Explore Trends, Forecasts & Insights Driving the Drilling Waste Management Industry to 2032

The global Drilling Waste Management Market was valued at USD 7.21 Billion in 2023 and is projected to grow at a CAGR of 6.69%, reaching USD 12.91 Billion by 2032. Discover key trends, drivers, and regional insights shaping the market’s future.

Global Drilling Waste Management Market Poised for Robust Growth, Projected to Reach USD 12.91 Billion by 2032

The global Drilling Waste Management Market is experiencing significant growth, driven by stringent environmental regulations, technological advancements, and increasing drilling activities worldwide. Valued at USD 7.21 billion in 2023, the market is projected to reach USD 12.91 billion by 2032, expanding at a CAGR of 6.69% from 2024 to 2032. The Market is experiencing significant growth as the oil, gas, and mining industries prioritize environmentally responsible and efficient waste handling practices. Drilling operations generate large volumes of waste, including drilling mud, cuttings, and other by-products, which require proper treatment, disposal, and recycling. Increasing regulatory pressures, rising environmental awareness, and technological advancements in waste treatment and solids control systems are driving market expansion. The adoption of sustainable practices and innovative solutions is enabling safer, cost-effective, and compliant operations worldwide.

Our comprehensive Drilling Waste Management Market report is ready with the latest trends, growth opportunities, and strategic analysis. View Sample Report PDF.

Key Takeaways

- The Drilling Waste Management Market is expected to grow from USD 7.21 billion in 2023 to USD 12.91 billion by 2032, reflecting a CAGR of 6.69% from 2024 to 2032.

- The Treatment & Disposal segment held a significant market share in 2023, driven by the need for effective waste management solutions in drilling operations.

- The Onshore segment captured the highest market share in 2023, accounting largest revenue of the total market revenue.

- North America led the market with largest market share in 2023, while the Asia Pacific region is anticipated to witness the fastest growth during the forecast period.

Premium Insights

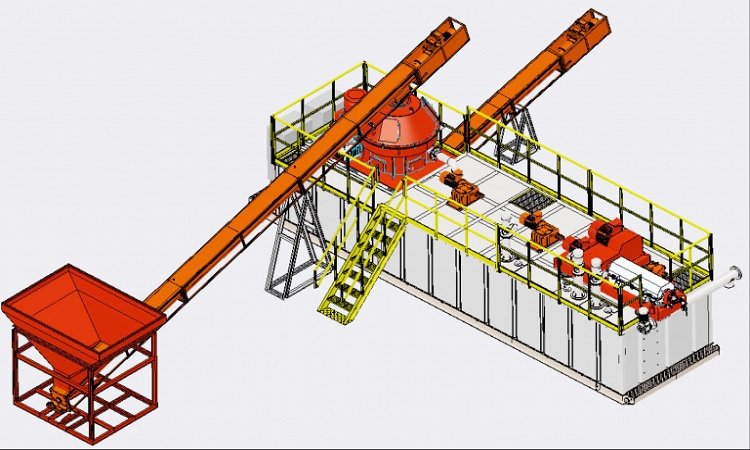

The Drilling Waste Management Market encompasses services and technologies aimed at managing and disposing of waste generated during drilling operations in the oil and gas industry. These services include treatment & disposal, containment & handling, and solids control. The market's growth is driven by the increasing emphasis on environmental sustainability, regulatory compliance, and the need for efficient waste management solutions in drilling activities.

The Drilling Waste Management Market is witnessing transformative trends driven by regulatory pressures and technological advancements. Companies are increasingly adopting advanced waste treatment technologies, such as thermal desorption, bioremediation, and automated solids control systems, to enhance operational efficiency and environmental compliance. Sustainability is a key focus, with firms emphasizing resource recovery and minimizing environmental impact. Additionally, the integration of digital monitoring and IoT-enabled systems allows real-time tracking of waste handling processes, improving safety, reducing costs, and supporting proactive decision-making across drilling operations globally.

Market Size & Forecast

- 2023: USD 7.21 billion

- 2032: USD 12.91 billion

- CAGR (2024–2032): 6.69%

The Drilling Waste Management Market is characterized by the presence of several key players offering a range of services and technologies. The market is moderately concentrated, with leading companies focusing on technological innovations, strategic partnerships, and expanding their service offerings to maintain a competitive edge.

For Drilling Waste Management Market Research Report and updates detailed: View Full Report Now!

Service Insights

The Drilling Waste Management Market is segmented into Treatment & Disposal, Containment & Handling, and Solids Control. Treatment & Disposal services focus on safely processing drilling waste to comply with environmental regulations. Containment & Handling ensures safe storage, transport, and management of waste materials, minimizing spillage and contamination. Solids Control technologies separate solids from drilling fluids, allowing reuse and reducing waste volumes. Each service segment addresses specific operational challenges, enhancing efficiency, safety, and sustainability in drilling operations across industries.

Application Insights

Applications are divided into Onshore and Offshore drilling operations. Onshore drilling dominates due to widespread land-based exploration, requiring efficient waste management solutions for large-scale operations. Offshore drilling, although more complex and costly, is witnessing increased adoption of specialized waste management technologies to handle challenging marine environments and stringent regulatory requirements. Both application segments emphasize compliance, safety, and operational efficiency, driving innovations in waste treatment, handling, and recovery systems to meet diverse operational and environmental needs globally.

Regional Insights

North America Drilling Waste Management Market Trends

North America leads the Drilling Waste Management Market, driven by extensive onshore and offshore drilling activities, particularly in the U.S. Shale gas and oil exploration projects demand advanced waste management solutions to comply with strict environmental regulations. The presence of major service providers, combined with technological adoption in waste treatment and solids control, supports steady market growth. Increasing focus on sustainability and regulatory compliance further encourages investments in innovative and efficient drilling waste management practices.

