Global Agricultural Microbials Market 2023-2030: Growth, Trends, and Key Insights

The global Agricultural Microbials Market is projected to grow at a CAGR of 15.20% from 2023 to 2030. Discover insights on key players, market trends, product innovations, and regional dynamics in the sustainable agriculture sector.

Agricultural Microbials Market Industry 2023-2030

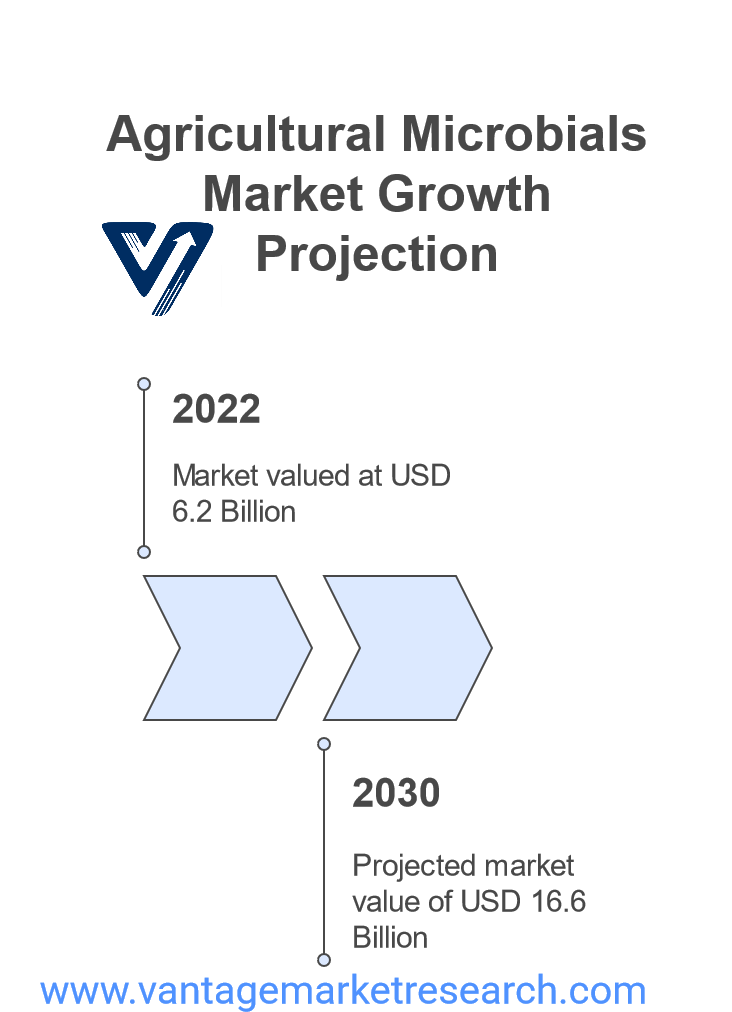

According to analysts at Vantage Market Research, the Global Agricultural Microbials Market was valued at approximately USD 6.2 billion in 2022 and is projected to grow at a robust compound annual growth rate (CAGR) of 15.20% from 2023 to 2030. Several factors drive this growth, including the rising consumer demand for organic food, the gradual phase-out of chemical fertilizers, pesticide residue concerns, pest resistance, and an increasing emphasis on agricultural sustainability.

Agricultural microbials refer to microorganisms such as bacteria, fungi, viruses, and other microbes, which are utilized in agriculture to enhance plant growth, improve soil fertility, and safeguard crops from pests and diseases. They offer an environmentally sustainable alternative to synthetic chemical fertilizers and pesticides by boosting plant health, increasing nutrient availability, and acting as natural protectors against harmful organisms. This sustainable approach, often called bio-fertilization and bio-control, is gaining momentum as farmers seek eco-friendly solutions to modern agricultural challenges.

