Automotive Blind Spot Detection System Market Growth | Trends, Demand & Key Players 2025-2035

Discover the latest trends, technologies, and forecasts shaping the global automotive blind spot detection system market. Learn how safety innovations and ADAS are driving demand.

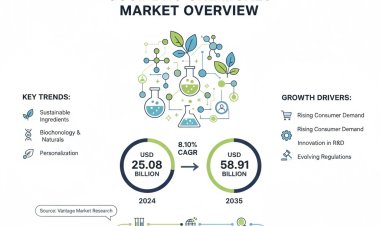

The global automotive industry is undergoing rapid transformation, with safety innovations at the forefront of new vehicle technologies. One such critical innovation is the Automotive Blind Spot Detection System, which enhances driver safety by reducing collision risks caused by vehicles in blind spots. With rising road safety concerns, stringent regulatory frameworks, and consumer demand for advanced driver assistance systems (ADAS), the market is expanding rapidly. According to Vantage Market Research, the global Automotive Blind Spot Detection System Market is projected to witness robust growth through 2035.

Our comprehensive Automotive Blind Spot Detection System Market report is ready with the latest trends, growth opportunities, and strategic analysis. View Sample Report PDF.

Key Takeaways

- Market Size 2024: USD 4.55 Billion

- Forecast 2035: USD 13.5 Billion

- CAGR (2025–2035): 10.40%

- Increasing integration of ADAS and growing adoption of electric and autonomous vehicles are driving demand.

- North America leads the market due to regulatory mandates and high vehicle safety awareness.

- Asia Pacific is projected to grow fastest, fueled by rising vehicle sales, urbanization, and safety regulations.

- Key players such as Bosch, Continental, ZF Friedrichshafen, Aptiv, and Denso dominate the global landscape.

- In 2025, Continental AG launched its next-gen radar-based BSD solution for electric and autonomous vehicles, enhancing range and accuracy.

Automotive Blind Spot Detection System Market Summary

Key Market Trends & Insights

The automotive BSD system market is witnessing accelerated adoption, thanks to the global emphasis on reducing road fatalities and enabling safer driving environments. Increasing consumer preference for connected and smart vehicles and the surge in ADAS integration are pushing automakers to incorporate BSD systems as standard features in mid- and high-end vehicles. Moreover, advancements in radar and camera-based sensing technologies, combined with government safety mandates across Europe, North America, and Asia, are fueling global growth.

Market Size & Forecast

The global Automotive Blind Spot Detection System Market generated USD 4.55 Billion in 2024 and is anticipated to reach USD 13.5 Billion by 2035, growing at a strong CAGR of 10.40% during 2025–2035. Rising vehicle production, coupled with safety technology integration across luxury and mass-market vehicles, will drive revenue. Increasing partnerships between automakers and sensor technology providers will further support this market expansion.

Market Concentration & Characteristics

The Automotive BSD System Market is moderately concentrated, with a few global players leading innovations and partnerships. Companies are heavily investing in R&D for radar and camera fusion technologies, AI-based driver assistance, and integration with autonomous driving platforms. The industry is characterized by high entry barriers due to technology complexity, safety certifications, and regulatory compliance requirements. Growing collaborations between OEMs and sensor manufacturers are shaping a competitive ecosystem where innovation and cost-effectiveness determine market leadership.

Technology Insights

The Automotive Blind Spot Detection (BSD) Market by technology is divided into radar-based, camera-based, and ultrasonic-based systems. Radar technology dominates, providing high accuracy in vehicle detection under various driving and weather conditions. Camera-based systems are gaining momentum in premium and electric vehicles, offering visual alerts and image processing capabilities. Ultrasonic systems are cost-effective for low-speed applications, such as parking assistance. The integration of sensor fusion technologies combining radar and cameras is an emerging trend, improving detection range, precision, and driver confidence globally.

Vehicle Type Insights

By vehicle type, the BSD market is segmented into passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). Passenger cars lead the market due to increasing consumer demand for advanced safety features in sedans and SUVs. LCVs and HCVs are rapidly adopting BSD systems to address blind spot risks in freight and logistics operations, particularly in congested urban areas. Rising e-commerce growth and last-mile delivery demand enhance adoption in LCV fleets. Simultaneously, OEMs are equipping HCVs with advanced BSD to improve operational safety.

Vehicle Propulsion Insights

The BSD market by propulsion type includes internal combustion engine (ICE) vehicles, electric vehicles (EVs), and hybrid vehicles. ICE vehicles still dominate in terms of volume, but the fastest growth is observed in EVs, where BSD integration supports enhanced driver safety and autonomous functionalities. Hybrid vehicles also feature BSD systems as part of broader ADAS integration. With governments mandating safety systems and EV manufacturers prioritizing innovation, the propulsion-based segmentation reflects a strong shift toward EV-centric BSD adoption over the forecast period.

Sales Channel Insights

By sales channel, the BSD market is classified into OEMs and aftermarket. OEMs dominate as global automakers increasingly integrate BSD systems as standard or optional features in new vehicles, particularly in luxury and electric segments. The aftermarket is witnessing steady growth as fleet operators and consumers retrofit older vehicles to enhance safety. Partnerships between automakers and sensor suppliers are strengthening OEM dominance, while increasing awareness and affordability of BSD retrofit kits ensure healthy aftermarket expansion, especially in developing economies with aging vehicle fleets.

Regional Insights

North America Automotive Blind Spot Detection System Market Trends

North America leads the global BSD market, supported by stringent National Highway Traffic Safety Administration (NHTSA) regulations and strong consumer preference for advanced safety systems. Automakers in the U.S. and Canada are increasingly equipping mid-range vehicles with BSD systems as standard features. Growth is further fueled by the rising adoption of electric vehicles (EVs), where safety systems are prioritized. Collaborations between OEMs and telematics providers, along with increasing government support for road safety initiatives, ensure the region maintains a strong market presence.

