Global Pharmaceutical Packaging Market | Value, Growth & Trends (2025-2035)

Discover the global Pharmaceutical Packaging Market, valued at USD 144.2 Billion in 2024 and projected to reach USD 698.1 Billion by 2035. Learn about the market's growth trends and forecasted CAGR of 15.40%.

Pharmaceutical Packaging Market Forecast to Reach USD 698.1 Billion by 2035, Driven by Rising Drug Demand & Regulatory Pressures

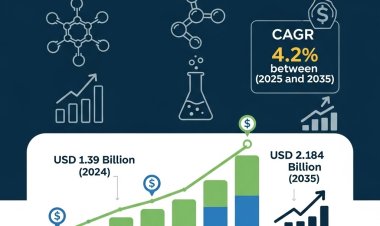

The global Pharmaceutical Packaging Market is set for rapid expansion, fueled by increasing demand for medicines, biologics, and temperature-sensitive drugs. In 2024, the market size reached USD 144.2 billion, and is forecast to grow to USD 698.1 billion by 2035, registering a CAGR of 15.40% from 2025–2035. Key drivers include patient safety requirements, drug delivery innovations, sustainability pressures, and growth in biopharmaceuticals, especially in emerging economies. Regulatory compliance and product integrity are playing ever-stronger roles in shaping packaging design and materials across the globe.

Our comprehensive Pharmaceutical Packaging Market report is ready with the latest trends, growth opportunities, and strategic analysis. View Sample Report PDF.

Key Takeaways

- Revenue 2024: USD 144.2 billion

- Forecast 2035: USD 698.1 billion

- CAGR (2025-2035): 15.40%

- Largest Region in 2024: North America, accounting for 36.5% share

- Fastest-growing Region (Forecast): Asia Pacific

- Top Segments by Type in 2024: Plastic bottles held a strong revenue share

- Application / Drug-Delivery Insight: Oral drugs segment is a major contributor to market growth in 2024

- Packaging Type: Primary packaging (bottles, vials, blister packs etc.) held 75.2% share in 2024 revenue

Premium Insights

The market is seeing increasing attention to primary packaging (containers, bottles, vials, blister packs) because these directly affect drug safety, dosage accuracy, and user convenience. There's rising demand for packaging capable of safeguarding biologics and temperature-sensitive drugs, leading to more sophisticated materials & controlled environments (cold chain). Sustainability is another major trend: eco-friendlier plastics, reduction of waste, recyclable materials and lightweight designs are gaining favor. Anti-counterfeiting and tamper-evident features are increasingly mandated. Balancing regulatory compliance with cost remains a central challenge.

Market Size & Forecast

- 2024 Market Size: USD 144.2 billion

- 2035 Forecast: USD 698.1 billion

- CAGR (2025-2035): 15.40%

This indicates the market is expected to nearly quintuple in size over the forecast period. Growth will be driven by expanded pharmaceutical production, growth in specialty & biologic drugs, increasing need for patient-centric and safe packaging, regulatory pressure, and innovation in materials and design.

The pharmaceutical packaging market is moderately (to highly) competitive, with presence of large multinational packaging firms and specialized players.

Key characteristics include:

- The necessity for stringent regulatory compliance (FDA, EMA, etc.) in terms of safety, sterilization, barrier properties, tamper evidence.

- Strong emphasis on material science innovation, especially plastics, glass, advanced polymers, coatings, and cold chain packaging.

- Global supply chain complexities (e.g., raw materials, transport, storage conditions) especially for biologic / injectable drugs.

- Increasing differentiation via features like child-resistant, tamper-evident, serialization / traceability, temperature control.

- Sustainability pressures (recycling, reducing waste, lightweighting) are pushing companies to modify designs and materials.

For Pharmaceutical Packaging Market Research Report and updates detailed: View Full Report Now!

Type Insights

The pharmaceuticals packaging market by type is divided into primary, secondary, and tertiary packaging. Primary packaging, including bottles, blister packs, and vials, dominates as it directly protects drugs and ensures patient safety. Secondary packaging, such as cartons and labels, is crucial for branding and regulatory compliance. Tertiary packaging, including bulk transport solutions, supports large-scale distribution. With growing regulatory scrutiny and the need for tamper-evident solutions, demand for innovative and sustainable packaging materials across all three categories is steadily rising.