The adoption of agricultural microbials is being driven by the growing awareness among farmers of their advantages in soil health management, particularly in minimizing soil erosion, improving water retention, and reducing the need for chemical inputs. These microorganisms break down organic matter in the soil, releasing nutrients in forms that plants can readily absorb. Additionally, microbials are known to foster natural disease suppression by competing with harmful pathogens, reducing the reliance on chemical pesticides, which can have adverse environmental and health effects.

Furthermore, there is increasing recognition of the limitations of traditional chemical-based solutions, as these often lead to pest resistance and environmental degradation. Agricultural microbials present an opportunity to enhance farm productivity without the negative side effects associated with conventional methods. However, education and outreach to farmers are essential to drive the broader adoption of microbial solutions in agriculture, particularly in regions with limited information on sustainable practices.

Download Sample Report PDF (Including Full TOC, Table & Figures) @ https://www.vantagemarketresearch.com/agricultural-microbials-market-1064/request-sample

Industry Trends

The agricultural microbials market is witnessing several key trends shaping the future of farming practices. One of the most significant developments is the rise of precision agriculture, which aims to optimize resource use and increase efficiency through technology. For example, in February 2024, John Deere and GUSS Automation introduced the Electric GUSS, the world’s first fully electric autonomous herbicide orchard sprayer. This groundbreaking machine enables growers to control multiple sprayers remotely and uses a smart spraying weed detection system to minimize herbicide usage. The Electric GUSS represents a significant advancement in precision agriculture, and it is expected that the demand for such autonomous systems will boost the agricultural microbials market by promoting the use of biologically based crop protection solutions.

Mahindra’s unveiling of new tractor models at the 2024 National Farm Machinery Show illustrates how advanced machinery is becoming an integral part of modern farming. These tractors, designed to enhance power, comfort, and user experience, reflect a broader trend toward more efficient, technology-driven farming. As farmers increasingly adopt high-tech equipment for precision applications, the role of agricultural microbials in these systems will likely grow, particularly in areas related to biopesticides, biofertilizers, and soil health management.

Government support for sustainable agricultural practices is also a key market driver. In April 2023, Native Microbials, a biotechnology firm specializing in animal health and nutrition, received a $1.4 million grant from the USDA's Natural Resources Conservation Service (NRCS). This funding, part of the Conservation Innovation Grants (CIG) program, underscores the growing importance of climate-smart agriculture and the USDA’s commitment to promoting innovative agricultural solutions. Such government initiatives are expected to foster the development and adoption of microbial-based solutions that enhance agricultural sustainability.

In the product space, introducing new formulations and delivery systems is enhancing the versatility and effectiveness of agricultural microbials. For example, the launch of LALFIX START SPHERICAL Granule in July 2022 combines two unique rhizobium strains with Bacillus velezensis, a plant growth-promoting microorganism. This granular inoculant is designed to increase root mass and enhance phosphorus solubilization, offering a new option for farmers looking to improve soil fertility and crop yields.

Moreover, mergers and acquisitions (M&A) in the agricultural microbials sector are helping companies expand their product portfolios and access new markets. For example, Corteva's acquisition of Symborg enhances its biocontrol offerings and adds to its expertise in microbiological technologies, making it a key player in the biologicals market.

These trends collectively highlight the dynamic nature of the agricultural microbials market, where innovation, strategic partnerships, and technological advancements drive growth and shape the future of farming practices.

Take Action Now: Secure Your Position in the Global Agricultural Microbials Industry Today – Purchase Now.

Product Insights

The agricultural microbial market is diverse in product types, including bacteria, fungi, viruses, and protozoa. The bacteria segment dominated the market in 2022, accounting for 52.8% of the revenue share. This can be attributed to the wide application of bacterial strains in formulating bio-pesticides, bio-fertilizers, and bio-stimulants. Bacteria play crucial roles in plant growth promotion by facilitating nutrient uptake, preventing root diseases, and enhancing soil health. Common bacterial strains such as Bacillus thuringiensis are also utilized as bio-control agents to manage insect pests, further boosting their market penetration.

