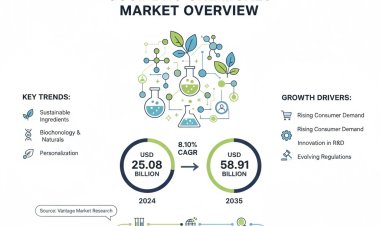

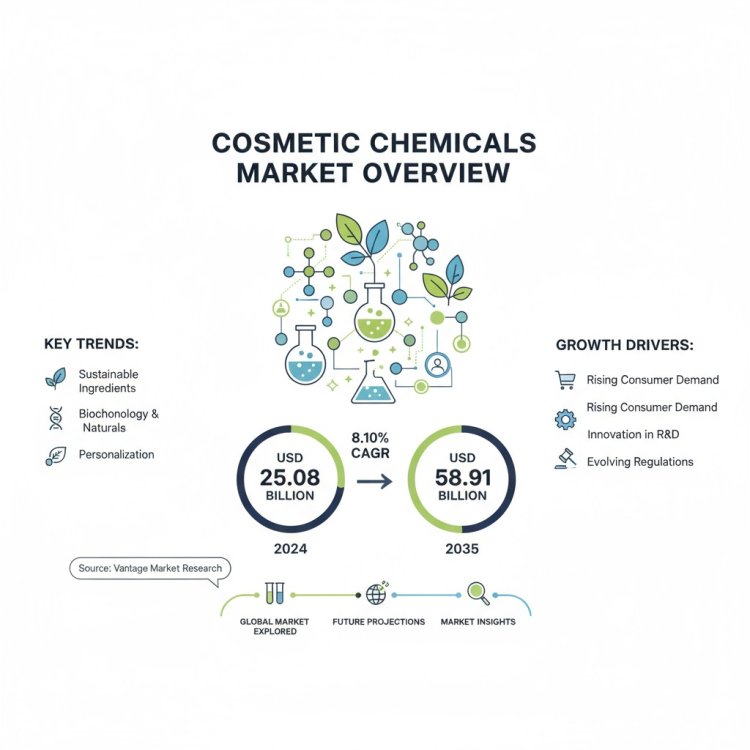

Global Cosmetic Chemicals Market Size 2025-2035 | Growth CAGR of 8.10%

Explore the global cosmetic chemicals market, valued at USD 25.08 billion in 2024. With a projected CAGR of 8.10%, the market is expected to reach USD 58.91 billion by 2035. Discover key trends, growth drivers, and market insights.

Global Cosmetic Chemicals Market to Surpass USD 58.91 Billion by 2035, Driven by Natural & Skin-Health Trends

The global Cosmetic Chemicals Market is entering a phase of strong expansion as consumer preferences shift towards skin-health, safety, and clean ingredients. Fueled by rising demand for natural and organic formulations, regulations aimed at ingredient transparency, and growth in personal care, makeup, hair care, and fragrance sectors, the market is poised for rapid growth. Companies are innovating with bio-based chemistries, sustainable sourcing, and advanced functional ingredients to meet evolving consumer expectations and regulatory mandates globally.

Our comprehensive Cosmetic Chemicals Market report is ready with the latest trends, growth opportunities, and strategic analysis. View Sample Report PDF.

Key Takeaways

- Revenue 2024: USD 25.08 billion

- Forecast 2035: USD 58.91 billion

- CAGR (2025-2035): 8.10%

- Largest Region (2024): North America

- Fastest-Growing Region (Forecast): Asia Pacific

- Key Growth Drivers: Increased demand for skin care and natural ingredients, consumer safety concerns, regulatory transparency, R&D in functional and bio-based ingredients

Premium Insights

The market is increasingly characterized by consumer concern over ingredient safety, driving demand for natural / botanical / “clean label” cosmetic chemicals. Functional and active ingredients (e.g. peptides, ceramides, hyaluronic acid) are gaining traction. There is also growing pressure from regulatory bodies (e.g. EU, etc.) for ingredient disclosure and bans on certain potentially harmful chemicals. Sustainability is becoming central — both in sourcing and manufacturing. Regions like Asia Pacific are embracing this shift rapidly, with local formulations and bio-based alternatives being developed to meet local preferences.