Europe Drilling Waste Management Market Trends

Europe’s market growth is fueled by stringent environmental regulations and a strong emphasis on sustainable operations. Countries like Norway, the UK, and Germany are investing in advanced waste management solutions for both onshore and offshore drilling projects. Technological adoption, including automated solids control systems and eco-friendly disposal methods, enhances operational efficiency while ensuring compliance with environmental standards. The market is also driven by increasing offshore exploration and the need to manage drilling waste in sensitive ecological regions.

Asia Pacific Drilling Waste Management Market Trends

The Asia Pacific region is poised for rapid growth due to increasing oil and gas exploration activities in China, India, and Southeast Asia. Rising regulatory pressure and environmental awareness are pushing companies to adopt advanced drilling waste management systems. Onshore operations dominate, but offshore exploration in countries like Australia is increasing demand for specialized solutions. Investments in technology, sustainability initiatives, and the growing number of drilling projects are driving strong market expansion across the region.

Latin America Drilling Waste Management Market Trends

Latin America is witnessing steady market growth, led by countries like Brazil and Mexico, where oil and gas exploration is expanding. The need for efficient drilling waste management arises from increasing onshore and offshore projects. Companies are implementing advanced treatment, disposal, and solids control systems to ensure compliance with environmental regulations and minimize operational risks. Market growth is also supported by investments in sustainable practices and the modernization of existing drilling infrastructure.

Middle East & Africa Drilling Waste Management Market Trends

The Middle East & Africa region is experiencing increased demand for drilling waste management due to extensive offshore and onshore oilfield developments, especially in Saudi Arabia, UAE, and South Africa. Environmental regulations, sustainability initiatives, and the need for operational efficiency are driving adoption of advanced waste treatment and handling technologies. Companies are focusing on resource recovery, automated monitoring, and eco-friendly disposal methods to manage the growing volume of drilling waste in this region efficiently and safely.

Key Drilling Waste Management Companies

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- National Oilwell Varco Inc.

- Veolia Environnement S.A.

- SUEZ

- Secure Energy Services Inc.

- Newalta Corporation

- Tervita Corporation

- Imdex Limited

- Augean plc

Recent Developments

- February 2024: TWMA, a prominent drilling waste management company, finalized a sustainability-linked bond of up to USD 62.5 million on the Nordic ABM Oslo, aiming to enhance its waste management capabilities and support sustainable practices.

Drilling Waste Management Market Report Scope

This report provides a comprehensive analysis of the Drilling Waste Management Market, covering market size, trends, segmentation, regional insights, and competitive landscape. It offers valuable information for stakeholders to make informed decisions and capitalize on emerging opportunities.

Market Dynamics

Driver

Stringent environmental regulations and growing awareness about ecological sustainability are primary drivers for the Drilling Waste Management Market. Oil, gas, and mining companies are increasingly adopting advanced waste treatment, containment, and solids control technologies to minimize environmental impact and ensure compliance. Rising drilling activities globally, particularly in onshore shale and offshore exploration, further boost demand for efficient and reliable waste management solutions, supporting operational safety and regulatory adherence while promoting sustainable resource utilization across the industry.

Restraint

High operational and capital costs associated with advanced drilling waste management technologies pose a significant restraint. Implementing treatment, disposal, and solids control systems requires substantial investment in equipment, training, and maintenance. Smaller operators or companies in emerging markets may face budgetary constraints, limiting widespread adoption. Additionally, integrating new technologies into existing drilling operations can be complex, creating operational challenges and potential downtime, which may hinder the market’s growth despite increasing regulatory and sustainability pressures.

Opportunity

The growing emphasis on resource recovery and recycling of drilling by-products presents a lucrative opportunity. Companies can recover valuable materials from waste, reduce disposal volumes, and enhance sustainability initiatives. Innovations in eco-friendly treatment technologies, digital monitoring, and automated solids control systems offer potential for efficiency gains and cost reduction. Expanding offshore exploration and unconventional drilling projects worldwide also create demand for specialized waste management solutions, allowing market players to diversify offerings and capitalize on emerging technological and regulatory-driven opportunities.

Challenge

Operational integration of advanced waste management systems remains a key challenge. Implementing sophisticated treatment, containment, and solids control technologies requires technical expertise, coordination with ongoing drilling operations, and adherence to strict safety standards. Variability in waste composition, differing regulatory frameworks across regions, and logistical complexities in remote or offshore locations further complicate operations. These challenges demand continuous innovation, training, and investment, making it difficult for some companies to maintain consistent efficiency and compliance in drilling waste management practices globally.

Market Segmentation

- By Service: Treatment & Disposal, Containment & Handling, Solids Control, Others

- By Application: Onshore, Offshore

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Frequently Asked Questions

Q1: What is the projected growth rate of the Drilling Waste Management Market?

The market is expected to grow at a CAGR of 6.69% from 2024 to 2032.

Q2: Which region leads the Drilling Waste Management Market?

North America led the market in 2023, accounting largest market share.

Q3: What are the key services in Drilling Waste Management?

Key services include Treatment & Disposal, Containment & Handling, and Solids Control.

Q4: Which application segment dominates the market?

The Onshore application segment held a dominant share in 2023.

Q5: Who are the leading companies in the Drilling Waste Management Market?

Leading companies include Baker Hughes, Halliburton, Schlumberger, Weatherford, and National Oilwell Varco.