Fungi, which contribute to enhanced crop yield and plant resilience, are gaining popularity. They form beneficial symbiotic relationships with plant roots, improving nutrient absorption and stress tolerance, particularly under adverse conditions such as drought or high salinity. As a result, the fungi segment is expected to witness increased adoption in the coming years. Additionally, fungi contribute to the decomposition of organic matter in the soil, enriching the ecosystem by cycling nutrients.

Viruses are also being explored for their use in pest management. Virus-based solutions, particularly engineered or selected viruses that target specific pests, offer a more targeted and environment-friendly alternative to chemical pesticides. These biological control methods present a promising direction for reducing crop losses due to pest infestations while minimizing the ecological impact of traditional pest control methods.

Although a smaller segment, protozoa also play a role in maintaining soil health and promoting plant growth. Their presence contributes to the breakdown of organic matter and the release of nutrients that plants require for optimal growth.

Crop Type Insights

Cereals and grains represent the largest crop segment within the agricultural microbials market, accounting for 39.9% of the market share in 2022. The significant demand for these crops can be attributed to their importance in global food production. Agricultural microbials enhance nutrient availability, improve root architecture, and stimulate plant growth, leading to higher crop yields. Furthermore, microbes like Bacillus thuringiensis protect cereals and grains from insect pests, reducing the reliance on chemical pesticides.

The increasing demand for high-value crops, including fruits and vegetables, drives the agricultural microbials market. The surge in consumer preference for organic produce is propelling the adoption of microbial-based solutions to ensure crop health and sustainability. Microbial inoculants provide essential nutrients to these crops, improve soil fertility, and promote organic matter decomposition, which enhances nutrient availability for plants.

Oilseeds and pulses are another growing segment within the agricultural microbial market. Microbial treatments have enhanced seedling vigor, increased resistance to pests and diseases, and improved stress tolerance in oilseeds and pulses. These crops often face environmental challenges such as drought or salinity, and agricultural microbials can help mitigate these effects by enhancing nutrient uptake and improving plant resilience.

Application Insights

The foliar application method accounted for 45.8% of the agricultural microbials market 2022. Foliar spraying allows plants to absorb nutrients through their leaves quickly, making it an efficient method for correcting nutrient deficiencies and addressing plant diseases. It is a widely adopted method due to its rapid response and ease of application. Foliar sprays can also apply microbials that promote plant growth, disease resistance, and soil health.

Soil treatments also play a crucial role in the agricultural microbial market. Farmers can enhance soil fertility, improve nutrient cycling, and increase microbial biodiversity by applying microbial agents directly to the soil. These treatments are often used to improve soil structure, promote healthy root development, and reduce the reliance on synthetic fertilizers.

Seed treatment is another critical application method. Microbial inoculants are applied to seeds before planting to promote early growth and protect against soil-borne diseases. Seed treatments ensure beneficial microbes are present early in the plant’s lifecycle, enhancing growth and improving crop yields.

Formulation Insights

The liquid formulation segment held the largest market share, 64.5%, in 2022. Liquid formulations are preferred because of their ease of application and efficient distribution across fields. They can be applied via irrigation systems, foliar spraying, or root dipping, ensuring even coverage and quick microbial activation. The ability of liquid formulations to be absorbed quickly by plants and soil enhances their effectiveness in improving plant growth and controlling diseases.

On the other hand, dry formulations are expected to remain a significant part of the market due to their longer shelf life, cost-effectiveness, and ease of storage and transportation. Dry formulations are often used in regions with logistical constraints or for long-term storage.

Regional Insights

North America dominated the agricultural microbials market 2022, accounting for 38.4% of the market share. This is largely due to the growing awareness of sustainable farming practices and the increasing adoption of organic farming methods. Farmers in North America increasingly turn to microbial-based solutions to replace synthetic chemicals, driven by environmental concerns and consumer demand for organic produce.

