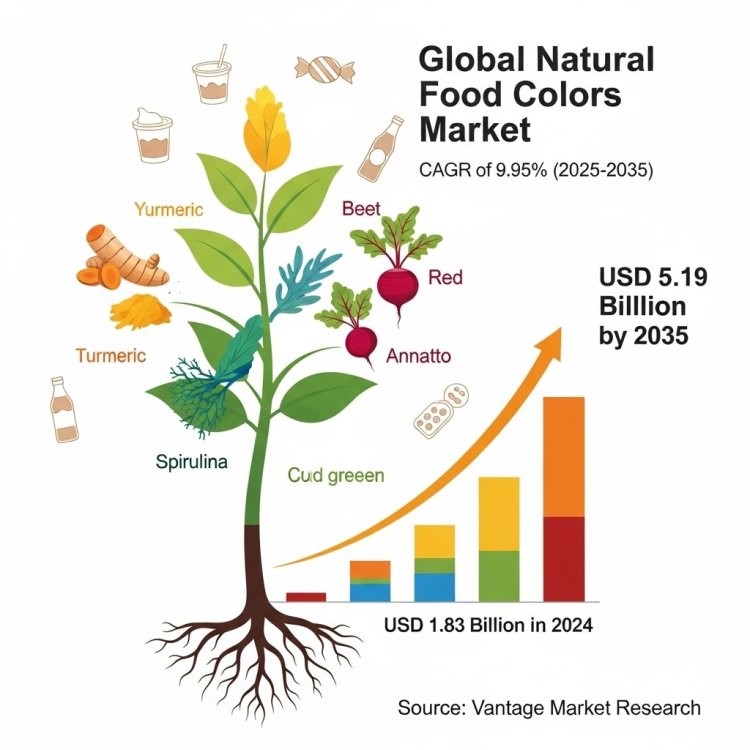

Natural Food Colors Market Size, Trends & Forecast (2024–2035) | CAGR of 9.95%

Discover insights on the global Natural Food Colors Market valued at USD 1.83 Billion in 2024, projected to reach USD 5.19 Billion by 2035, growing at a CAGR of 9.95% from 2025 to 2035.

Global Natural Food Colors Market Surges to USD 5.19 Billion by 2035 at a Robust 9.95% CAGR

The global Natural Food Colors Market—from vibrant annatto to vivid anthocyanins and more—is witnessing a transformative growth trajectory. Growing consumer demand for clean-label, health-conscious alternatives is reshaping food and beverage coloration, positioning natural colorants as a vital segment from 2025 through 2035.

Our comprehensive Natural Food Colors Market report is ready with the latest trends, growth opportunities, and strategic analysis. View Sample Report PDF.

Key Takeaways

- The global Natural Food Colors Market was valued at USD 1.83 billion in 2024 and is projected to reach USD 5.19 billion by 2035, growing at a CAGR of 9.95% (2025–2035).

- Increasing consumer preference for natural, organic, and plant-based ingredients is driving strong adoption of natural food colors in beverages, dairy, confectionery, and bakery industries.

- Stringent restrictions on synthetic additives and growing regulatory support for safe, plant-derived colors are accelerating market expansion.

- Carotenoids and anthocyanins remain the most widely used natural food colors due to their stability, vibrant shades, and versatility across multiple applications.

Premium Insights

Demand for natural food colors is surging as consumers increasingly seek non-toxic, non-GMO, environmentally friendly alternatives to synthetic dyes. Regulatory pressure against artificial colorants and rising health consciousness are prompting food and beverage makers to switch to natural extracts such as turmeric, spirulina, and beet juice. Natural colorants also convey a "clean" brand image, enhancing product appeal in processed foods and beverages alike.

Market Size & Forecast

- 2024: USD 1.83 billion

- 2035: USD 5.19 billion

- CAGR: 9.95% (2025–2035)

The natural food colors market features a broad range of colorant types—carotenoids, anthocyanins, carmine, turmeric, and more—sourced from plants, minerals, microbes, and animals. Liquid forms dominate due to their stability and processing advantages. The competitive landscape includes major ingredient suppliers driving innovation in functionality and clean-label applications. Regulatory trends globally favor natural substitutes, reinforcing market dynamics.

For Natural Food Colors Market Research Report and updates detailed: View Full Report Now!

