Tronox Plans Permanent Closure of Its TiO₂ Pigment Plant in Fuzhou, China

Tronox Holdings plc (NYSE: TROX) says it intends to permanently close its TiO₂ pigment plant in Fuzhou, China, citing weak domestic demand, higher costs (including sulfur), and persistent industry overcapacity.

Tronox to Permanently Close Its 46,000 tpy TiO₂ Pigment Plant in Fuzhou, China

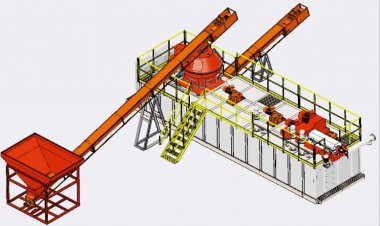

Tronox Holdings plc (NYSE: TROX) announced on January 26, 2026 that it intends to permanently close its titanium dioxide (TiO₂) pigment manufacturing plant in Fuzhou, China. The facility has capacity of about 46,000 metric tons per year.

Tronox said the planned closure reflects ongoing weakness in Chinese domestic demand alongside rising input costs, with sulfur highlighted as a key cost pressure. The company also pointed to continued excess production capacity among Chinese TiO₂ manufacturers, which has contributed to aggressive competition and what it described as unsustainable pricing.

The site currently employs approximately 550 permanent staff, all of whom are expected to be affected. Chief Executive Officer John D. Romano thanked employees in China for their work over many years and said the prolonged downturn and cost increases had eroded the long-term viability of continuing operations at the plant.

Tronox stated that, given its globally diversified manufacturing footprint, it does not expect the shutdown to affect its ability to serve customers.

Financially, the company expects to record restructuring and other related charges of approximately $60 million to $80 million, primarily in the fourth quarter of 2025. This estimate includes roughly $35 million to $45 million of non-cash write-downs associated with the shutdown.

Tronox also expects the closure to generate ongoing cost savings of more than $15 million per year, driven mainly by the elimination of fixed operating costs.