Top Companies in Buy Now Pay Later Market | Major Players of Market Statistics, Overview by Vantage Market Research

Retailers are now offering buy now, pay later options, allowing customers to acquire everyday necessities by selecting an affordable financing plan and paying in installments rather than in one lump sum.

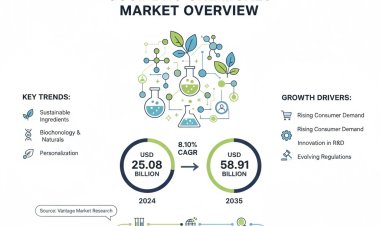

Market Overview:

The Global Buy Now Pay Later Market is valued at USD 4,829.1 Million in the year 2021 and is forecasted to reach a value of USD 1,8333.3 Million by the year 2028. The Global Market is anticipated to grow to exhibit a Compound Annual Growth Rate (CAGR) of 24.9% over the forecast period.

Buy Now Pay Later is a temporary subsidy that allows customers to buy and allows them to pay later at a future date, usually without interest. Many companies offer purchases now, paying later services to consumers like Klarna and Affirm. BNPL arrangements become an increasingly popular payment option, especially when shopping online. E-commerce businesses, fintech companies, and even banks have started offering offers now paying later services to customers. This payment option is available on Amazon and Flipkart websites, as well as banks such as ICICI Bank and HDFC Bank. The recent repayment loan also expands the number of applications based on fintech firms, including LazyPay, PayTM, MoneyTap, PhonePe, and CASHe, among others. This option is now available in a wide range of shopping, from gadgets to fashion, as well as food delivery, travel bookings, grocery shopping, and other expenses.

The introduction of online payment methods by people in developing countries accelerates the growth of the now-paying purchasing market. The economical and easy-to-purchase payment service now pays for the latest forums, as well as the expansion of the e-commerce sector, the main reasons driving the growth of global purchases paying for the market later.

Increasing acceptance of online payment methods among people around the world accelerates the growth of the payment market later. The availability of high-speed internet connection, increased smartphone penetration, and increased awareness about digital payment services are some of the key factors that enhance the adoption of online payment technology among people. The high number of internet users in the region is expected to create market growth opportunities.

Buy Now Pay Later - Many of the challenges offered by BNPL are for customers with very high credit scores. With only Prime Lending offered, many consumers are “locked out” of BNPL practice. For retailers, this means that a large proportion of consumers may have a bad credit experience and eventually stop selling.

Get Access to Our Free Sample Report: https://www.vantagemarketresearch.com/buy-now-pay-later-market-1628/request-sample

Some of the key players operating in the Buy Now Pay Later market are listed below:

|

Company Name |

Revenue in the US |

|

$597 Million |

|

$24 Billion |

|

$965 Million |

|

$1 Billion |

|

$9 Million |

|

$114 Million |

|

$22 Million |

|

$18 Million |

|

$10 Million |

|

<$5 Million |

Afterpay is a technology-driven payments company that facilitates commerce between retail merchants and their end customers by offering a "Buy Now Pay Later" service that does not require customers to enter into a traditional loan or pay any upfront fees or interest. Afterpay has developed an end-to-end digital platform and transaction integrity engine that performs real-time fraud and repayment capability assessments. The company is headquartered in Melbourne, Australia.

PayPal Holdings, Inc. operates as a technology platform company that enables digital and mobile payments on behalf of consumers and merchants. It allows its customers to use their accounts for both purchases and paying for goods, as well as to transfer and withdraw funds. The Company offers online payment solutions. PayPal Holdings serves customers worldwide. The company was founded in December 1998 and is headquartered in San Jose, CA.

Affirm is a publicly-traded financial technology company headquartered in San Francisco, United States. Founded in 2012, Affirm, Inc. designs and develops software. The Company offers an online platform that provides lending and consumer credit services, as well as enables customers to buy what they want and pay over time. Affirm serves customers in the United States.

Klarna Inc. provides e-commerce payment systems and solutions. The Company offers credit to shoppers and allows them to pay after they receive the goods. Klarna serves customers worldwide. The company's platform offers in-store, mobile, and online payments, as well as deliveries and returns services and works on a Buy Now, Pay Later model, thereby enabling shoppers to finance their retail purchases and make paying simple, safe and smooth.

Splitit Ltd, doing business as Split Payments, operates as an open banking payment platform. The Company focuses on card payment, debit solutions, money transfers, and other related activities. Splitit serves customers in Australia. Splitit is a payment method solution enabling customers to pay for purchases with an existing debit or credit card by splitting the cost into interest and fee-free monthly payments, without the need for additional registrations or applications. Splitit enables merchants to offer their customers an easy way to pay for purchases in monthly installments with instant approval, decreasing cart abandonment rates and increasing revenue. Headquartered in New York, Splitit has a Research and Development (R&D) center in Israel and offices in London, with plans to establish itself in Australia for its expansion into the Asia-Pacific region.

Sezzle Inc. headquartered in Minneapolis, the U.S operating in the United States and Canada, is a technology-driven payments company. The Company develops a digital payments platform that allows merchants to offer consumers a flexible alternative to traditional credit. Sezzle operates in the United States.

PerPay, Inc. provides payment security solutions. The company develops a platform that extends an income-based spending limit supported by automated direct deposit payments, enabling individuals to have a stable repayment behavior, significant credit score increases, and high rates of engagement. PerPay offers solutions that provide various options for companies to accept payments, make payments, payment data security, alternate payment methods, and facilitate credit card transactions, professional, mobile, and shopping cart solutions, and services. ProPay operates in the State of Utah.

Openpay is a cutting-edge in-store, in-home and online payments solution that features a buy now and pay later service, interest-free. Openpay allows customers to make in-store and online purchases, and effectively split the payment for these purchases into multiple repayments over time. The company generates revenue from fees charged to merchants and customers in exchange for the use of its payment platform. The Company offers online shopping solutions for apparel, beauty, garden, home, automotive, health, wellbeing, and sports. Openpay is available across Australia and New Zealand in many industries including retail, medical, automotive, home improvement, and more.

Quadpay is one of the leading US-based installment payment platforms, providing consumers with a simple, transparent, and financially responsible alternative to traditional credit. Quadpay is reinventing the payments landscape with its focus on innovation and customer-centricity, enabling more than millions of customers to pay in four interest-free installments over six weeks. QuadPay Inc. designs and develops application software. The Company offers a payment platform that gives shoppers the choice to pay for their purchases via 4 interest-free installments. QuadPay serves customers in the State of New York.

Latitude Financial Services is a rebranded consumer finance company in Australia & NZ as LatitudePay, offering loans, credit cards, insurance, and retail finance. Latitudepay Australia PTY LTD is located in Docklands, Victoria, Australia, and is part of the Activities Related to the Credit Intermediation industry. The company has 1,393 total employees across all of its locations There are 22 companies in the Latitudepay Australia pty ltd corporate family.

Read More: https://www.vantagemarketresearch.com/industry-report/buy-now-pay-later-market-1628

Read Latest Blog Top Companies in Solar Inverter Market: https://v-mr.biz/solar-inverter-market

Get a Free Sample Here: https://www.vantagemarketresearch.com/buy-now-pay-later-market-1628/request-sample

For More Information about each of these companies.

Contact Us: https://www.vantagemarketresearch.com/contact-us

Vantage Market Research Report comes up with a detailed analysis of each major player in the industry. The Study provides Global market size & share, Emerging trends.