Type Insights

Natural food colors are segmented into carotenoids, anthocyanins, chlorophyll, curcumin, and others. Carotenoids dominate due to their strong antioxidant properties and wide use in beverages, bakery, and dairy. Anthocyanins, extracted from berries and grapes, are gaining traction as clean-label alternatives. Chlorophyll is increasingly used in beverages and nutraceuticals for its natural green pigment. Curcumin remains prominent in Asia for traditional food applications. Growing consumer preference for plant-based colorants is driving innovation in type-specific formulations across industries.

Source Insights

Sources include plants, animals, and minerals, with plant-based dominating the market due to rising veganism and sustainability awareness. Fruits, vegetables, and edible flowers serve as prime natural coloring agents, aligning with clean-label demand. Mineral-based pigments like titanium dioxide alternatives are emerging, though limited in scope. Animal-derived colors, such as carmine, retain niche demand but face regulatory scrutiny and ethical concerns. The trend favors plant-based, eco-friendly sources, leading to R&D in novel extraction technologies from spirulina, turmeric, and beetroot.

Form Insights

Natural food colors are available in liquid, powder, and gel forms, catering to diverse industrial applications. Powder form dominates due to its stability, longer shelf life, and ease of transport. Liquids find wide application in beverages, confectionery, and sauces for better blending. Gel-based colors cater to bakery and decorative products requiring precision and consistency. Manufacturers are innovating with microencapsulation and spray-drying techniques to enhance form stability, solubility, and resistance to heat and light, supporting broader food and beverage adoption.

Solubility Insights

The market is segmented into water-soluble and oil-soluble natural colors. Water-soluble pigments, such as anthocyanins and chlorophyll, dominate the segment due to their extensive use in beverages, dairy, and confectionery. Oil-soluble colors, such as carotenoids and curcumin, are increasingly used in fat-rich products like margarine, butter, cheese, and snack coatings. Rising demand for multipurpose soluble pigments is driving innovation in emulsification and encapsulation techniques. The focus on enhancing solubility, stability, and intensity is expanding adoption across diverse food and beverage categories.

Application Insights

Applications include beverages, bakery & confectionery, dairy & frozen products, meat products, processed foods, and others. Beverages hold the largest share as natural colors are widely used in juices, soft drinks, energy drinks, and flavored water. Bakery and confectionery leverage natural colors for icings, candies, and fillings. Dairy applications include yogurts, ice creams, and cheese. Clean-label meat products increasingly use natural colors for appeal and freshness. Rising health-consciousness is boosting adoption in sauces, snacks, and ready-to-eat processed foods.

Regional Insights

North America

North America held the largest share (~36.2%) of the global natural food colors market in 2024. Strong consumer awareness around clean-label products, combined with strict regulatory scrutiny of synthetic additives, has driven the shift toward natural alternatives. Manufacturers across the U.S. and Canada are increasingly reformulating products with turmeric, beet-based pigments, and carotenoids. Extensive food processing infrastructure and premium pricing tolerance support rapid adoption and innovation in colorant technologies.

Europe

Europe’s prepared food and beverage sectors are seeing steady growth in natural food color adoption, driven by consumer demand for additive-free formulations and strict EU regulations. Brands across Germany, France, and the U.K. are replacing synthetic dyes with plant-based extracts such as anthocyanins and annatto. Regulatory emphasis on food safety and natural ingredients compels manufacturers to invest in clean-label color solutions, fostering R&D and eco-friendly manufacturing practices.

Asia Pacific

Asia Pacific is the fastest-growing region in the natural food colors market. Rapid urbanization, rising disposable incomes, and increasing health awareness are driving demand across China, India, Japan, and Southeast Asia. Local food manufacturers are incorporating turmeric, spirulina, and carotenoid colorants into popular snacks and beverages. Growth is boosted by modern retail expansion and traditional acceptance of natural ingredients, enabling natural color adoption across diverse culinary formats.

Latin America

Latin America’s natural food colors market is expanding steadily, underpinned by growing demand for clean-label and sustainable food ingredients. Brazil and Argentina lead adoption, with food and beverage brands replacing synthetic dyes with annatto, beet, and turmeric extracts. Urbanization and evolving consumer health preferences support this shift. However, limited industrial-scale processing and pricing sensitivity among consumers remain challenges to faster momentum.

Middle East & Africa

In the Middle East & Africa, demand for natural food colors is growing moderately among health-conscious and affluent consumers. Regional cuisines emphasize natural colorants like saffron, beet, and annatto in traditional dishes and packaged goods. Halal certification and clean ingredient lists are increasingly important. Market growth is constrained by uneven regulatory frameworks and limited manufacturing infrastructure, but premium product segments are rising steadily in GCC and South African markets.

