Global Electrical Steel Market Forecast 2025β2035 | Growth at 5.75% CAGR

Discover insights into the global electrical steel market valued at USD 32.19 billion in 2024, projected to reach USD 59.5 billion by 2035, growing at a CAGR of 5.75%.

Magnetizing Growth — The Global Electrical Steel Market Accelerates Toward 2035

The global Electrical Steel Market is entering a decisive growth phase, driven by rising electricity demand, renewable energy expansion, and the spread of electric vehicles. According to Vantage Market Research, the market is valued at USD 32.19 billion in 2024 and is projected to reach USD 59.5 billion by 2035, reflecting a CAGR of 5.75% between 2025 and 2035.

Key Takeaways

- Market Revenue 2024: USD 32.19 billion

- Forecast 2035: USD 59.5 billion

- CAGR (2025–2035): 5.75%

- Leading Drivers: Electrification trends—particularly EVs, renewables, and grid upgrades—are fueling demand for electrical steel.

- Increasing adoption of electrical steel in transformers, motors, and power generation equipment is driving demand, fueled by the global shift toward renewable energy integration and grid modernization.

- Asia Pacific dominates the market due to rapid industrialization, expansion of power infrastructure, and the rise of electric vehicles. Europe and North America are growing steadily, driven by renewable energy targets and demand for advanced transformers and EV components.

- Key players such as ArcelorMittal, Nippon Steel, POSCO, Voestalpine AG, and Thyssenkrupp AG are investing in advanced production technologies and expanding capacity to strengthen their market share.

Our comprehensive Electrical Steel Market report is ready with the latest trends, growth opportunities, and strategic analysis. View Sample Report PDF.

Premium Insights

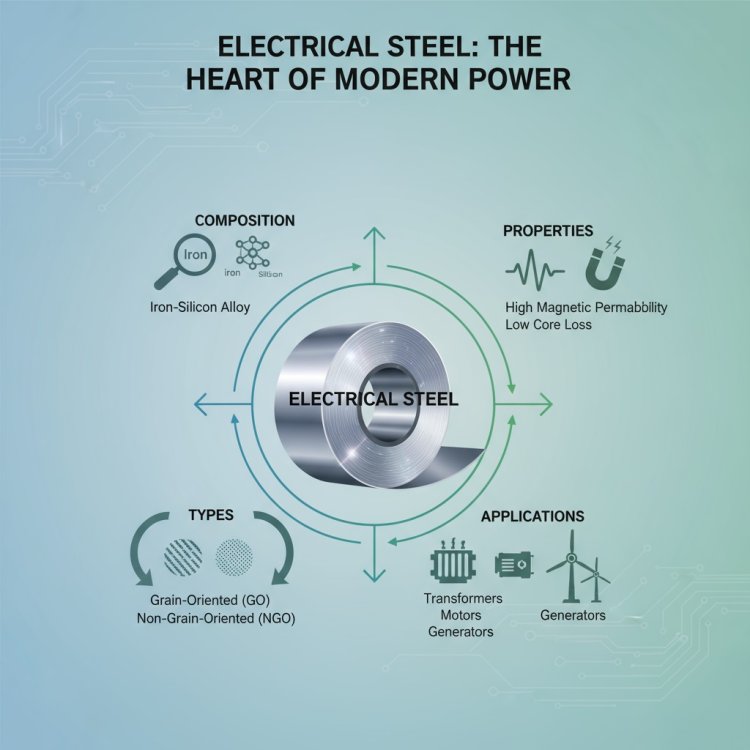

Advancements in power infrastructure, the rise of electric vehicles, and grid modernization are driving demand for electrical steel—particularly grain-oriented (GOES) and non-grain-oriented (NGOES) variants. Manufacturers are focusing on low-loss and high-magnetic-permeability grades to boost energy efficiency. Renewable integration and transformer modernization further cement the role of electrical steel in decarbonization strategies.

