Artificial Disc Replacement Market 2025: Growth Trends, Key Players & Future Innovations

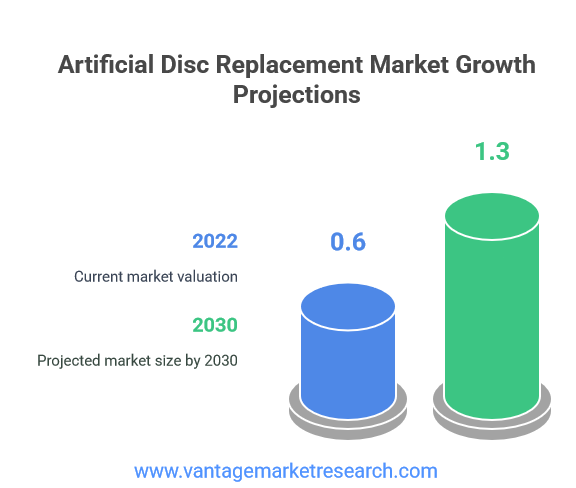

Explore the $0.6Bn artificial disc replacement market projected to reach $1.3Bn by 2030. Discover growth drivers, challenges, major players, and emerging trends in spinal care innovation.

Artificial Disc Replacement Market: Transforming Spinal Care Through Innovation

Key Takeaways

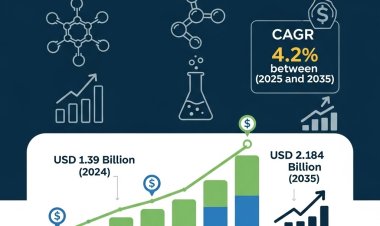

- The global Artificial Disc Replacement Market is experiencing robust growth, valued at USD 0.6 billion in 2022 and projected to reach USD 1.3 billion by 2030.

- The market demonstrates a strong compound annual growth rate of 12.3% between 2023 and 2030.

- Technological advancements in disc materials and surgical techniques are driving market expansion.

- An aging global population and increasing prevalence of degenerative disc disease fuel demand.

- Minimally invasive surgical approaches are becoming increasingly preferred by patients and surgeons.

- Major players are investing heavily in research and development to maintain competitive positioning.

- Regulatory challenges and reimbursement limitations present ongoing market obstacles.

- COVID-19 pandemic disrupted elective procedures but accelerated adoption of outpatient surgery models.

- Emerging markets present significant growth opportunities for market expansion.

- Integration of robotics and AI technologies promises to revolutionize surgical precision and outcomes.