Key Natural Food Colors Companies

- CHR Hansen Holding A/S

- Koninklijke DSM N.V.

- Sensient Technologies Corporation

- Archer Daniels Midland Company

- Döhler Group

- D. Williamson & Co.

- Naturex S.A.

- Aromata Group S.R.L.

- Kalsec Inc.

- FMC Corporation

- BASF SE

- Lycored Ltd.

- GNT Group B.V.

- San-Ei Gen F.F.I. Inc.

- Phinix International

- Kolorjet Chemicals Pvt. Ltd.

- Vinayak Ingredients India Pvt. Ltd.

- IFC Solutions

- INCOLTEC

Recent Developments

- The U.S. FDA recently approved several new natural color additives, including gardenia (genipin) blue, galdieria extract blue (from red algae), butterfly pea flower extract, and calcium phosphate, marking the fourth batch of FDA-cleared natural food colors within a two-month span. These approvals support a growing campaign to phase out petroleum-based dyes by 2026–2027.

- Major food companies are committing to eliminate synthetic dyes. Giants like Nestlé, Hershey, Kraft Heinz, General Mills, Conagra, and J.M. Smucker have pledged to phase out artificial colors from U.S. products between 2026 and 2027, aligning with the "Make America Healthy Again" initiative.

Natural Food Colors Industry Scope

According to Vantage Market Research, the report provides both quantitative and qualitative insights—covering 2021–2023 historic data, 2024 base year, and forecasts through 2035. It segments the market by Type, Source, Form, Solubility, Application, and Region, offering competitive benchmarking, regulatory insights, and ESG considerations, enabling stakeholders to make data-driven strategic decisions.

Market Dynamics

Driver

Surging consumer preference for clean-label, natural ingredients is the principal growth driver for natural food colors. Heightened awareness of adverse health effects linked to synthetic dyes pushes manufacturers to adopt natural alternatives. Regulatory constraints on artificial colors further reinforce this shift. Additionally, the functional appeal of natural pigments—such as antioxidant-rich carotenoids—enhances both visual and health profiles of products, elevating demand across processed foods and beverages globally.

Restraint

The natural food colors market faces challenges in cost competitiveness and consistency. Natural extracts can be more expensive and variable in hue and stability compared to synthetic dyes, complicating formulation and shelf-life. Supply chain limitations and crop dependency introduce price fluctuations and availability risks. Furthermore, stringent purity and labeling standards impose compliance costs on producers, hindering scalability—especially in emerging markets where infrastructure is less developed.

Opportunity

Proliferating demand for plant-based, non-GMO, and organic products presents a substantial opportunity for natural food colorants. Innovations in extraction technologies, color stability enhancement, and novel sources like spirulina and anthocyanins are unlocking new applications. Expanding into emerging markets—particularly in Asia Pacific and Latin America—where health-conscious consumption is rising, offers scope for growth. Additionally, collaboration with beverage and confectionary sectors opens fresh pathways for color innovation and formulation.

Challenges

Key challenges include maintaining consistent quality and shade uniformity across large batches. Natural pigments are sensitive to pH, light, and temperature, requiring complex formulation controls. Inter-regional regulatory disparities complicate product approval and labeling. Cost-sensitive buyers in developing regions may resist premium natural color pricings. Brands must invest in R&D to improve stability and scalability, while aligning with diverse culinary practices and regulatory regimes, to ensure broad adoption and profitability.

Global Natural Food Colors Market Report Segmentation

- By Type: Carmine; Anthocyanins; Caramel; Annatto; Carotenoids; Chlorophyll; Spirulina; Turmeric; Beet; Others

- By Source: Plant; Mineral; Micro-organism; Animal

- By Form: Liquid; Powder; Gel; Emulsion

- By Solubility: Water; Dye; Oil

- By Application: Processed Food Products; Beverages

- By Region: North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Frequently Asked Questions

Q1: What was the global natural food colors market size in 2024?

USD 1.83 billion

Q2: What is the forecast for 2035?

USD 5.19 billion

Q3: What is the CAGR from 2025 to 2035?

9.95%

Q4: Which segments are leading?

By Type: Carotenoids; By Form: Liquid; By Application: Processed Foods (65.3%)

Q5: Which regions are the largest and fastest-growing?

Largest: North America (~36.2% share in 2024)

Fastest Growing: Asia Pacific