such as probiotics and prebiotics enhance gut health, while sensory additives improve feed palatability. Technological additives stabilize and preserve feed quality, and zootechnical additives promote animal performance. The growing awareness of gut microbiota’s role in animal health, along with regulatory pressure to minimize antibiotics, is driving innovation in additive categories, supporting sustainable livestock production and catering to rising global demand for safe and high-quality animal-based food products.

Species Insights

This segment covers poultry, swine, cattle, aquaculture, and others. Poultry dominates due to high global demand for chicken meat and eggs, requiring additives that boost growth and feed efficiency. Swine and cattle benefit from additives for enhanced immunity, gut health, and reproductive performance. Aquaculture’s reliance on feed additives is rising with the expansion of fish farming. Overall, increasing demand for animal protein, coupled with intensifying farming practices, drives growth in species-specific formulations to enhance health, yield, and sustainability.

Form Insights

Feed additives are available in dry and liquid forms. Dry additives dominate due to better stability, longer shelf life, and ease of handling during feed mixing. Liquid forms, however, are gaining traction in intensive farming practices as they allow precise dosing and uniform distribution. Manufacturers are innovating encapsulated and coated additive forms to enhance nutrient bioavailability. The choice of form largely depends on the type of livestock, production scale, and feeding system, enabling flexibility in addressing diverse farm requirements.

Lifecycle Insights

This segmentation focuses on starter, grower, and finisher phases of animals. Starter phase additives boost immunity and digestive health in young animals. Grower stage focuses on accelerating weight gain and nutrient utilization. Finisher phase additives improve feed conversion efficiency, carcass quality, and reduce disease risks before slaughter. Lifecycle-based additives ensure balanced nutrition at each stage, supporting animal welfare, maximizing productivity, and minimizing production costs. The adoption of lifecycle-targeted solutions is growing with precision livestock farming trends worldwide.

Regional Insights

North America Market Trends

North America’s animal feed additives market is driven by the well-established livestock industry, particularly poultry, swine, and cattle. The region emphasizes high-quality meat and dairy production, creating consistent demand for additives that improve feed efficiency and animal health. Stringent FDA and USDA regulations promote the use of safe, sustainable additives. Growing consumer preference for organic and antibiotic-free meat is pushing companies to innovate natural alternatives, while investments in R&D and precision feeding technologies are further shaping market growth.

Europe Market Trends

Europe is a mature market for animal feed additives, supported by stringent EU regulations on food safety and animal welfare. The region leads in adopting sustainable and natural feed solutions, with increasing demand for probiotics, enzymes, and organic acids as alternatives to antibiotics. Rising meat consumption in Eastern Europe complements Western Europe’s focus on premium, high-quality products. Key players invest heavily in innovation and traceability systems, aligning with sustainability targets and consumer demand for healthier, eco-friendly livestock production practices.

Asia Pacific Market Trends

Asia Pacific is the fastest-growing market for animal feed additives, driven by its massive livestock population, rapid urbanization, and rising meat and dairy consumption. Countries like China, India, and Vietnam dominate production and consumption, while increasing disposable income fuels demand for protein-rich diets. Governments are promoting modern livestock farming and biosecurity measures, boosting additive adoption. The region faces challenges like disease outbreaks, encouraging the use of health-promoting feed solutions. Expanding aquaculture in coastal economies further supports growth in this dynamic market.

Latin America Market Trends

Latin America’s feed additives market benefits from its strong livestock sector, particularly beef, poultry, and swine production, with Brazil and Argentina leading exports. The region’s growing meat exports require consistent quality and efficiency, increasing reliance on additives for feed optimization and disease prevention. Rising domestic demand, coupled with modernization of farming practices, supports additive adoption. However, fluctuating raw material costs and regulatory complexities remain challenges. International investments and partnerships are expanding, fostering innovation and sustainable practices across the Latin American market.

Middle East & Africa Market Trends

The Middle East & Africa market is experiencing steady growth, fueled by rising demand for animal protein and poultry products amid increasing population and urbanization. Governments are investing in food security and livestock farming to reduce import dependency, driving demand for feed additives that enhance productivity and animal health. Poultry dominates consumption in the Middle East, while Africa sees growth in ruminants and aquaculture. Challenges include infrastructure and cost constraints, but rising awareness of livestock health and international collaborations boost prospects.