Drug Delivery Insights

Based on drug delivery, the market includes oral, injectable, topical, pulmonary, transdermal, and ocular packaging solutions. Oral drug delivery packaging leads due to its wide application in tablets, capsules, and syrups. Injectable packaging, including prefilled syringes, vials, and ampoules, is expanding rapidly with the rise of biologics and vaccines. Topical and transdermal formats are gaining demand in dermatology, while pulmonary and ocular packaging solutions are niche but growing. Increasing personalized medicine adoption and advanced drug delivery systems are further driving packaging innovations.

Packaging Type Insights

The packaging type segment consists of blister packs, bottles, pouches, prefilled syringes, vials & ampoules, tubes, and others. Blister packs dominate due to their convenience, dosage accuracy, and tamper resistance. Bottles remain essential for liquid formulations and over-the-counter (OTC) medicines. Prefilled syringes and vials are witnessing accelerated adoption in biologics and injectable drugs, particularly in vaccine distribution. Sustainability trends are pushing innovation in recyclable pouches and tubes. As pharmaceutical companies prioritize patient-friendly formats, smart and connected packaging is also emerging as a key innovation trend.

Raw Material Insights

The pharmaceuticals packaging market by raw material includes plastic, glass, paper & paperboard, aluminum foil, and others. Plastics dominate due to their lightweight, versatility, and cost-effectiveness across bottles, blisters, and pouches. Glass remains vital for sterile injectable drugs due to its inert properties and ability to preserve drug integrity. Paper & paperboard are gaining popularity for eco-friendly secondary packaging solutions, while aluminum foil is widely used in blister packs for its barrier protection. Increasing regulatory push for sustainability is shaping raw material choices.

Regional Insights

North America Pharmaceutical Packaging Market Trends

North America accounted for ~36.5% of global market revenue in 2024, making it the largest regional market. High healthcare expenditure, strict regulatory environments (FDA and others), strong biopharma presence, patient safety requirements, and demand for advanced drug delivery systems drive market dominance. There is also increasing emphasis on tamper-evident, child-resistant, and serialization requirements. Additionally, sustainability initiatives and eco-friendly packaging innovation are gathering momentum in response to consumer and regulatory pressures.

Europe Pharmaceutical Packaging Market Trends

Europe shows strong demand for high-quality packaging solutions that adhere to EU regulations around drug safety, packaging standards, anti-counterfeiting, and environmental impact. Primary packaging like blisters, vials, and bottles with high barrier properties is in demand. Sustainability regulations are pushing adoption of recyclable or biodegradable materials. Growth is also supported by increasing biologic drug production, vaccines, and specialty medications requiring advanced packaging. EU member states often enforce strict packaging waste and material usage norms, influencing designs.

Asia Pacific Pharmaceutical Packaging Market Trends

Asia Pacific is forecast to be the fastest growing region from 2025 to 2035. Growth is propelled by rising pharmaceutical manufacturing in countries like China, India, Japan, and Southeast Asia, increasing healthcare spending, growing access to medicines, and higher investments in cold chain and advanced packaging. Demand for oral drugs, biologics, self-injectables, and prefilled syringes is rising. Also, regulatory modernization, growing focus on counterfeit prevention, and increasing consumer awareness of drug safety are pushing improvements in packaging quality and materials.

Latin America Pharmaceutical Packaging Market Trends

Latin America is showing steady growth, though from a smaller base. Demand is increasing with improving healthcare infrastructure, higher drug consumption, and rising regulatory oversight. Primary packaging dominates, though cost sensitivity influences material selection. There is opportunity in emerging economies like Brazil, Mexico, Argentina. Adoption of sustainable and anti-counterfeit packaging features is growing. Logistics and supply chain complexity can hamper performance, especially for temperature-sensitive or biologic products. But overall, Latin America offers a rising contribution to global demand. (While Vantage’s summary focuses more on NA and Asia Pacific, Latin America is included among regions covered.)

Middle East & Africa Pharmaceutical Packaging Market Trends

Middle East & Africa is an emerging market with increasing pharmaceutical demand, expanding access, growing healthcare expenditure, and efforts to improve regulatory and logistical infrastructure. There's rising interest in cold chain capability, child-resistant and tamper-proof packaging, especially for vaccines and injectables. However, challenges include inconsistent supply chains, price sensitivity, and regulatory heterogeneity among countries. Sustainable packaging and material alternatives are slower to uptake, but demand is increasing in urban centers and from government contracts (immunization, etc.).

