Future Trends Impacting the Artificial Blood Cells Market Until 2035

Explore the burgeoning Artificial Blood Cells market, projected to hit $5.265B by 2035. This in-depth analysis covers market drivers, product types (HBOCs, PFCs), regional trends, and the challenges shaping the future of synthetic blood.

The Dawn of a New Era: Navigating the Artificial Blood Cells Market

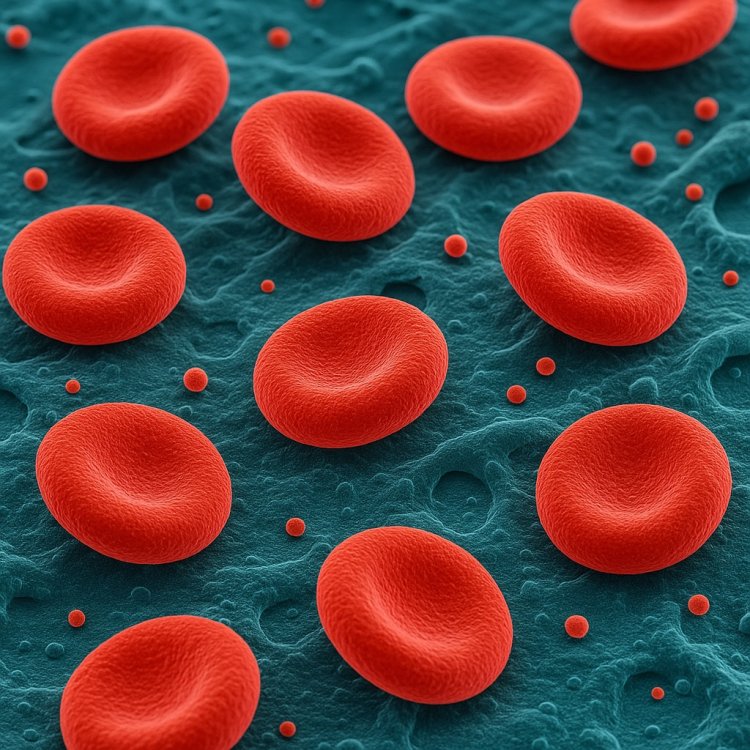

In the landscape of modern medicine, few innovations hold the transformative potential of artificial blood. For centuries, the reliance on human-to-human blood donation has been the bedrock of transfusion medicine—a system that is both a miracle of altruism and a logistical challenge fraught with limitations. Now, we stand at the precipice of a new era. Artificial Blood Cells, or more accurately, synthetic oxygen carriers, promise to revolutionize emergency care, surgery, and the management of chronic diseases by offering a universally compatible, pathogen-free, and readily available alternative to donor blood. This article delves into the dynamic world of artificial blood, exploring the market forces, technological advancements, and formidable challenges that define this next frontier in healthcare.

Key Takeaways

- Significant Market Growth: The global Artificial Blood Cells market is on a steep upward trajectory. It is forecasted to grow from USD 1.355 billion in 2024 to USD 5.265 billion by 2035, driven by a strong CAGR of 13.15%.

- Diverse Product Landscape: The field is dominated by two primary technologies: Hemoglobin-based Oxygen Carriers (HBOCs), which use modified hemoglobin to transport oxygen, and Perfluorocarbons (PFCs), synthetic chemicals that dissolve oxygen. Emerging technologies focus on creating fully synthetic "cell mimics."

- Critical Need Driving Demand: Market growth is fueled by the inherent limitations of donor blood, including chronic shortages, short shelf-life, compatibility issues, and the risk of disease transmission. The rising global incidence of chronic diseases and trauma cases further amplifies this need.

- Regional Market Dynamics: North America currently leads the market due to high R&D investment and a robust healthcare infrastructure. However, the Asia Pacific region is projected to experience the fastest growth, driven by increasing healthcare access and government investment in biotechnology.

- Substantial Hurdles Remain: Despite immense promise, the path to commercialization is laden with challenges. Strict regulatory scrutiny following past trial failures, high development and manufacturing costs, and the need to build clinical and public trust are major barriers.