Competitive Landscape

Vantage’s report lists key market players including Cargill, BioMar Group, Ridley Corp., Aller Aqua, BENEO, Alltech, Aker BioMarine, Charoen Pokphand, Skretting, Purina, INVE Aquaculture, Avanti Feeds, and Biostadt India. These companies drive feed innovation through specialization and geographic reach.

Recent Developments

- In May 2024, five prominent global aquaculture firms pledged to pilot products from the F3 Krill Replacement Challenge, emphasizing sustainability and reduced dependency on wild krill, marking a significant step toward alternative feed ingredients.

Aquafeed Market Scope

Vantage Market Research’s Aquafeed Market Report provides a comprehensive analysis of market dynamics, emerging trends, and growth opportunities. The report explores key factors such as the rising demand for sustainable aquaculture, innovations in feed formulations, and regulatory developments. It covers detailed segmental analysis by ingredient, additive, species, lifecycle, form, and region, offering deep insights into consumption patterns and production strategies. Additionally, it examines the competitive landscape, company profiles, and regional market performance to support strategic decision-making.

Market Dynamics

Driver

The aquafeed market is driven by the rising global demand for seafood, fueled by population growth and changing dietary preferences. With capture fisheries unable to meet demand, aquaculture has become a key source of protein, boosting aquafeed consumption. Advances in feed formulations, incorporating high-quality proteins, amino acids, and functional additives, are further driving market expansion. Government support for sustainable aquaculture practices and the adoption of advanced farming systems also contribute to strong growth momentum in the aquafeed sector.

Restraint

Despite strong growth potential, the aquafeed market faces challenges due to fluctuating raw material prices, particularly fishmeal and fish oil, which directly impact production costs. Overdependence on these marine ingredients raises sustainability concerns, limiting expansion. Additionally, strict environmental regulations on aquaculture practices can create compliance burdens for feed producers. Disease outbreaks in aquaculture systems also hinder feed demand stability. Moreover, supply chain disruptions and high production costs for specialty feed additives restrain broader market penetration, especially in cost-sensitive regions.

Opportunity

Opportunities in the aquafeed market stem from innovations in alternative protein sources such as plant-based proteins, algae, and insect meals, reducing reliance on fishmeal and fish oil. Rising adoption of functional and medicated feeds to improve fish health and growth performance also creates growth avenues. Increasing investments in R&D for sustainable, nutrient-rich aquafeeds tailored to different species unlock new potential. Growing aquaculture practices in emerging markets like Asia-Pacific and Latin America provide vast opportunities for feed manufacturers to expand operations.

Challenge

The aquafeed market faces challenges in balancing sustainability with profitability, as sourcing eco-friendly, alternative ingredients remains costly and less scalable. Ensuring feed quality and consistency across diverse species is another hurdle, especially with the rising demand for customized formulations. Disease outbreaks in aquaculture farms can disrupt feed consumption cycles, impacting demand. Additionally, limited awareness among small-scale fish farmers about advanced feed solutions slows adoption. Intense competition among global and regional players further increases pressure on pricing and margins.

Global Aquafeed Market Segmentation

- By Ingredient; Soybean, Corn, Fishmeal, Fish Oil, Additives, Other type

- By Additives: Antibiotics, Vitamins & minerals, Antioxidents, Amino Acids, Enzymes, Probiotics & prebiotics, Others

- By Species: Fish, Crustaceans, Crustaceans, Others

- By Form: Dry, Moist, Wet

- By Lifecycle: Starter feed, Grower feed, Finisher feed, Brooder feed, Brooder feed

- By Region: North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Frequently Asked Questions

- What was the global aquafeed market size in 2024?

USD 65.5 billion.

- What is the projected market size by 2035 and CAGR?

Expected to reach USD 100.15 billion, with a 3.95% CAGR .

- Which region leads the market?

Asia Pacific, commanding 45–60% of global share.

- What segmentation does the report cover?

Segmented by Product Type, Species, and Region.

- Who are the major players?

Includes Cargill, BioMar, Ridley, Alltech, Skretting, Purina, etc.