Pharmaceutical Filtration Market to Reach USD 37 Billion by 2035 | CAGR 9.75%

The global pharmaceutical filtration market, valued at USD 13.31 billion in 2024, is expected to reach USD 37 billion by 2035, growing at a CAGR of 9.75%. Explore trends, key drivers, and market forecasts.

Global Pharmaceutical Filtration Market: Projected Growth and Key Insights

The global pharmaceutical filtration market is experiencing significant growth, driven by advancements in filtration technologies, increasing demand for biopharmaceuticals, and stringent regulatory standards. Filtration plays a crucial role in ensuring the purity and safety of pharmaceutical products, making it an essential process in drug manufacturing. This press release provides an overview of the market's current status, future projections, and key insights.

Our comprehensive Pharmaceutical Filtration Market report is ready with the latest trends, growth opportunities, and strategic analysis. View Sample Report PDF.

Key Takeaways

- The global pharmaceutical filtration market was valued at USD 13.31 billion in 2024 and is projected to reach USD 37 billion by 2035, growing at a CAGR of 9.75% from 2024 to 2035.

- North America dominated the pharmaceutical filtration market in 2024, accounting for a significant market share.

- The membrane filters segment held the largest market share in 2024, while the single-use systems segment is expected to witness the fastest growth over the forecast period.

- The final product processing application segment led the market in 2024, with the cell separation segment projected to experience significant growth from 2025 to 2034.

- Microfiltration captured the largest revenue share in 2024, while ultrafiltration is expected to witness significant growth over the forecast period.

Premium Insights

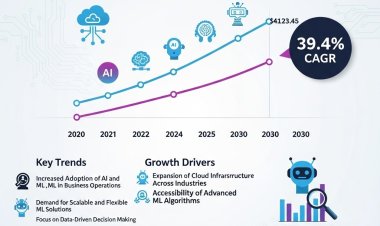

The pharmaceutical filtration market is witnessing robust growth driven by advancements in filtration technologies, increasing demand for biologics, and stringent regulatory requirements. There is a growing trend toward single-use systems and membrane-based filters that offer efficiency, sterility, and reduced cross-contamination risks in drug manufacturing. Automation and smart monitoring technologies are being integrated to enhance process control, reliability, and throughput. Additionally, the rising prevalence of chronic diseases and increasing R&D activities in biopharmaceuticals are fueling the demand for innovative and high-performance filtration solutions globally.

Market Size & Forecast

- 2024: USD 13.31 billion

- 2034: USD 37 billion

- CAGR (2024–2034): 9.75%

The pharmaceutical filtration market is characterized by the presence of several key players offering a wide range of filtration products and solutions. These companies are focusing on technological advancements, strategic partnerships, and expanding their product portfolios to maintain a competitive edge in the market.

For Pharmaceutical Filtration Market Research Report and updates detailed: View Full Report Now!

Filters Insights

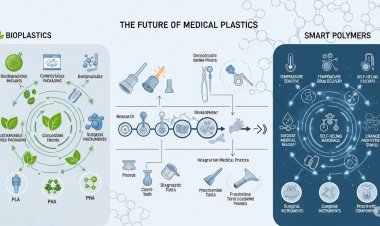

The pharmaceutical filtration market is segmented into membrane filters, depth filters, prefilters, and others. Membrane filters dominate due to their precision in removing bacteria, particulates, and contaminants. Depth filters and prefilters are used for bulk removal of impurities in early-stage processing. Selection depends on particle size, process requirements, and desired purity levels. Increasing demand for sterile filtration in biopharmaceuticals and vaccines is driving the adoption of advanced membrane and depth filtration technologies globally.

Systems Insights

Filtration systems include single-use systems, reusable systems, and integrated systems. Single-use systems are gaining traction for their convenience, reduced contamination risk, and cost-effectiveness in short-term processes. Reusable systems offer sustainability for long-term operations, while integrated systems combine multiple filtration stages for efficient production. The growing adoption of biologics and personalized medicine drives demand for flexible and efficient filtration systems tailored to diverse manufacturing needs.

Technique Insights

Filtration techniques encompass microfiltration, ultrafiltration, nanofiltration, and others. Microfiltration is widely used for particle removal, while ultrafiltration and nanofiltration are essential in concentration and purification of proteins, enzymes, and biologics. Advancements in membrane technology and increasing regulatory focus on product safety are boosting adoption. The choice of technique depends on process requirements, molecular size, and sterility standards in pharmaceutical production.