- The Future is Multifunctional: The next generation of artificial blood products aims to do more than just carry oxygen. Researchers are exploring ways to integrate capabilities like drug delivery, diagnostics, and hemostatic functions, positioning these products as advanced therapeutic platforms.

Overview of the Artificial Blood Cells Market

The global market for Artificial Blood Cells is not just a niche segment of biotechnology; it represents a seismic shift in how we approach one of the most fundamental aspects of medical care: oxygen delivery to tissues. According to a detailed analysis by Vantage Market Research, this burgeoning market is valued at USD 1.355 billion in 2024. More impressively, it is projected to surge to USD 5.265 billion by 2035, expanding at a robust Compound Annual Growth Rate (CAGR) of 13.15%. This powerful growth trajectory is a clear indicator of the immense clinical need and commercial potential that investors, researchers, and healthcare systems see in this technology. At its core, the term "artificial blood" is slightly of a misnomer. Current and near-future products are more accurately described as "oxygen therapeutics" or "red blood cell substitutes." Their primary function is to replicate the oxygen-carrying capacity of red blood cells, a critical task in cases of severe blood loss (hemorrhagic shock), anemia, or during complex surgeries where large-volume transfusions are anticipated. They are not designed to replicate the full spectrum of blood's functions, such as immunity (white blood cells) or clotting (platelets), though future iterations may incorporate these features.

The target market for these innovative products is broad and diverse, touching nearly every corner of advanced medical care. The primary segment is hospitals, surgical centers, and trauma units, where the immediate need for a universally compatible blood product can mean the difference between life and death. In emergency situations, there is often no time to cross-match blood types, making a "one-size-fits-all" solution like artificial blood invaluable. Another critical target segment is the military and defense. The logistical challenges of transporting and storing donor blood in combat zones are immense. A stable, long-shelf-life artificial blood product could revolutionize battlefield medicine, dramatically improving survival rates for wounded soldiers. Furthermore, emergency medical services (EMS) and ambulance crews represent a key pre-hospital market, where administering an oxygen carrier at the scene of an accident could stabilize a patient long before they reach a hospital. Other potential markets include organ preservation, where artificial blood can be used to perfuse organs awaiting transplant, and for patients who refuse donor blood for religious reasons, such as Jehovah's Witnesses. The factors driving this market are compelling and multifaceted. They are rooted in the fundamental vulnerabilities of the current blood supply chain and the growing demands of an aging global population.

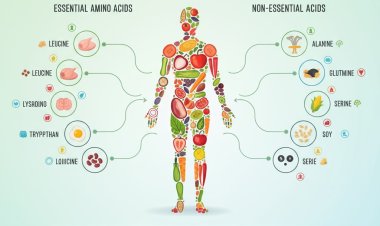

Types of Artificial Blood Products

The quest to create a viable blood substitute is not a monolithic effort; it's a complex scientific race being run on multiple tracks. Researchers have pursued several distinct technological avenues, each with its own set of advantages and challenges. The two most developed categories are Hemoglobin-based Oxygen Carriers (HBOCs) and Perfluorocarbons (PFCs), with a new wave of synthetic technologies on the horizon.

Hemoglobin-based Oxygen Carriers (HBOCs)

This is the most intuitive approach. The logic is simple: if hemoglobin is the molecule that carries oxygen within red blood cells, why not extract it and use it directly? However, the reality is far more complex. Free hemoglobin, when removed from the protective environment of the red blood cell, is unstable and highly toxic. It breaks down into smaller, toxic subunits that can cause severe kidney damage. More critically, it scavenges nitric oxide (NO) from the bloodstream. Nitric oxide is a vital molecule that helps keep blood vessels dilated. When it's removed by free hemoglobin, the result is vasoconstriction (narrowing of blood vessels), leading to high blood pressure and reduced blood flow to vital organs—the exact opposite of the desired effect.

To overcome these issues, scientists have developed sophisticated modification techniques. These include:

- Polymerization: Linking multiple hemoglobin molecules together using chemical cross-linkers to create larger, more stable complexes (e.g., PolyHeme).