Market Size & Forecast

- 2024: USD 25.08 billion

- 2035: USD 58.91 billion

- CAGR 2025-2035: 8.10%

This means the market is expected to more than double over the forecast period. Growth is underpinned by rising consumer disposable income, expanding beauty & personal care sectors globally, innovation in functional cosmetic chemicals, and increasing regulatory demands for safety and sustainability.

The cosmetic chemicals market is moderately fragmented, with a mix of large multinational chemical producers and smaller specialty firms. Key differentiators include R&D capabilities (to develop high-purity actives, natural alternatives, novel functional ingredients), regulatory compliance (safety, environmental), supply chain robustness, and cost control. The need to satisfy diverse application needs (skin care, hair care, makeup, fragrance, etc.) and varying regulatory regimes across regions increases complexity. Margins are generally better for premium / specialty / natural cosmetic chemicals compared to basic ones.

For Cosmetic Chemicals Market Research Report and updates detailed: View Full Report Now!

Product Types Insights

The cosmetic chemicals market by product types includes surfactants, emollients, polymers, oleochemicals, and active ingredients. Surfactants dominate due to their extensive use in cleansing and foaming products such as shampoos, face washes, and body cleansers. Emollients are witnessing strong demand in skincare products to improve texture, hydration, and smoothness. Active ingredients like antioxidants, peptides, and anti-aging compounds are increasingly integrated into premium cosmetics. Rising consumer inclination toward multifunctional and sustainable ingredients continues to drive innovation and demand across these product types.

Applications Insights

In terms of applications, cosmetic chemicals find significant usage in skincare, haircare, makeup, oral care, and fragrances. Skincare leads the market owing to growing awareness about anti-aging, sun protection, and natural ingredient-based formulations. Haircare is also expanding rapidly with demand for anti-dandruff, hair growth, and damage repair solutions. Makeup applications leverage colorants and polymers to enhance product longevity and quality. Meanwhile, oral care is gaining traction with whitening and antibacterial solutions, while fragrances remain vital for premium consumer product positioning.

Regional Insights

North America Cosmetic Chemicals Market Trends

North America holds the largest share in 2024, due to mature cosmetic and personal care industries, stringent regulations encouraging safer ingredient use, high consumer awareness, and spending power. The availability of R&D infrastructure and regulatory bodies (FDA, etc.) pushes the industry toward innovation in clean, effective chemicals. There is strong demand from skin care, fragrance, and makeup sectors. Companies in this region are early adopters of bio-based chemical ingredients and functional actives.

Europe Market Cosmetic Chemicals Trends

Europe is also significant, driven by regulatory rigor (e.g. EU cosmetics regulation, REACH), strong consumer preference for natural and safe ingredients, and high penetration of personal care / skin care products. Sustainability is a strong theme: demand for green chemistry, bio-based preservatives, and natural extracts is high. Premium and luxury cosmetics sectors are robust. Countries like Germany, France, UK are important hubs.

Asia Pacific Cosmetic Chemicals Market Trends

Asia Pacific is projected to be the fastest-growing region over 2025-2035. Drivers include large populations, rising disposable incomes, increasing beauty & personal care demand, and growing awareness about skin health and safety. Local manufacturers are expanding, and there is increasing acceptance of natural ingredients. Innovation in formulation adapted for climate, skin type preferences, and cost sensitivity is important. Countries like China, India, South Korea lead growth.

Latin America Cosmetic Chemicals Market Trends

Latin America is expected to witness robust growth, though from a smaller base. Increasing consumer awareness of personal care, rising spending on skin care and beauty, growth of retail channels, plus rising demand for safer and more natural ingredients. Regulatory improvements and imports of higher-quality cosmetics also push demand for better cosmetic chemical inputs.

Middle East & Africa Cosmetic Chemicals Market Trends

Growth in Middle East & Africa is more gradual but promising. Rising urbanisation, increased demand for personal care and cosmetic products, and improving regulatory oversight are positive. However, challenges include cost sensitivity, limited R&D infrastructure in some countries, and inconsistent regulatory enforcement. Natural / low hazard ingredients are gaining interest, especially in premium urban markets (Gulf etc.).

Top Key Cosmetic Chemicals Companies

Some of the major players in this market include:

- Solvay S.A.