Type Insights

Types of pharmaceutical filtration include sterile filtration, clarification, purification, and concentration. Sterile filtration is critical for injectables and biologics to ensure pathogen-free products. Clarification and purification remove suspended solids and impurities, enhancing product quality. Concentration techniques are used to adjust biomolecule concentrations for formulation purposes. Growing demand for high-purity pharmaceuticals and biologics is accelerating adoption across these filtration types globally.

Application Insights

Applications of pharmaceutical filtration cover final product processing, water purification, cell separation, and air purification. Final product processing ensures drug safety and efficacy, while water and air purification maintain regulatory compliance and cleanroom standards. Cell separation is critical in biologics, vaccines, and regenerative medicine. Rising biopharmaceutical production, stricter regulatory guidelines, and the need for sterile environments are driving adoption across all application segments.

End Scale Insights

End-scale segmentation includes laboratory-scale, pilot-scale, and commercial-scale filtration. Laboratory-scale is used in R&D for testing and process optimization, pilot-scale supports scale-up studies, and commercial-scale handles full production operations. Increasing R&D investments and expansion of pharmaceutical manufacturing capacities are driving demand for efficient and scalable filtration solutions suitable for all stages of production.

Filtration Products Insights

Filtration products include cartridges, capsules, filter holders, and filtration accessories. Cartridges and capsules are widely used for efficient and sterile filtration, while filter holders and accessories support seamless integration into production lines. Advances in disposable and single-use products are enhancing operational efficiency, reducing contamination risks, and providing flexible solutions to meet the growing demand for biologics, vaccines, and complex pharmaceuticals.

Regional Insights

North America Pharmaceuticals Filtration Market Trends

North America leads the pharmaceutical filtration market due to a well-established pharmaceutical and biopharmaceutical industry, high R&D expenditure, and stringent regulatory standards. The U.S. dominates adoption, driven by increasing demand for biologics, vaccines, and sterile drug production. Advanced filtration technologies, automation, and single-use systems are widely implemented. Government support, favorable reimbursement policies, and the presence of major market players further strengthen the region’s dominance, making it the largest and most mature market globally.

Europe Pharmaceuticals Filtration Market Trends

Europe’s pharmaceutical filtration market is growing steadily, supported by strong pharmaceutical manufacturing infrastructure in countries like Germany, Switzerland, and the UK. Strict regulatory frameworks and quality standards drive the adoption of advanced filtration solutions, particularly in biologics and sterile drug production. Increasing outsourcing to contract manufacturing organizations (CMOs) and expansion of cleanroom facilities further fuel growth. Technological innovations, such as high-efficiency membranes and single-use filtration systems, are enhancing operational efficiency and market penetration in the region.

Asia Pacific Pharmaceuticals Filtration Market Trends

Asia Pacific is expected to witness the fastest growth in the pharmaceutical filtration market, driven by increasing pharmaceutical and biopharmaceutical production, rising healthcare investments, and a large patient population. China, India, and Japan are key contributors, supported by growing R&D activities, expanding manufacturing capacities, and rising demand for vaccines and biologics. Government initiatives promoting local manufacturing and medical exports, along with adoption of cost-effective single-use filtration systems, are further boosting market growth in the region.

Latin America Pharmaceuticals Filtration Market Trends

Latin America’s pharmaceutical filtration market is expanding gradually, led by Brazil and Mexico. Market growth is supported by increasing healthcare infrastructure, rising pharmaceutical production, and growing awareness of quality standards. Hospitals, research institutions, and CMOs are increasingly adopting advanced filtration technologies to ensure compliance with international regulations. Although the market is price-sensitive, gradual improvements in manufacturing capabilities and the presence of multinational players offering cost-effective solutions are fueling regional growth.

Middle East & Africa Pharmaceuticals Filtration Market Trends

The Middle East & Africa region shows moderate growth in pharmaceutical filtration, driven by rising healthcare investments and expanding pharmaceutical manufacturing capacities. Countries such as Saudi Arabia, the UAE, and South Africa are leading adoption due to increasing demand for biologics, vaccines, and sterile drugs. Growing awareness of quality standards, cleanroom compliance, and single-use filtration technologies is encouraging market expansion. Additionally, partnerships with international companies and government initiatives promoting healthcare infrastructure are boosting regional market potential.