- Encapsulation: Enclosing hemoglobin within a synthetic shell, such as a liposome, creating a tiny artificial cell.

- Recombinant Technology: Genetically engineering bacteria or yeast to produce human hemoglobin with specific modifications that increase its stability and reduce its toxicity.

- Conjugation: Attaching molecules like polyethylene glycol (PEG) to the hemoglobin surface to increase its size and shield it from interaction with nitric oxide. Sources for hemoglobin include expired human donor blood, purified bovine (cow) blood, and recombinant production. Despite decades of research and numerous clinical trials, safety concerns, particularly vasoconstriction, have plagued HBOC development and prevented any product from gaining FDA approval in the United States, although some have seen limited approval elsewhere.

Perfluorocarbons (PFCs)

PFCs represent a completely different, purely synthetic approach. These are biologically inert, fluorine-and-carbon-based chemicals that have an exceptionally high capacity to dissolve gases, including oxygen and carbon dioxide. Think of them as a "liquid Teflon" that can carry oxygen. Unlike hemoglobin, which chemically binds to oxygen, PFCs simply dissolve it based on the surrounding partial pressure of oxygen. This means a patient receiving a PFC-based product must breathe highly concentrated oxygen (often 100%) for the PFCs to become saturated and effectively transport oxygen to the tissues.

Because PFCs are not water-soluble, they must be emulsified—whipped into microscopic droplets and suspended in a liquid, much like vinegar and oil in a salad dressing. This emulsion is then infused into the bloodstream. The primary advantages of PFCs are that they are completely synthetic, eliminating the risk of biological contamination, and they can be produced in large quantities. However, they also have drawbacks. The emulsion can be unstable, and the particles can be taken up by the immune system, sometimes causing flu-like symptoms. Products typically require frozen storage and careful thawing before use, adding a layer of logistical complexity. An early PFC product, Fluosol-DA, was approved in the 1980s but was later withdrawn due to side effects and cumbersome administration. Newer generations, like NuvOx Pharma's dodecafluoropentane (DDFP) emulsion, are in development with improved stability and efficacy.

Emerging Synthetic Technologies

The future of artificial blood lies in combining the best of both worlds: the biological efficiency of hemoglobin with the safety and purity of synthetic chemistry. Researchers are now focused on creating true "red blood cell mimics." This involves using advanced nanotechnology and polymer chemistry to build a complete artificial cell from the ground up. The goal is to create a flexible, durable membrane that encapsulates hemoglobin, protecting it from the bloodstream and preventing toxic side effects while mimicking the deformability of a real red blood cell, allowing it to squeeze through the tiniest capillaries. These "third-generation" products are still in the early stages of research but hold the ultimate promise of creating a safe, effective, and truly biomimetic blood substitute.

Key Growth Drivers in the Market

The projected 13.15% CAGR for the artificial blood market isn't based on speculation; it's fueled by a convergence of powerful, persistent, and growing global healthcare challenges. These drivers create a compelling "pull" for innovation, pushing researchers and investors to overcome the significant scientific hurdles. The three primary pillars driving this growth are the inherent limitations of the donor blood system, the rising tide of chronic diseases, and continuous advancements in the enabling biotechnologies.

Increasing Incidence of Chronic Diseases and an Aging Population

The global demographic landscape is shifting. People are living longer, but often with one or more chronic conditions. Diseases such as cancer, chronic kidney disease, gastrointestinal disorders, and cardiovascular diseases are on the rise worldwide. Many of these conditions, or their treatments, lead to severe anemia, a condition characterized by a deficiency of red blood cells or hemoglobin. For example, chemotherapy and radiation therapy for cancer often suppress bone marrow function, drastically reducing the body's ability to produce new red blood cells. Patients with end-stage renal disease often suffer from anemia because their kidneys no longer produce enough erythropoietin, the hormone that stimulates red blood cell production. Major surgeries, which are also becoming more common in an aging population, frequently require blood transfusions to manage blood loss. As the prevalence of these conditions grows, the demand for blood products skyrockets, placing an ever-increasing strain on the finite supply of donor blood and making the case for a reliable, mass-produced alternative more urgent than ever.

