Top Companies in Electronic Funds Transfer Market | Leading Top Players Growth rate Statistical data by VMR

An Electronic Funds Transfer Market is a fund transfer system that allows for the instant transfer of money or securities. It is a common method of transferring funds from one account to another over a computer network

UpComing Trends in Electronic Funds Transfer Market

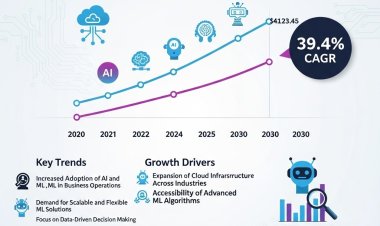

The Global Electronic Funds Transfer Market is valued at USD 61.9 Billion in the year 2021 and is projected to reach a value of USD 103.2 Billion by the year 2028. The Global Market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 8.9% over the forecast period. A fund transfer system that allows instant transfer of money or securities is referred to as an Electronic Funds Transfer Market. It is a popular method for transferring funds from one account to another over a computer network. An Electronic Funds Transfer is a widely used method for moving funds from one account to another using a computer network. Electronic Funds Transfers replace paper-based transfers and human intermediaries but provide the customer with the convenience of doing her own banking.

Electronic Funds Transfers replace paper transfers and human intermediaries while allowing the customer to do their banking. Furthermore, Electronic Funds Transfers are protected by a personal identification number (PIN) or the login information used to access the customer's online banking service. The payment is processed by an automated clearing house (ACH). This serves as the foundation for an Electronic Funds Transfer system.

Some of the key contributors in the field of Electronic Funds Transfer Market are as below:

|

Company Name |

Revenue in USD |

|

$39 Billion |

|

$18 Billion |

|

$75 Billion |

|

$35 Billion |

|

$61 Billion |

|

$93 Billion |

|

$130 Billion |

|

$59 Billion |

|

$4 Billion |

|

$20 Billion |

Royal Bank of Canada is a Canadian multinational financial services company and the largest bank in Canada by market capitalization. The bank serves over 16 million clients and has 86,000+ employees worldwide. The bank is listed as RY (TSE) in the stock market. The company generates USD 49.69 billion in 2021 and has 85,301 total employees working.

The Charles Schwab Corporation is an American multinational financial services company. It offers banking, commercial banking, investing, and related services including consulting, and wealth management advisory services to both retail and institutional clients. The company is listed in the New York stock market as SCHW (NYSE). In 2020 the company generated revenue of USD 11.69 billion and has approximately 21,000 employees working.

Citigroup Inc. or Citi is a US-American multinational investment bank and financial services corporation headquartered in New York City. The company was formed by the merger of banking giant Citicorp and financial conglomerate Travelers Group in 1998; Travelers was subsequently spun off from the company in 2002. The company is listed in the New York stock market as C (NYSE). In 2020, the company has approximately 2,10,000 employees working.

UBS Group AG is a multinational investment bank and financial services company founded and based in Switzerland. Co-headquartered in the cities of Zürich and Basel, it maintains a presence in all major financial centers as the largest Swiss banking institution and the largest private bank in the world. The company is listed on the UBSG (SWX) stock market. The company generated revenue of approximately 36.03 billion in 2020 and has 71,551 employees working across the globe.

Morgan Stanley is an American multinational investment bank and financial services company headquartered at 1585 Broadway in Midtown Manhattan, New York City. With offices in more than 42 countries and more than 60,000 employees, the firm's clients include corporations, governments, institutions, and individuals. The company is listed in New York as MS (NYSE) and generated revenue of USD 148 billion in 2021. In 2022, the headcount of the company is 75,000.

The Bank of America Corporation is an American multinational investment bank and financial services holding company headquartered in Charlotte, North Carolina. The bank was founded in San Francisco and took its present form when NationsBank of Charlotte acquired it in 1998.

JPMorgan Chase & Co. is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. The company is listed in the stock market as JPM (NYSE) and generated revenue of USD 127.2 billion in 2021.

The Goldman Sachs Group, Inc. is an American multinational investment bank and financial services company headquartered in New York City. The company is a privately held organization generation approximately USD 5 billion and has 43,900 total employees.

Julius Bär Group AG, known alternatively as Julius Baer Group Ltd., is a private banking corporation founded and based in Switzerland. Headquartered in Zürich, it is among the older Swiss banking institutions. The company is listed as BAER (SWX) and generated revenue of USD 12.32 billion. The company has a total of 6,667 employees working.

Credit Suisse Group AG is a global investment bank and financial services firm founded and based in Switzerland. The company is a privately held organization generating revenue of USD 23.59 billion and has approximately 45,000 employees working.

Read Latest Blog Top Companies in Lithium-Ion Battery Packs Market: https://v-mr.biz/lithium-ion-battery-packs-market

Get a Free Sample Here: https://www.vantagemarketresearch.com/electronic-funds-transfer-market-1501/request-sample

For More Information about each of these companies.

Vantage Market Research Report comes up with a detailed analysis of each major player in the industry. The Study provides Global market size & share, Emerging trends, an in-depth analysis of key players, Development opportunities, Sales, and a Revenue Forecast.