- Cargill Incorporated

- The Dow Chemical Company

- Croda International PLC

- BASF SE

- P&G

- Evonik Industries AG

- Stepan Company

- Symrise

- Ashland Inc

These companies compete through innovation (new actives, sustainable ingredients), compliance with regulations, sustainable sourcing, and strong supply chains.

Recent Developments

- In 2024, several cosmetic chemical firms increased investment in green / bio-based preservative systems and natural skin care actives, in response to regulatory pressure and consumer demand. For example, companies announced launches of botanical-derived alternatives to traditional synthetic preservatives.

- In 2025, specific R&D initiatives were reported by leading firms to develop safer colorants and polymer ingredients with enhanced biodegradability and lower toxicity.

Cosmetic Chemicals Market Future Scope

Vantage Market Research’s report on the Cosmetic Chemicals Market provides a detailed examination of the market as of base year 2024, with forecasts through 2035. The report segments the market by Product Types (Surfactants; Polymer Ingredients; Colorants; Preservatives), Applications (Skin Care; Hair Care; Make-Up; Oral Care; Fragrances; Others/Toiletries), and Regions (North America; Europe; Asia Pacific; Latin America; Middle East & Africa). It includes historical data from 2021-2023, profiles of key players, segmentation insights, regional trends, market drivers, restraints, opportunities, and challenges—combining both quantitative revenue forecasts and qualitative market intelligence.

Market Dynamics

Driver

A major driver is growing consumer awareness of skin health, safety, and ingredient transparency. Concerns about allergic reactions, long-term exposure to synthetic chemicals, and environmental impact push demand for safer and more sustainable cosmetic chemicals. Concurrently, rising incomes, expanding middle-classes, and growth of beauty & personal care markets globally fuel demand. The rise of digital beauty, skincare actives, multifunctional cosmetic formulations, and natural / bio-based ingredients reinforce growth.

Restraint

Restraints include high cost of premium / bio-based raw materials, complex regulatory compliance (varied regulations across regions), and the challenges of ensuring stability, safety, and performance comparable to synthetic alternatives. Moreover, supply chain volatility (e.g. for botanical or plant-derived ingredients), and consumer skepticism about new ingredients may slow adoption. Environmental regulations banning certain chemicals also impose costs on reformulation.

Opportunity

Significant opportunities lie in green chemistry (bio-based, biodegradable ingredients), safer preservatives, novel functional actives (e.g., anti-pollution, antioxidant, skin barrier repair), and clean / minimal ingredient formulations. Also, emerging markets (Asia Pacific, Latin America) offer high growth potential. Expanding e-commerce, influencer-driven product innovation, and personalized beauty further widen opportunity. Regulatory incentives and standards for “natural / organic” cosmetics can also catalyze adoption.

Challenges

Challenges include maintaining performance, stability, and safety when reformulating synthetic ingredients into natural or bio-based ones; managing cost vs margin pressures; navigating complex regulatory landscapes; ensuring reliable supply of high-quality raw materials; and building consumer trust. Additionally, competition is intense, and achieving differentiation while complying with evolving safety and environmental norms is a persistent task.

Global Cosmetic Chemicals Market Segmentation

Segments covered in the report:

- By Product Types: Surfactants; Polymer Ingredients; Colorants; Preservatives

- By Applications: Skin Care; Hair Care; Make-Up; Oral Care; Fragrances; Others (Toiletries)

- By Region: North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Frequently Asked Questions

Q1. What was the size of the Cosmetic Chemicals Market in 2024?

- USD 25.08 billion.

Q2. What is the expected market size by 2035 and growth rate?

- Expected to reach USD 58.91 billion by 2035, with a CAGR of ~ 8.10% from 2025-2035.

Q3. Which region is the largest and which is the fastest growing?

- North America is the largest region in 2024. Asia Pacific is projected to be the fastest-growing region over the forecast period.

Q4. What product type segments are included and which are growing?

- Segments include Surfactants, Polymer Ingredients, Colorants, Preservatives. Growth is especially strong in polymer ingredients, surfactants (milder / natural), and bio-based colorants / safer preservatives.

Q5. What applications lead the market?

- Skin Care leads among applications, followed by Hair Care, Make-Up, Oral Care, Fragrances, and others (toiletries).