Intrinsic Limitations of Donor Blood Supply

The altruistic system of blood donation is a modern marvel, yet it is fundamentally fragile and fraught with limitations that an artificial substitute could elegantly solve.

- Chronic Shortages: Blood banks worldwide struggle to maintain adequate inventory. The donor pool is limited, with only a small percentage of the eligible population regularly donating. The supply is vulnerable to disruptions from holidays, seasonal illnesses (like the flu), and public health crises, as seen during the COVID-19 pandemic.

- Short Shelf-Life: Donated red blood cells have a shelf life of only about 42 days under refrigeration. This creates immense logistical pressure for collection, testing, storage, and distribution, and leads to significant wastage when blood expires before it can be used. Artificial blood products, particularly PFCs and some HBOC formulations, could have a shelf life of one to three years at room temperature, transforming supply chain management.

- Compatibility and Blood Typing: The need to match blood types between donor and recipient is a critical safety step. In emergencies, there may not be time for typing, forcing reliance on O-negative blood, the "universal donor," which is often in critically short supply. An artificial blood product would be universally compatible, eliminating this life-threatening bottleneck.

- Risk of Transfusion-Transmitted Infections (TTIs): While screening has made the blood supply in developed nations incredibly safe, the risk of transmitting known pathogens (like HIV, Hepatitis B and C) and emerging ones is never zero. Artificial blood, being synthetically produced and sterilized, would completely eliminate this risk.

Advancements in Biotechnology and Nanotechnology

The scientific toolkit available to researchers today is vastly more powerful than it was during the first wave of artificial blood development in the 1980s and 90s. These technological advancements are the "push" factor, making it possible to design safer and more effective products.

- Nanotechnology: The ability to engineer materials at the molecular level is the key to creating third-generation blood substitutes. Researchers can now design nanoparticles and liposomes with precise control over size, surface charge, and flexibility, allowing them to create stable shells for encapsulating hemoglobin.

- Recombinant DNA Technology: Genetic engineering allows for the production of highly purified, modified human hemoglobin in bioreactors, bypassing the need for human or animal sources and allowing for molecular tweaks to improve safety and reduce side effects like vasoconstriction.

- Advanced Polymer Chemistry: Scientists are developing new biocompatible polymers that can coat hemoglobin molecules (PEGylation) or form the basis of the artificial cell membrane, creating a "stealth" effect that helps the product evade the immune system and prolong its circulation time.

Regional Market Analysis

The global pursuit of artificial blood is a shared goal, but the market's structure, growth rate, and key players vary significantly by region. This geographic disparity is shaped by factors like healthcare expenditure, regulatory environments, research infrastructure, and the specific healthcare needs of the population. Understanding these regional dynamics is crucial for any stakeholder in the artificial blood ecosystem.

The Established Leader and Innovation Hub

North America, particularly the United States, stands as the dominant force in the artificial blood market. This leadership position is built on a foundation of several key strengths. Firstly, the region boasts the world's highest healthcare spending per capita, providing the financial resources for both the development and eventual adoption of high-cost, advanced therapies. Secondly, it is home to a vibrant and unparalleled research and development ecosystem, with world-class universities, government-funded institutions like the National Institutes of Health (NIH), and a dense concentration of biotechnology and pharmaceutical companies. This creates a fertile ground for innovation. Thirdly, the U.S. Department of Defense has been a significant source of funding for artificial blood research, driven by the clear strategic need for a field-ready blood substitute for military medicine. While the U.S. Food and Drug Administration (FDA) has a reputation for being one of the most stringent regulatory bodies in the world—a major reason no product has yet been approved—its clear, albeit challenging, pathway for clinical trials provides a structured framework for developers. The high incidence of trauma, complex cardiovascular surgeries, and a well-established system for advanced medical care ensures a ready market for any product that successfully navigates the regulatory gauntlet.

