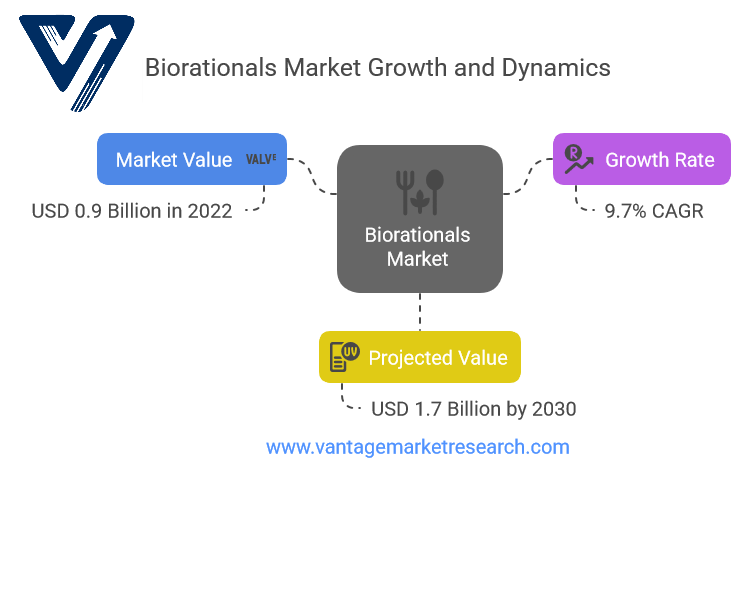

Biorationals Market Growth: Analyzing the Projected Reach of USD 1.7 Billion by 2030

Explore the comprehensive Biorationals Market Report (2023–2030) covering global trends, market segmentation, competitive landscape, and growth forecasts. Discover how eco-friendly pest control methods are shaping sustainable agriculture worldwide.

Biorationals Market Size and Forecast

The global Biorationals Market was valued at USD 0.9 billion in 2022 and is projected to reach USD 1.7 billion by 2030, growing at a Compound Annual Growth Rate (CAGR) of 9.7% during the forecast period from 2023 to 2030. The market's growth is strongly influenced by the increasing adoption of biorational solutions in modern agricultural practices, fueled by the global shift toward sustainable farming and eco-friendly pest management strategies.

Biorationals, which include biopesticides, bioinsecticides, pheromones, and plant growth regulators, represent a pivotal innovation in the agrochemical industry. These substances are derived from natural or biological origins and are typically less toxic to humans and non-target organisms. Their primary role is to disrupt pests' life cycles rather than eradicate them outright, which minimizes collateral damage to beneficial insects and promotes long-term ecological balance.

Growing global awareness of the environmental and health risks associated with conventional pesticides pushes farmers, policymakers, and industry stakeholders toward alternatives like biorationals. The rising prevalence of integrated pest management (IPM) strategies, especially in high-value crops like fruits and vegetables, has further elevated the demand for such products. IPM promotes using multiple pest control methods that are environmentally sensitive and economically viable, with biorationals playing a central role.

Developing regions such as the Asia Pacific are witnessing rapid adoption of biorational solutions, driven by increased agricultural exports, improvements in farming practices, and stringent food safety regulations targeting chemical residues. Additionally, countries in this region are increasingly prioritizing sustainable agriculture, offering fertile ground for expanding the bioreals industry.

However, despite these growth trends, the market faces challenges, including high production costs, limited farmer awareness in some regions, and an imbalanced demand-supply dynamic. These factors can cause price fluctuations, particularly in organic-based pesticides and insecticides, impacting small-scale producers and farmers.

Nevertheless, continued investment in R&D, governmental support for eco-agriculture initiatives, and expanding applications beyond traditional farming—such as aquaculture, public health, and forestry—signal a positive long-term outlook for the global biorationals market.

Download Sample Report PDF (Including Full TOC, Table & Figures) @ https://www.vantagemarketresearch.com/biorationals-market-2283/request-sample

Biorationals Industry Trends

The biorational market is experiencing strong momentum driven by rising health consciousness, increasing demand for organic foods, and governmental efforts to reduce chemical usage in agriculture. As consumer awareness about food safety increases, so does the pressure on producers to deliver cleaner, residue-free produce. This demand shift encourages biorational alternatives, especially in sectors like fruit and vegetable cultivation, where post-harvest chemical residue is a critical concern.

One of the primary advantages of bio-biorationals is their ability to reduce harmful residues on crops, particularly in fruits and vegetables. These products also shorten germination periods, improve pollination efficiency, and enhance overall yield quality. Due to their biological nature, biocrop supports the natural growth cycle of crops without disturbing the balance of beneficial soil and foliar microorganisms.

Another rising trend is the use of pheromone-based biorationals, which act as behavior-modifying agents to interfere with pests' mating patterns. This non-lethal control method is especially appealing in sustainable farming as it doesn’t kill insects but suppresses population growth, thereby preserving ecological integrity.

Globally, major agricultural economies like the U.S., Germany, France, and Japan are observing a surge in biorational product adoption under initiatives like “Farm to Fork” strategies, emphasizing reduced chemical dependency across the food value chain. In these countries, regulatory agencies are tightening restrictions on chemical pesticide use, which has opened doors for biologically derived solutions.

Additionally, ongoing technological advancements in fermentation processes, microbial culturing, and formulation techniques enable the production of highly effective biorational products that rival conventional pesticides in efficacy but have a vastly reduced environmental footprint.

There is also increasing interest in multi-functional biorationals, combining pest control, nutrient enhancement, and stress resistance, offering farmers a consolidated solution that supports productivity and sustainability.