Market Size & Forecast

- 2024 Market Size: USD 32.19 billion

- 2035 Forecast: USD 59.5 billion

- CAGR (2025–2035): 5.75%

The electrical steel market is dominated by established steel giants and specialty producers who ensure consistent supply and technological innovation—particularly in low-loss materials. High capital and technological requirements limit market entry, but regional and domestic players are emerging to meet local demand with tailored offerings and competitive pricing.

For Electrical Steel Market Research Report and updates detailed: View Full Report Now!

Type Product Insights:

The electrical steel market by type is categorized into Grain-Oriented Electrical Steel (GOES) and Non-Grain-Oriented Electrical Steel (NGOES). GOES is primarily used in transformers due to its superior magnetic properties and efficiency in reducing energy loss. NGOES, on the other hand, finds applications in electric motors, generators, and other rotating equipment. Growing demand for renewable energy and electric vehicles is boosting both segments. Manufacturers are focusing on developing advanced alloys with higher energy efficiency to meet sustainability goals.

Type Application Insights:

Based on applications, the market is segmented into Transformers, Motors, Inductors, and Others. Transformers dominate due to large-scale adoption in power generation, transmission, and distribution infrastructure, especially with grid modernization initiatives. Motors represent another fast-growing segment, largely fueled by the global surge in electric vehicle adoption. Inductors and other niche applications are seeing steady growth in electronics and industrial equipment. Rising focus on energy-efficient devices and reduced power loss is creating long-term growth opportunities across these application segments.

Type End-Use Insights:

By end-use industries, the electrical steel market spans Energy, Automotive, Manufacturing, and Others. The energy sector holds the largest share, driven by the expansion of renewable power generation, electricity grids, and distribution networks. Automotive is growing rapidly due to the surge in hybrid and electric vehicles requiring advanced motor components. Manufacturing industries utilize electrical steel for machinery, industrial automation, and consumer electronics. Other end uses include aerospace and defense. Each industry is investing in high-performance electrical steels to ensure improved efficiency and durability.

Regional Insights

North America

North America’s electrical steel market is expanding steadily, led by the United States and Canada. Growth is driven by modernization of power grids, adoption of smart transformers, and increased production of electric vehicles. Low-loss and high-efficiency steels are in demand for energy optimization and sustainability compliance. Domestic manufacturing investments and the integration of renewable energy sources such as solar and wind further propel market expansion. Technological innovations in motor and transformer design continue to boost product adoption across industries.

Europe

Europe’s electrical steel market is strongly influenced by stringent energy efficiency regulations and sustainability goals. Germany, France, and the UK are major contributors, investing in low-loss transformers and electric vehicle motors. Renewable energy integration, recycling initiatives, and smart grid deployment are key trends shaping regional demand. The focus on reducing carbon emissions has encouraged manufacturers to develop high-performance GOES and NGOES products. Growing awareness of energy conservation in industrial and automotive sectors further drives market adoption.

Asia Pacific

Asia Pacific dominates the global electrical steel market, accounting for the largest share. Rapid industrialization, urbanization, and infrastructure development in China, India, Japan, and South Korea fuel demand. Expansion of renewable energy projects and rising electric vehicle adoption contribute to strong growth. Local manufacturers are scaling production to meet both domestic and export requirements. Technological advancements in low-loss, high-efficiency steels for transformers and motors support market competitiveness, making the region a key hub for electrical steel production and consumption.

Latin America

Latin America’s electrical steel market is witnessing steady growth, primarily in Brazil, Mexico, and Argentina. The demand is fueled by investments in power infrastructure, grid modernization, and industrial automation. Local manufacturers are enhancing production capacity to meet regional transformer and motor requirements. Economic reforms and foreign investments are facilitating the adoption of high-performance electrical steels. Despite challenges such as fluctuating feedstock costs and limited technological expertise, the region presents long-term growth opportunities in energy, automotive, and industrial sectors.