The High-Growth Frontier

While North America is the current leader, the Asia Pacific region is widely projected to be the fastest-growing market for artificial blood cells over the next decade. This explosive growth potential is driven by a powerful confluence of factors. Rapid economic development in countries like China, India, and South Korea is leading to a massive increase in healthcare spending and infrastructure. Governments are actively investing in their domestic biotechnology sectors to foster innovation and reduce reliance on Western pharmaceuticals. The sheer size of the population, combined with a rising middle class demanding better healthcare, creates an enormous potential patient base. Furthermore, the region is experiencing a sharp increase in the prevalence of "Western" chronic diseases like cancer and diabetes, alongside a high burden of trauma from traffic accidents and industrialization. While traditional blood donation systems are improving, they often struggle to keep pace with this surging demand, creating a significant opportunity for artificial blood to fill the gap. Regulatory pathways in some APAC countries may also prove to be more streamlined, potentially allowing for earlier market entry once a product demonstrates a strong safety profile.

A Strong but Fragmented Market

The European market shares many characteristics with North America, including high standards of care, strong research institutions (particularly in Germany, the UK, and Switzerland), and an aging population with a high prevalence of chronic disease. European nations have been active in artificial blood research, with notable companies and academic groups contributing significantly to the field. However, the market is more fragmented. The regulatory landscape, while centralized to a degree under the European Medicines Agency (EMA), still involves country-specific health technology assessments and reimbursement negotiations. This can create a more complex and slower path to widespread market adoption compared to the single-market structure of the U.S. Public and physician attitudes, as well as healthcare funding models, can vary significantly from country to country. Despite this fragmentation, the clear clinical need and strong scientific base ensure that Europe will remain a critical market for artificial blood products as they become available. Some products that have struggled to gain traction in the U.S. have found limited, niche approval in countries like South Africa or Russia, highlighting how different regulatory philosophies can shape market access.

Challenges and Barriers

The path from a brilliant scientific concept to a standard-of-care medical product is long and treacherous, and for artificial blood, the road has been particularly fraught with obstacles. This technology's immense promise is matched only by the scale of the challenges that have delayed its commercialization for decades. Understanding these barriers is essential to appreciating why a solution to such an obvious need remains just over the horizon.

Regulatory Hurdles and Overarching Safety Concerns

This is, without question, the single greatest barrier. The history of artificial blood research is haunted by the ghosts of failed clinical trials. In the 1990s and 2000s, several large-scale Phase III trials for HBOC products were halted due to safety signals, most notably an increased risk of heart attacks (myocardial infarction) and death in some patient groups. The controversy surrounding Northfield's PolyHeme trial, for example, cast a long shadow over the entire field. The core scientific issue remains the off-target effects of cell-free hemoglobin, particularly its tendency to scavenge nitric oxide and cause vasoconstriction, leading to hypertension and poor tissue perfusion. As a result, regulatory bodies like the FDA have an extremely low tolerance for risk. Any new artificial blood product must not only prove that it is effective at carrying oxygen but that it is, at a minimum, as safe as donor blood—a very high bar. Demonstrating this requires massive, expensive, and meticulously designed clinical trials, and even a small negative safety signal can derail an entire development program.

High Development and Manufacturing Costs

Bringing any new drug to market is a billion-dollar endeavor, but artificial blood presents unique financial challenges. The R&D process is incredibly complex, requiring expertise in biochemistry, polymer science, nanotechnology, and medicine. The subsequent clinical trials needed to satisfy regulators are among the most expensive to run, given the large patient numbers and the critical-care settings in which they are tested. Beyond R&D, manufacturing is a formidable hurdle. Producing sterile, consistent, and stable batches of a complex biologic or nano-emulsion at a commercial scale is technically demanding and requires significant capital investment in specialized facilities. These astronomical costs create a high-risk environment for investors and mean that the final price per unit of artificial blood will likely be significantly higher than the cost of a unit of donor blood, at least initially. This creates a "cost-effectiveness" barrier, where hospitals and healthcare systems will need to be convinced that the benefits (e.g., universal compatibility, long shelf-life) justify the premium price.