Current Market Overview and Size Projections

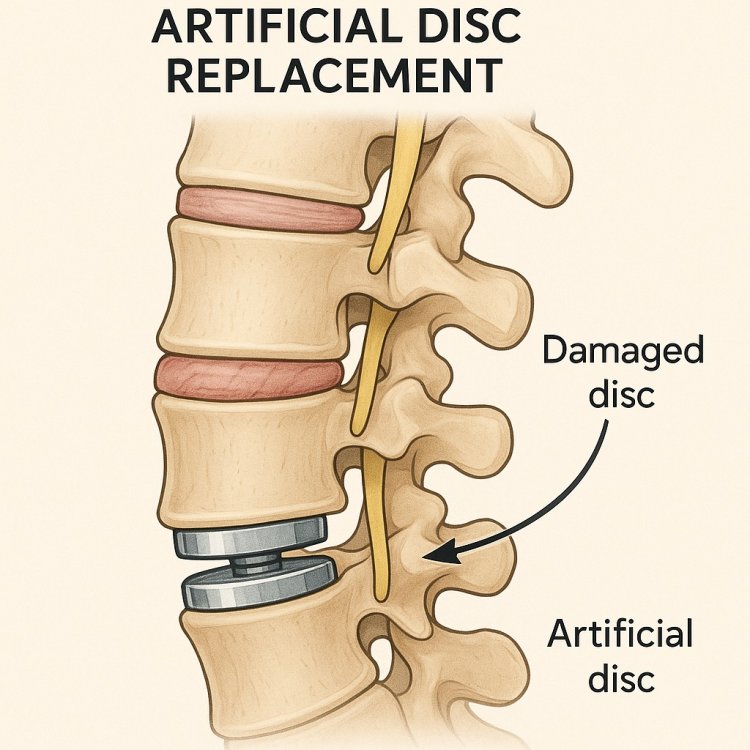

The Artificial Disc Replacement Market represents one of the most dynamic segments within the broader spinal implant industry, reflecting a fundamental shift in how medical professionals approach degenerative disc disease treatment. Current market valuation stands at approximately USD 0.6 billion as of 2022, with analysts projecting substantial growth trajectory toward USD 1.3 billion by 2030. This impressive expansion represents more than doubling of market size within an eight-year period, underscoring the increasing acceptance and adoption of artificial disc replacement procedures worldwide.

The compound annual growth rate of 12.3% between 2023 and 2030 significantly outpaces many traditional medical device markets, indicating strong underlying demand drivers and favorable market conditions. This growth rate reflects not only increasing procedure volumes but also premium pricing for advanced disc replacement technologies that offer superior patient outcomes compared to traditional spinal fusion procedures. The market's robust performance demonstrates growing confidence among surgeons, patients, and healthcare systems in artificial disc replacement as a viable long-term solution for degenerative disc disease.

Regional market distribution reveals interesting patterns, with North America currently commanding the largest market share due to advanced healthcare infrastructure, higher patient awareness, and favorable reimbursement policies. The United States leads global adoption rates, driven by an aging population, high prevalence of back pain, and established surgical training programs for artificial disc replacement procedures. European markets follow closely, with Germany, France, and the United Kingdom showing particularly strong adoption rates supported by comprehensive healthcare systems and increasing surgeon expertise.

Asia-Pacific regions present the most significant growth potential, with countries like Japan, China, and India experiencing rapid healthcare infrastructure development and growing middle-class populations seeking advanced treatment options. These emerging markets offer substantial opportunities for market expansion, though challenges related to regulatory approval processes, surgeon training, and cost considerations must be addressed. Latin American and Middle Eastern markets, while smaller in absolute terms, demonstrate increasing interest in artificial disc replacement technologies as healthcare systems modernize and patient expectations evolve.

Market size projections indicate sustained growth driven by multiple converging factors including demographic trends, technological innovations, and evolving treatment paradigms. The transition from traditional spinal fusion procedures toward motion-preserving artificial disc replacement represents a fundamental shift in spinal care philosophy, supported by accumulating clinical evidence demonstrating superior long-term outcomes. This market expansion reflects not merely increased procedure volumes but also the development of more sophisticated, durable, and biocompatible artificial disc technologies that address previous limitations and expand patient eligibility criteria.

Factors Driving Market Growth

Technological advancements serve as the primary catalyst driving artificial disc replacement market expansion, with manufacturers continuously innovating to address historical limitations and improve patient outcomes. Modern artificial discs incorporate advanced materials science, featuring next-generation polyethylene, titanium alloys, and ceramic composites that offer superior wear resistance, biocompatibility, and longevity compared to earlier generations. These material improvements directly address previous concerns about device durability and long-term performance, expanding the patient population suitable for artificial disc replacement procedures.

The global demographic shift toward an aging population represents perhaps the most significant long-term driver of market growth. As populations age, the prevalence of degenerative disc disease increases dramatically, with individuals over 65 experiencing significantly higher rates of symptomatic disc degeneration requiring surgical intervention. This demographic trend creates sustained demand for effective treatment options, positioning artificial disc replacement as an attractive alternative to traditional spinal fusion procedures that may compromise adjacent spinal segments over time.

Increasing prevalence of back pain across all age groups, driven by sedentary lifestyles, occupational hazards, and rising obesity rates, further expands the potential patient population. Modern work environments, characterized by prolonged sitting and computer use, contribute to earlier onset of disc degeneration, creating demand for treatment options that preserve spinal mobility and function. This trend particularly affects younger patients who prioritize maintaining active lifestyles and career productivity, making motion-preserving artificial disc replacement particularly appealing compared to traditional fusion procedures.