Europe Automotive Blind Spot Detection System Market Trends

Europe remains a strong market for BSD systems, driven by the European Union’s Vision Zero initiative, which aims to reduce road fatalities. Countries like Germany, France, and the U.K. have enforced strict safety regulations, making BSD a critical ADAS component. The region is also a hub for premium car manufacturers such as BMW, Audi, and Mercedes-Benz, which extensively integrate BSD systems into their models. Additionally, the growing penetration of EVs across Europe further accelerates demand for advanced safety technologies.

Asia Pacific Automotive Blind Spot Detection System Market Trends

Asia Pacific is expected to register the fastest growth during the forecast period, led by rising vehicle sales in China, India, Japan, and South Korea. Rapid urbanization, increasing traffic congestion, and government safety regulations are driving adoption. Local automakers are increasingly adopting BSD to meet consumer safety expectations. China and Japan are at the forefront, with significant investments in ADAS-enabled EVs. Growing e-commerce and logistics sectors also support adoption in commercial fleets, making Asia Pacific the most dynamic BSD market globally.

Latin America Automotive Blind Spot Detection System Market Trends

Latin America is gradually adopting BSD systems, driven by rising demand for safer vehicles in Brazil, Mexico, and Argentina. While penetration remains lower compared to developed markets, increasing awareness of road safety, coupled with a growing middle class, is boosting adoption. Automakers are introducing BSD systems in premium and mid-range vehicle segments, particularly SUVs, which are highly popular in the region. Economic improvements and safety regulation harmonization with global standards are expected to further drive adoption in the coming years.

Middle East & Africa Automotive Blind Spot Detection System Market Trends

The Middle East & Africa region presents a growing opportunity, primarily driven by increasing luxury and premium vehicle sales in Gulf countries like the UAE and Saudi Arabia. Awareness about safety technologies is improving, with regional governments focusing on reducing accident-related fatalities. Africa, though still in its nascent stage, is witnessing slow adoption due to affordability challenges. However, as automotive imports rise and safety mandates expand, BSD system adoption is expected to increase gradually, especially in commercial fleets and high-end cars.

For the Automotive Blind Spot Detection System Market Research Report and updates, View the Full Report Now!

Key Automotive Blind Spot Detection System Company

The market is dominated by established global players focusing on radar innovation, sensor integration, and AI-enabled BSD platforms. These companies are partnering with OEMs to expand deployment across vehicle categories.

- Bosch GmbH

- Continental AG

- Denso Corporation

- ZF Friedrichshafen AG

- Aptiv PLC

- Valeo SA

- Magna International

- Hyundai Mobis

- Autoliv Inc.

- Gentex Corporation

Recent Developments

- In 2024, Denso Corporation unveiled its next-generation millimeter-wave radar technology to enhance BSD system accuracy for urban driving and EV applications.

- In 2025, Continental AG announced the launch of an advanced radar-based BSD solution designed for autonomous and electric vehicles, offering improved detection range, AI-driven alerts, and seamless ADAS integration.

Automotive Blind Spot Detection System Market Report Scope

Vantage Market Research provides a comprehensive analysis of the Automotive Blind Spot Detection System Market, offering insights into revenue trends, growth forecasts, segmentation, and competitive landscapes. The report covers global and regional dynamics, technological advancements, and strategic developments by key players. The scope includes segmentation by product type, application, end-use, and region, providing actionable intelligence for stakeholders. The study highlights the influence of regulations, consumer safety awareness, and evolving ADAS technologies shaping the market outlook from 2024 to 2035.

Market Dynamics

Driver:

Rising consumer awareness about road safety and increasing regulatory mandates for vehicle safety technologies are driving adoption. Governments worldwide are enforcing ADAS integration, with BSD systems playing a crucial role in reducing collisions and saving lives. Automakers are responding by integrating BSD into mid-range and high-end models.

Restraint:

High costs of BSD system integration, particularly in entry-level vehicles, remain a barrier to adoption. Additionally, affordability challenges in developing regions limit penetration. Complexity in integrating BSD with multiple sensors and software platforms also adds to cost and deployment challenges for automakers.

Opportunity:

The rapid growth of electric and autonomous vehicles presents a major opportunity for BSD systems. With EV adoption rising globally, safety becomes paramount, and BSD integration enhances driver confidence. Additionally, sensor fusion technologies and AI-based predictive analytics are opening new opportunities for innovation and market expansion.

Challenges:

Technical limitations in adverse weather conditions, such as heavy rain or snow, can affect BSD performance. Ensuring system reliability across different driving environments remains a challenge. Moreover, the need for continuous R&D investments and standardization across global markets poses challenges for both OEMs and technology providers.

Global Automotive Blind Spot Detection System Market Report Segmentation

- By Product Type: Radar-Based, Camera-Based, Ultrasonic-Based

- By Application: Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles

- By End-Use: OEM, Aftermarket

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Frequently Asked Questions

- What is the market size of the Automotive Blind Spot Detection System Market in 2024?

The market size is USD 4.55 Billion in 2024.

- What will be the Automotive Blind Spot Detection System Market size by 2035?

The market is projected to reach USD 13.5 Billion by 2035.

- What is the CAGR of the market during 2025–2035?

The CAGR is 10.40%.

- Which region leads the Automotive Blind Spot Detection System Market?

North America currently dominates, while Asia Pacific is expected to grow fastest.

- Who are the major players in this market?

Key players include Bosch, Continental, Denso, ZF Friedrichshafen, Aptiv, and Valeo.