Limited Clinical, Public, and Physician Acceptance

Even with a safe, effective, and approved product, a final barrier remains: acceptance.

- Physician Acceptance: Clinicians are inherently conservative and evidence-driven. They have decades of experience with donor blood and understand its risks and benefits intimately. They will require overwhelming, unambiguous clinical trial data before they are comfortable replacing a known standard of care with a novel technology. Building this trust will take time and extensive post-market surveillance.

- Public Perception: The idea of "artificial blood" or "synthetic blood" can be unsettling for the public, conjuring up science-fiction imagery. A significant public education effort will need to explain the science, the benefits, and the rigorous safety testing involved. Overcoming this potential "ick factor" is crucial for patient consent and broad acceptance.

- Ethical Considerations: Depending on the source material, ethical questions can arise. The use of bovine hemoglobin, for instance, may raise concerns among certain patient groups and could be associated with the theoretical risk of prion diseases. While this risk is considered negligible with modern purification techniques, the perception can still be a barrier.

Major Players in the Market

The landscape of the artificial blood market is a dynamic mix of tenacious start-ups, specialized biotechs, and the lingering influence of large pharmaceutical companies that have dabbled in the field. Unlike mature pharmaceutical markets dominated by a few giants, this sector is characterized by pioneering entities focused on cracking one of medicine's toughest codes. The market is defined less by current sales and more by the progress of clinical pipelines and the strength of intellectual property.

Overview of Leading Companies and Innovators

The list of active players has evolved over the years, with some historical names fading and new ones emerging. It's important to note that this is a research-intensive field, and the "leaders" are often those with the most promising technology in clinical or pre-clinical stages.

- Hemarina: This French-based biotech company has taken a unique approach to the HBOC problem. Instead of using human or bovine hemoglobin, they are leveraging the extracellular hemoglobin of the lugworm (Arenicola marina). This marine worm's hemoglobin is naturally 250 times smaller than human hemoglobin but has a much larger, multi-branched structure that is 50 times more effective at binding oxygen. Crucially, its large size is believed to prevent it from seeping out of blood vessels and scavenging nitric oxide, thus avoiding the vasoconstriction side effect that plagued earlier HBOCs. Their product, HEMO2life®, is being developed primarily for organ preservation and has shown promising results.

- NuvOx Pharma: A key player in the PFC space, this US-based company is developing a dodecafluoropentane (DDFP) emulsion. Their lead candidate, NanO2®, is designed to deliver oxygen specifically to hypoxic (oxygen-starved) tissues. Their primary focus is not as a total blood replacement but as an adjunct therapy to enhance the effectiveness of radiation and chemotherapy in solid tumors like glioblastoma, which are notoriously hypoxic and resistant to treatment. This targeted approach may provide a quicker path to regulatory approval than a broad trauma indication.

- KaloCyte: A US-based biotech spun out of Washington University, KaloCyte is developing a "third-generation" product called ErythroMer. This is a true red blood cell mimic, a bio-inspired nanoparticle that encapsulates purified human hemoglobin within a synthetic polymer shell. The shell is designed to be flexible and to have a surface chemistry that maximizes circulation time. Their initial focus is on treating life-threatening hemorrhages in pre-hospital and battlefield settings.

Research and Development Advancements & Historical Context

It's impossible to discuss the current players without acknowledging the giants on whose shoulders they stand—and whose failures they have learned from. Companies like Baxter International, Northfield Laboratories (with PolyHeme), and Hemosol were pioneers in the HBOC space. Their extensive clinical trials in the 1990s and 2000s generated a wealth of data that, while ultimately leading to failure, provided invaluable lessons about the pathophysiology of cell-free hemoglobin. This research has directly informed the design of modern HBOCs, which now incorporate advanced polymer coatings and recombinant modifications to mitigate toxicity. The story of these early players serves as a cautionary tale about the immense challenges but also provides the foundational science for the current generation of innovators.