The Asia Pacific region is expected to experience significant growth due to its status as the largest producer of organic products. China and India, two major regional agricultural hubs, are increasing their focus on microbial-based solutions to improve crop yields and soil health. Meanwhile, expanding organic farming practices and government incentives in Europe are expected to drive demand for agricultural microbials.

For the Agricultural Microbials Market Research Report and updates, view the full report now!

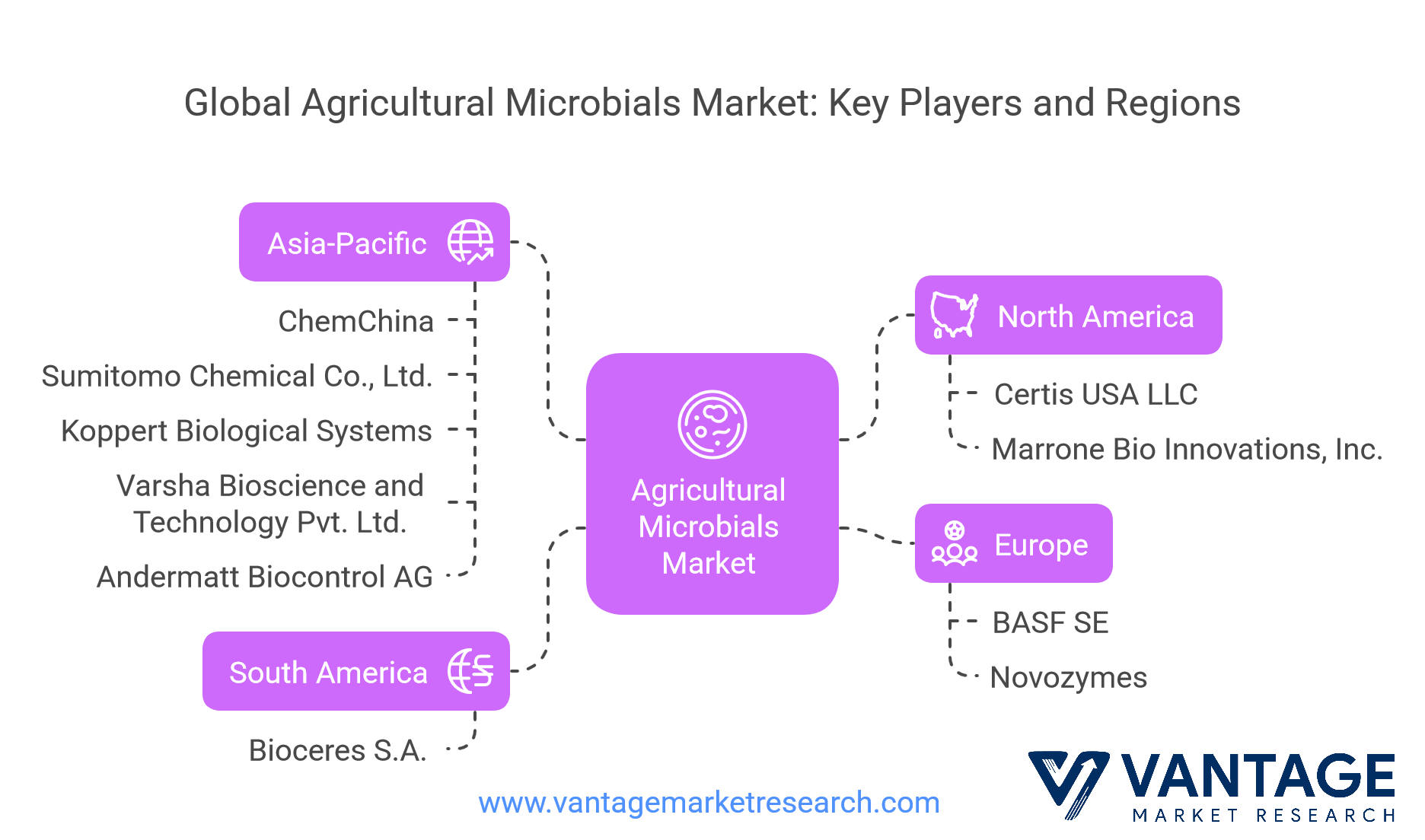

Top 10 Companies in Agricultural Microbials Industry

- Certis USA LLC (U.S.)