Key Pharmaceutical Filtration Company Insights

Leading companies in the pharmaceutical filtration market include:

- Merck KGaA

- Sartorius AG

- Danaher Corporation

- 3M Company

- Thermo Fisher Scientific Inc.

- Eaton Corporation

- Amazon Filters Ltd.

- Parker Hannifin Corporation

- GE Healthcare

- Graver Technologies

These companies are focusing on technological advancements, strategic partnerships, and expanding their product portfolios to maintain a competitive edge in the market.

Recent Developments

- In August 2024, SGS launched new specialized bioanalytical testing services in North America. These services cater to both biopharmaceutical and pharmaceutical applications, supporting the growing demand for advanced filtration solutions in the region.

Pharmaceutical Filtration Market Report Scope

This report provides a comprehensive analysis of the global pharmaceutical filtration market, covering market dynamics, segmentation, regional insights, and competitive landscape. It offers valuable information for stakeholders to make informed decisions.

Market Dynamics

Driver:

The primary driver of the pharmaceutical filtration market is the growing demand for biologics, vaccines, and high-purity pharmaceuticals, which require advanced filtration solutions. Increasing regulatory scrutiny by agencies such as the FDA and EMA compels manufacturers to adopt sterile and high-efficiency filtration technologies. Technological innovations, including single-use systems, membrane-based filters, and automated filtration processes, enhance efficiency, reduce contamination risks, and improve overall product quality, further fueling market growth globally.

Restraint:

High costs associated with advanced filtration technologies and single-use systems act as a major restraint. Implementation requires substantial capital investment in equipment, validation, and maintenance. Additionally, complex manufacturing processes, stringent regulatory compliance, and the need for skilled personnel to operate and maintain filtration systems may limit adoption, particularly in small-scale or cost-sensitive pharmaceutical manufacturing facilities, slowing overall market expansion.

Opportunity:

Significant opportunities exist in emerging markets such as Asia Pacific and Latin America, where pharmaceutical and biopharmaceutical industries are expanding rapidly. Rising demand for vaccines, biologics, and sterile drugs, coupled with increasing R&D investments, creates prospects for innovative filtration solutions. The growing trend toward single-use systems and integration of smart monitoring technologies presents opportunities for manufacturers to develop scalable, efficient, and cost-effective filtration products tailored to evolving market needs.

Challenges:

Key challenges include maintaining consistent filtration efficiency, process reliability, and regulatory compliance across diverse pharmaceutical applications. Ensuring sterility, avoiding cross-contamination, and validating filtration systems are critical concerns. Additionally, manufacturers face pressure to reduce costs while adopting advanced technologies, and navigating complex global regulatory requirements poses significant hurdles. Market fragmentation and competition among global and regional players also present challenges in sustaining growth and profitability.

Market Segmentation

The pharmaceutical filtration market is segmented based on:

- By Filters: Membrane Filters, Depth Filters, Other Filters

- By Systems: Single Use, Reusable

- By Technique: Microfiltration, Ultrafiltration, Nanofiltration, Other Techniques

- By Type: Sterile Filtration, Non-Sterile Filtration

- By Application: Final Product Processing, Raw Material Filtration, Cell Separation, Water Purification, Air Purification

- By End Scale: Manufacturing Scale, Pilot Scale, R&D Scale

- By Filtration Products: Filtration Assemblies, Filter Holders, Filtration Accessories

- Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Frequently Asked Questions

- What is the current market size of the pharmaceutical filtration industry?

The global pharmaceutical filtration market was valued at USD 13.31 billion in 2024.

- Which regions are leading in the pharmaceutical filtration market?

North America currently holds the largest market share, followed by Europe and Asia Pacific.

- What are the key drivers of market growth?

Technological advancements, increasing demand for biopharmaceuticals, and stringent regulatory standards are key drivers.

- What are the major challenges faced by the industry?

High costs and complexity of filtration processes are major obstacles to market growth.

- Which companies are leading the market?

Key players include Merck KGaA, Sartorius AG, Danaher Corporation, and Thermo Fisher Scientific Inc.