Top Key Pharmaceutical Packaging Companies:

Some of the prominent players in the market noted by Vantage include:

- Gerresheimer AG

- Amcor

- AptarGroup

- West Pharmaceutical Services

- Berry Global

These companies compete via innovation in materials (plastics, advanced polymers, glass, etc.), sustainability (recyclable/eco materials), child-resistant / tamper-evident / anti-counterfeit packaging, temperature / cold chain packaging, primary vs secondary packaging technologies, and strong regulatory compliance and supply chain capability.

Recent Developments

- In 2024, Gerresheimer AG expanded its capacity in the pharmaceutical packaging segment by investing in enhanced production facilities and increasing output of plastic bottles, blister packs, and specialized containers to meet growing global demand.

- In 2024, there was growing movement towards incorporating sustainable and tamper-evident packaging solutions across major pharmaceutical companies, including innovations in child-resistant closures, anti-counterfeit features, and packaging designs that reduce material usage.

Pharmaceutical Packaging Market Future Scope

Vantage Market Research’s report on the Pharmaceutical Packaging Market uses 2024 as the base year and provides forecasts through 2035. It includes historical data (2021-2023), revenue estimates for 2024, and CAGR projections for 2025-2035. The report is segmented by Type (plastic bottles, blister packs, pre-filled syringes, etc.), Drug Delivery/Application Type (oral drugs, injectables, specialty / biologics, etc.), Packaging Type (primary, secondary, temperature-controlled, etc.), Raw Material (plastics, glass, metal, paper, etc.), and by Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa). It also features profiles of leading companies, recent developments, market drivers and restraints, and qualitative insights on trends such as sustainability, regulatory requirements, anti-counterfeiting, cold chain packaging, and material innovations.

Market Dynamics

Driver:

The main drivers include explosive growth in pharmaceutical and biologic drug production, increased focus on patient safety, regulatory mandates around product integrity, anti-counterfeit and child-resistant packaging. Growth in emerging markets and increasing healthcare access further fuel demand. Innovations such as cold chain packaging, specialized containers, safety features, and sustainable materials are also pushing growth.

Restraint:

Challenges include high costs of advanced material (e.g. glass, cold chain elements), regulatory complexity across geographies, supply chain and logistics issues (especially for temperature-controlled or specialized packaging), and cost pressures from generic drug manufacturers who favor cost minimization. Additionally, environmental concerns about plastic waste and difficulty in recycling some multi-material packaging may slow adoption of some solution types.

Opportunity:

Opportunities lie in sustainable packaging (recyclable, biodegradable materials), smart packaging (IoT, serialization, traceability), packaging innovation for biologics and vaccines (cold chain, prefilled syringes), increasing demand in Asia Pacific and other emerging markets, and regulations pushing for safer / anti-tamper packaging. Also, partnerships and M&A among packaging players to expand capacity and reach, especially in high-growth regions.

Challenges:

Significant challenges include maintaining drug packaging integrity under varying storage / transportation conditions (temperature, humidity), balancing cost with regulatory compliance, developing materials that are both sustainable and able to meet barrier / safety requirements, ensuring supply of high-quality raw materials, and navigating diverse regulatory standards among countries. Tackling counterfeiting and ensuring patient safety while keeping costs manageable are ongoing tasks.

Global Pharmaceutical Packaging Market Segmentation

Segments covered:

- By Type: Plastic Bottles; Blister Packs; Caps & Closures; Pre-filled Syringes; Pouches & Strips; Pre-filled Inhalers; Vials; Ampoules; Cartridges; Labels & Accessories; Temperature-controlled Packaging; Medication Tubes; Jars & Canisters; Others

- By Drug Delivery / Application Type: Oral Drugs; Injectables; Specialty / Biologics; Others

- By Packaging Type: Primary Packaging; Secondary Packaging; etc.

- By Raw Material: Plastics; Glass; Metal; Paper; etc.

- By Region: North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Frequently Asked Questions

Q1. What was the size of the pharmaceutical packaging market in 2024?

- A1. USD 144.2 billion.

Q2. What is the forecast market size by 2035 and CAGR?

- A2. Projected to reach USD 698.1 billion by 2035, with a CAGR of 15.40% from 2025–2035.

Q3. Which region leads the market and which region grows fastest?

- A3. North America is the largest region in 2024. Asia Pacific is forecast to grow the fastest over the 2025-2035 period.

Q4. Which packaging types and applications are most significant?

- A4. Plastic bottles are significant by type; oral drugs segment contributes significantly. Primary packaging holds a large share. Temperature-controlled packaging and pre-filled syringes/injectables are growing fast.

Q5. Who are some of the key players in this market?

- A5. Gerresheimer AG; Amcor; AptarGroup; West Pharmaceutical Services; Berry Global among others.