- ChemChina (China)

- Marrone Bio Innovations Inc. (U.S.)

- Koppert Biological Systems (Netherlands)

- Varsha Bioscience and Technology Pvt. Ltd. (India)

- Andermatt Biocontrol AG (Switzerland)

- BASF SE (Germany)

- Sumitomo Chemical Co. Ltd. (Japan)

- Novozymes (Denmark)

- Bioceres S.A. (Argentina)

Competitive Landscape

The global agricultural microbials market is marked by intense competition from various players, including large multinational corporations, regional players, and emerging startups. Each entity vies for a slice of the rapidly growing market, driven by increasing demand for eco-friendly and sustainable farming solutions. Key players invest significantly in research and development (R&D) to develop cutting-edge microbial products designed for different crops, environmental conditions, and farming practices. This emphasis on innovation is crucial as modern agriculture emphasizes improving crop productivity while minimizing environmental harm.

One of the primary strategies market players adopt is the creation of tailored microbial solutions for various agricultural needs. For example, companies are developing specialized bacteria, fungi, and viruses that can be applied to specific crops to enhance growth, improve nutrient uptake, or protect against pests and diseases. This trend reflects the growing demand for precision agriculture solutions that optimize the use of resources and reduce the reliance on synthetic chemicals. In addition to developing microbial products, players also focus on creating new formulations and delivery methods, such as liquid and dry formulations, which allow for more efficient application and better results.

Major companies like Certis USA LLC, ChemChina, Marrone Bio Innovations, Inc., and Koppert Biological Systems are prominent players. Certis USA LLC, for instance, has a strong portfolio of bio-based pest management products and continues to expand its offerings through innovative microbial formulations. Similarly, ChemChina’s subsidiary, Adama Agricultural Solutions, is working on commercializing microbial pesticides that offer environmentally sustainable alternatives to traditional chemical products. Marrone Bio Innovations, a leading player in the U.S., is known for its bio-based crop protection solutions. Koppert Biological Systems specializes in integrated pest management and biological crop protection products.

Other key players include Varsha Bioscience and Technology Pvt. Ltd., a notable company based in India that is making significant strides in the development of microbial products for sustainable agriculture, and Andermatt Biocontrol AG, a Swiss firm that focuses on biological control solutions. BASF SE, Sumitomo Chemical Co., Ltd., Novozymes, and Bioceres S.A. are also major players, leveraging their extensive experience in agricultural chemicals and biological solutions to drive innovation and meet the growing demand for sustainable farming practices.

The rise of startups in this space is also noteworthy. These companies are often at the forefront of innovation, introducing novel microbial solutions and addressing niche market needs. Startups such as Native Microbials and Symborg (acquired by Corteva) are expanding the range of agricultural microbial products available, focusing on advanced biocontrol solutions and developing new microbial strains tailored to specific challenges in crop production. These emerging players receive significant investment and support as governments and organizations recognize the importance of advancing sustainability in agriculture.

Furthermore, R&D and strategic partnerships are key to competitiveness in the agricultural microbials sector. For instance, Corteva's acquisition of Symborg in 2022 allowed Corteva to diversify its biological portfolio and enhance its technical expertise in microbiological solutions. Similarly, partnerships between biotechnology firms and agricultural equipment manufacturers are helping integrate microbial technologies into precision agriculture systems, such as using microbial agents in autonomous herbicide sprayers.

As environmental concerns continue to grow and consumer demand for organic products increases, the competitive landscape of the agricultural microbials market will likely continue to evolve. Companies must focus on developing solutions that enhance crop productivity, reduce environmental impact, promote soil health, and ensure food safety. Those who can meet these demands will be positioned to succeed in this rapidly expanding market.