Middle East & Africa

The Middle East & Africa region is experiencing growing demand for electrical steel, driven by large-scale infrastructure, power, and renewable energy projects. Gulf nations like Saudi Arabia, UAE, and Qatar are expanding transformer and generator production for domestic use and export. In Africa, industrialization and grid development are creating new opportunities for high-efficiency electrical steels. The market is also witnessing investments in advanced GOES and NGOES products to meet sustainability goals and reduce energy losses across power and industrial applications.

Top Key Electrical Steel Companies:

Leading global producers include Aperam, ArcelorMittal, Tata Steel, POSCO, Nippon Steel, Baosteel Group, Voestalpine, JFE Holdings, Cleveland-Cliffs, and the Slovenian Steel Group, leveraging scale, innovation, and footprint to capture the evolving market.

Recent Developments

- In 2025, Voestalpine launched a new ultra-thin grain-oriented electrical steel grade, optimized for high-efficiency transformers in renewable energy applications. The innovation significantly lowers iron losses, enhancing transformer performance and reaching commercial availability within 2025.

Electrical Steel Market Scope

Vantage’s report offers comprehensive historical data, 2024 baseline, and projections through 2035. It includes segmentation by product type (GOES, NGOES), application, end-use, and geography; competitive landscape analysis; and strategic insights for stakeholders aligning with electrification trends.

Market Dynamics

Driver:

The electrical steel market is primarily driven by the rising adoption of renewable energy, electrification of transport, and modernization of power grids. Increasing demand for electric vehicles is boosting NGOES consumption for high-efficiency motors. Transformers for grid upgrades and renewable integration require GOES with low energy losses. Additionally, governments worldwide are implementing energy efficiency standards, encouraging manufacturers to produce advanced electrical steels. Technological innovations in low-loss alloys and sustainable production methods further propel market growth across all regions.

Restraint:

High manufacturing costs and technical complexity restrict the growth of the electrical steel market. Producing low-loss GOES requires advanced equipment, precision processing, and energy-intensive manufacturing, which elevates costs. Volatile raw material prices, including iron and alloying elements, add financial unpredictability. Stringent environmental regulations can also increase compliance costs. Moreover, developing countries may face infrastructure and technology gaps, limiting local adoption. These constraints collectively slow market penetration, particularly for new entrants and small-to-medium scale producers seeking competitive positioning.

Opportunity:

Rising global focus on electric vehicles, renewable energy, and smart grids presents significant growth opportunities for the electrical steel market. Manufacturers can capitalize on growing demand for low-loss, high-efficiency GOES and NGOES products. Expanding production in emerging markets like Asia Pacific and Latin America allows access to rising industrialization and infrastructure projects. Investments in research and development for sustainable steel and recycling technologies offer additional growth avenues. The trend toward energy-efficient electrical equipment drives long-term innovation and market expansion.

Challenges:

The electrical steel market faces challenges from fluctuating raw material costs, competition from low-cost producers, and energy-intensive manufacturing processes. Balancing performance, efficiency, and cost-effectiveness remains critical. Market volatility, trade restrictions, and geopolitical uncertainties can disrupt supply chains and production schedules. Additionally, the shift toward sustainable and recycled electrical steel requires heavy capital and technical investment, which may deter smaller manufacturers. Ensuring consistent quality across large-scale production while meeting evolving regulatory standards is another ongoing challenge for market participants.

Global Electrical Steel Market Segmentation

- By Product Type: GOES; NGOES

- By Application: Transformers; Motors & Generators; Others

- By End-Use Industry: Energy & Power; Automotive; Industrial; Renewable

- By Region: North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Frequently Asked Questions

- What is the current market size and forecast?

2024 size: USD 32.19 billion

2035 forecast: USD 59.5 billion

CAGR: 5.75%

- Which region leads the market?

Asia Pacific leads, driven by industrialization and electrification .

- What are the key applications?

Transformers dominate; motors and generators are growing with EV and industrial demand.

- Who are the leading players?

Major players include Aperam, ArcelorMittal, POSCO, Nippon Steel, and others.

- What recent innovations are emerging?

Voestalpine’s 2025 launch of ultra-thin GOES for renewable transformers marks a key industry development.