Mergers, Acquisitions, and Collaborations

The artificial blood market is ripe for strategic partnerships. Small biotechs with promising technology often lack the capital to fund late-stage clinical trials and commercial-scale manufacturing. This creates opportunities for collaborations with larger pharmaceutical companies, which may prefer to wait for a product to demonstrate Phase II safety and efficacy before investing or acquiring. We also see critical collaborations between academic institutions, where foundational research is conducted, and private companies that license the technology and drive it toward commercialization. As a product gets closer to potential approval, we can expect to see an increase in M&A activity, with larger players looking to add a potentially transformative, first-in-class asset to their portfolios.

Future Outlook and Trends

Looking beyond the current market projections to 2035, the future of artificial blood is poised to be even more innovative and integrated into healthcare. The successful commercialization of a first-generation oxygen carrier will be a watershed moment, but it is only the beginning. The trends shaping the long-term future of this technology point towards multi-functionality, personalization, and a deeper synergy with other advanced medical fields. The ultimate goal is to evolve from simple "red blood cell substitutes" to sophisticated, engineered "therapeutic platforms" that circulate in the bloodstream.

Innovations in Artificial Blood Technology: The Multifunctional Cell

The holy grail of artificial blood research is not just to replicate one function of a red blood cell, but to build a platform that can be customized to perform multiple tasks. The future lies in the "multi-functional" blood substitute. Imagine an artificial cell that not only carries oxygen but is also engineered to:

- Deliver Drugs: The surface of the artificial cell or its internal payload could be loaded with chemotherapy drugs. These cells could then be designed to release their payload only in the low-oxygen, acidic environment of a tumor, dramatically increasing treatment efficacy while minimizing systemic side effects.

- Carry Hemostatic Agents: For trauma patients, a second-generation artificial blood product could be co-infused with nanoparticles that carry clotting factors, helping to control bleeding at the source while simultaneously restoring oxygen transport.

- Act as a Diagnostic Sensor: Future artificial cells could be embedded with nanosensors that detect specific biomarkers in the blood—such as proteins indicating a heart attack or glucose levels for diabetics—and report this information to an external device or release a therapeutic agent in response.

- Enhance Imaging: PFC-based products, being fluorine-based, are highly visible on 19F-MRI scans. This opens up possibilities for using them as highly effective contrast agents to visualize blood flow and inflammation in real-time.

Potential for Synergies with Other Fields

The development of artificial blood does not exist in a vacuum. It will run in parallel with another groundbreaking field: lab-grown blood. Using pluripotent stem cells, scientists are now able to grow functional, transfusable red blood cells in a bioreactor. The UK has already launched the first-ever clinical trial of lab-grown blood in humans. These two fields are not necessarily competitors; they may become complementary solutions. Lab-grown blood could provide a perfect, non-toxic source of human hemoglobin for encapsulation in next-generation artificial cells. While lab-grown whole cells may solve the supply and disease-transmission problem, they would still have a limited shelf-life, leaving a critical role for stable, long-lasting artificial products in emergency and military medicine.

Predictions for Market Growth Beyond 2035

The projection of a USD 5.265 billion market by 2035 is predicated on one or more products successfully navigating regulatory approval and achieving market adoption for specific indications (e.g., trauma, surgery). The first company to cross this finish line will unlock a market with enormous pent-up demand and will likely command a significant market share. This initial success will de-risk the entire field, attracting a flood of new investment and accelerating the development of the more advanced, multifunctional products described above. Therefore, the growth rate is likely to remain exceptionally strong well beyond 2035. As the technology matures and manufacturing scales up, costs will decrease, opening up new markets in middle-income countries and for broader applications. The ultimate vision is a world where no one dies for lack of blood, and the journey to that reality, while challenging, is well underway. Artificial blood cells are not just a product; they are the key to a future of more resilient, responsive, and effective medical care.

FAQs

- What factors are driving the growth of the Artificial Blood Cells Market?

- How is the value of the Artificial Blood Cells Market expected to change from 2024 to 2035?

- What are the potential applications of Artificial Blood Cells in transfusion medicine?

- What challenges does the Artificial Blood Cells Market face in its development and adoption?