Take Action Now: Secure Your Position in the Global Biorationals Industry Today – Purchase Now.

Market Segmentation Analysis

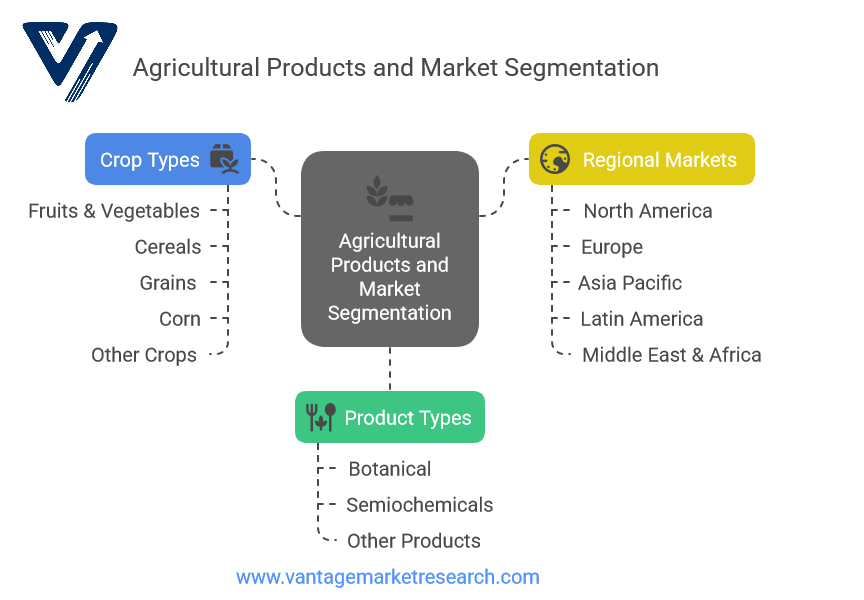

The biorationals market is segmented based on product type, crop type, application sector, and geography.

By Product Type:

- Botanical Products: Expected to reach USD 500 million in 2023 with a 9.5% CAGR through 2032. An increasing preference for plant-derived solutions in organic farming drives their growth. Botanical biocidal products provide a safer alternative to synthetic pesticides and are highly compatible with IPM systems.

- Microbial Products: Bacteria, fungi, and virus-based agents targeting specific pests and pathogens.

- Semiochemicals (Pheromones): Increasingly used for mating disruption and pest monitoring, especially in high-value crops.

By Crop Type:

- Fruits & Vegetables: This segment is projected to reach USD 300 million in 2024, growing at a 4.7% CAGR. Consumers’ demand for organic, chemical-free produce pushes growers to embrace biorational pest control methods.

- Cereals & Grains: Moderate growth anticipated, driven by increasing integration of biorationals in large-scale farming operations.

- Others (Oilseeds, Pulses): Seeing incremental growth due to increased awareness and trial adoption.

By Application Sector:

- Agriculture: Remains the largest segment, fueled by demand for sustainable farming practices.

- Forestry: Use of bioionicals to control invasive pests and maintain biodiversity.

- Public Health: Mosquito control and disease vector management applications are gaining prominence.

- Aquaculture: Emerging segment using biorationals to maintain water quality and control fish pathogens.

By Region:

- Asia Pacific: Projected to reach USD 300 million with a 9.6% CAGR by 2032. The region’s large agricultural base, increasing regulatory support, and export-driven farming models are accelerating growth.

- North America and Europe: These are high-maturity markets with strong regulatory frameworks and consumer awareness. Innovation in formulations and product portfolios is key to growth here.

- Latin America & Africa: Offering untapped potential due to the growing need for residue-free farming and export-grade produce.

View the full report now for the Biorationals Market Research Report and updates!

Competitive Landscape

The global biorationals market is highly competitive and fragmented, with key players continually innovating to gain a competitive edge and expand their market presence.

Key Companies:

- Valent BioSciences Corporation

- Bayer AG

- Isagro S.p.A.

- BASF SE

- Marrone Bio Innovations Inc.

- Syngenta AG

- Koppert B.V.

- Suterra LLC

- Gowan Company LLC

- Bioworks Inc.

- Certis USA LLC

- Russell IPM Ltd

- Andermatt Biocontrol AG

- Real IPM Kenya Ltd

- Camson Bio Technologies Ltd

These companies focus on R&D investments, mergers & acquisitions, and strategic alliances to bolster their product portfolios and expand geographically. For instance, Bayer’s acquisition of AI company Blackford in 2023 signals a move toward enhanced digital integration in agricultural diagnostics and imaging.

Meanwhile, Valent BioSciences’ expansion into the U.S. bio-stimulant market reflects growing demand for holistic plant health solutions. These companies meet agricultural needs and are venturing into public health, aquaculture, and forestry, further diversifying the market.

There is also a growing emphasis on supply chain optimization, local production facilities, and farmer education initiatives to improve adoption, especially in emerging economies.

In conclusion, the biorational market is poised for robust growth, driven by global trends in sustainability, regulatory changes, and evolving agricultural practices. Companies that innovate, diversify, and adapt to regional needs are expected to lead the next wave of growth in this dynamic and vital sector.

FAQ.

- What factors are driving the growth of the global Biorationals Market?

- How does the CAGR of 9.7% influence the future of the Biorationals Market?

- What are the key applications of bio-renewables in different sectors?

- How does the valuation of USD 0.9 billion in 2022 compare to projections for 2030?

- What challenges does the bioreationals market face in reaching its projected value?