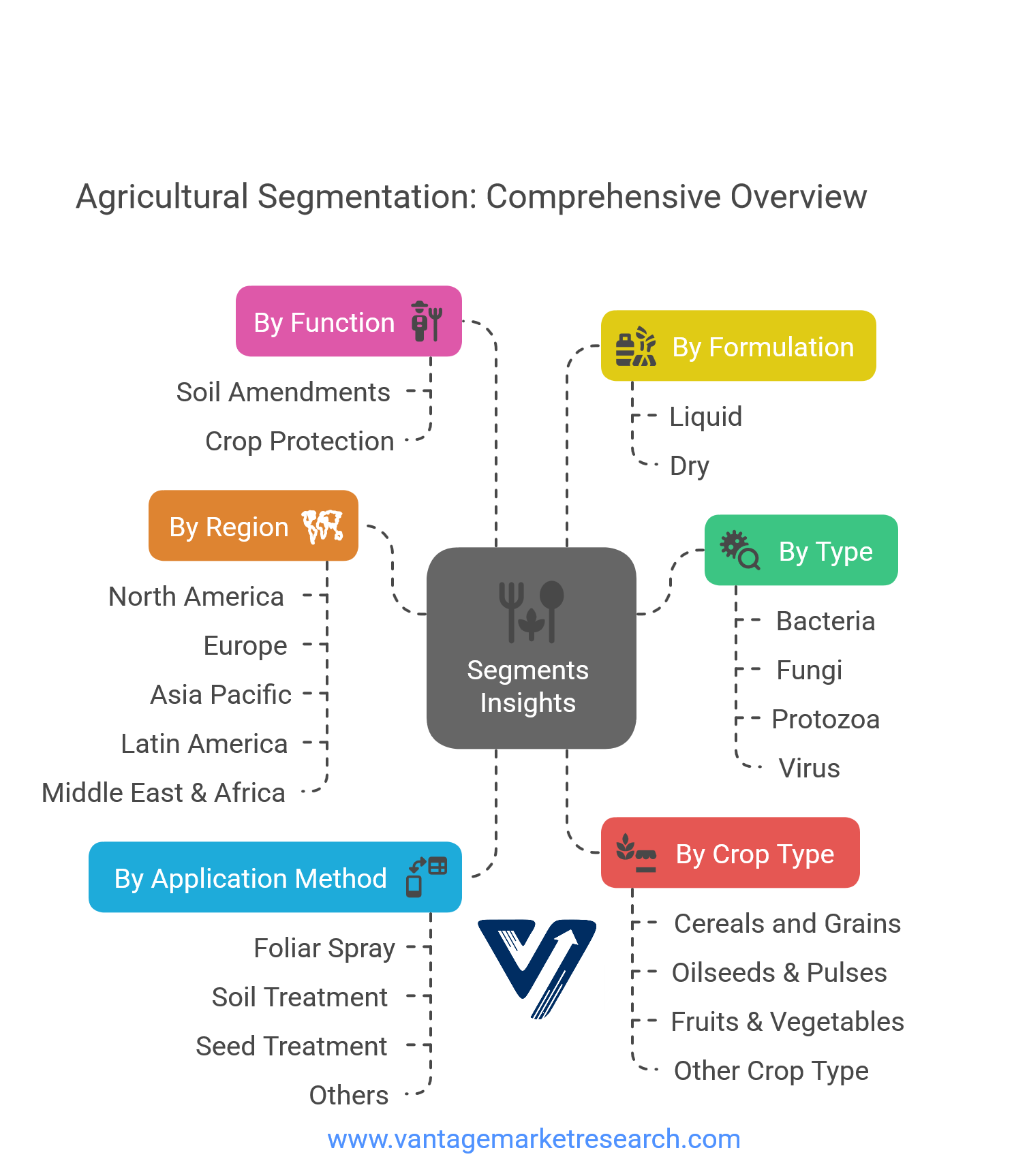

Segments Insights

The global agricultural microbials market is segmented into various categories, each reflecting different aspects of the sector’s complexity and breadth. The market is primarily segmented based on types of microorganisms, crop types, functions, formulations, application methods, and regions.

Types

- Bacteria

- Fungi

- Protozoa

- Virus

The agricultural microbial market is divided into bacteria, fungi, viruses, and protozoa. Among these, the bacteria segment holds the largest market share, primarily due to the extensive use of bacteria in bio-pesticides, bio-fertilizers, and bio-stimulants. Bacteria such as Bacillus thuringiensis are widely used to promote plant growth and control pests. Fungi are also gaining prominence due to their ability to enhance nutrient uptake and improve crop resilience. Virus-based solutions are gaining attention for their precision in pest control, while protozoa play a role in soil health and nutrient cycling.

Crop Types

- Cereals and Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Other Crop Type ( turf & ornamentals, plantation crops, fiber crops, and silage & forage crops)

The market is also segmented by crop type, including cereals and grains, oilseeds and pulses, fruits and vegetables, and other crops such as turf, ornamentals, and fiber. Cereals and grains dominate the market, driven by their importance in global food production. Oilseeds and pulses are also significant segments, as microbial solutions enhance plant growth and stress tolerance in these crops. The growing demand for organic fruits and vegetables is propelling the use of agricultural microbials in this segment.

Functions

- Soil Amendments

- Crop Protection

The agricultural microbials market is further categorized into soil amendments and crop protection. Soil amendments, such as microbial inoculants, help improve soil health and nutrient availability, while crop protection products protect against pests and diseases, reducing the reliance on chemical pesticides.

Formulations and Application Methods

- Liquid

- Dry

Microbial products are available in liquid and dry formulations, each with distinct advantages. Liquid formulations are easier to apply and provide rapid activation of microbial activity, while dry formulations have a longer shelf life and are easier to store and transport. The primary application methods include foliar sprays, soil treatments, seed treatments, and other specialized applications.

Regional Insights

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Geographically, North America is expected to dominate the agricultural microbials market during the forecast period, driven by strong demand for sustainable farming practices. However, the Asia-Pacific region, led by China and India, is anticipated to witness significant growth, fueled by the large-scale adoption of organic farming and government incentives. Europe is also a growing market, with increasing support for organic farming and biocontrol solutions.

Overall, the agricultural microbial market is poised for substantial growth, driven by technological advancements, changing consumer preferences, and increasing environmental awareness.

Conclusion

The global agricultural microbials market is poised for significant growth in the coming years. With the increasing demand for organic and sustainable agricultural practices, agricultural microbials provide an environmentally friendly alternative to synthetic chemicals. As technological advancements continue, the market is expected to increase adoption across various regions and crop types. Furthermore, with the growing emphasis on soil health and sustainable farming, agricultural microbials are positioned to play a pivotal role in the future of global agriculture.

FAQ.

- What is driving the growth of the Agricultural Microbials Market from 2023 to 2030?

- How are agricultural microbials helping in sustainable farming practices and reducing dependency on chemical fertilizers and pesticides?

- What are the key types of agricultural microbials and their specific applications in crop protection and growth enhancement?

- How is the demand for organic food products influencing the adoption of agricultural microbials?

- Which regions are expected to dominate the Agricultural Microbials Market during the forecast period, and why?

- What are the market's most common microbial formulations (liquid vs dry), and which is more widely used in agricultural practices?

- How are innovations in microbial technology, such as bio-pesticides and bio-stimulants, transforming crop management and pest control strategies?

- How do bacterial-based microbials improve soil health and plant growth?

- What challenges do farmers face in adopting agricultural microbials, and how can these challenges be overcome?

- How are regulatory trends and government policies shaping the future of the Agricultural Microbials Market globally?