Growing demand for minimally invasive surgical procedures represents another crucial growth driver, as patients increasingly seek treatment options that minimize recovery time, reduce complications, and preserve normal anatomy. Artificial disc replacement procedures, particularly when performed through anterior approaches, often result in shorter hospital stays, reduced postoperative pain, and faster return to normal activities compared to traditional spinal fusion surgeries. This preference for minimally invasive approaches aligns with broader healthcare trends emphasizing outpatient procedures and value-based care models.

Surgeon education and training programs have expanded significantly, increasing the number of qualified practitioners capable of performing artificial disc replacement procedures. Major medical device manufacturers invest heavily in comprehensive training programs, surgical simulation systems, and ongoing education initiatives that build surgeon confidence and competency. This expanded surgeon base directly translates to increased procedure volumes and market growth, as more patients gain access to artificial disc replacement options.

Healthcare system economics also favor artificial disc replacement adoption, as these procedures often demonstrate superior cost-effectiveness compared to spinal fusion when considering long-term outcomes, revision surgery rates, and patient quality of life measures. Health economics research increasingly supports artificial disc replacement as a value-based treatment option that delivers better patient outcomes while potentially reducing overall healthcare costs through decreased need for revision procedures and improved patient productivity.

Competitive Landscape and Major Players

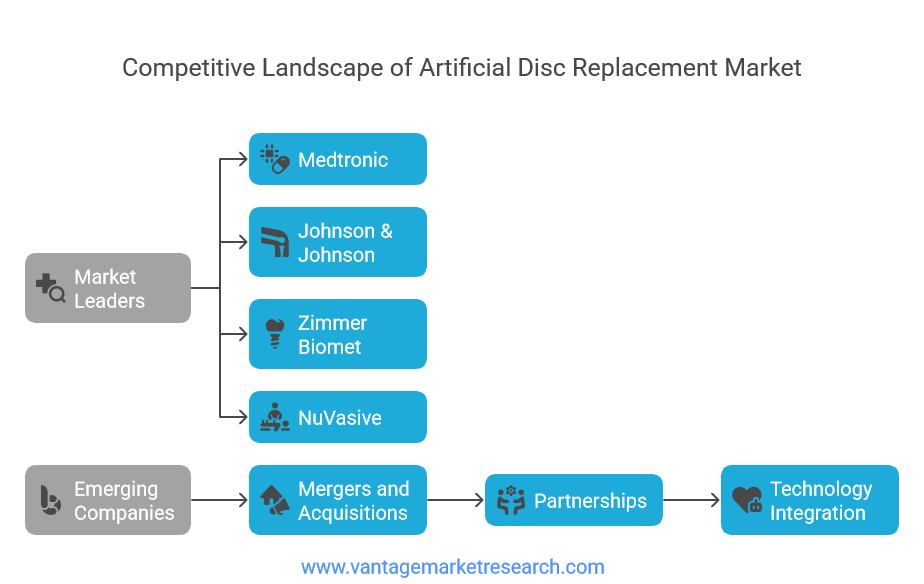

The artificial disc replacement market features a competitive landscape dominated by established medical device manufacturers with extensive orthopedic and spinal implant portfolios, alongside specialized companies focused exclusively on motion-preservation technologies. Market leaders leverage their existing surgeon relationships, distribution networks, and research capabilities to maintain competitive positioning while investing heavily in next-generation product development and clinical research initiatives.

Medtronic stands as a prominent market leader, offering comprehensive artificial disc replacement solutions including the Prestige LP Cervical Disc and Bryan Cervical Disc systems. The company's market position benefits from extensive clinical data, broad surgeon adoption, and strong international distribution capabilities. Medtronic's strategic approach emphasizes continuous product innovation, with significant investments in advanced materials research and surgical instrumentation development. Their comprehensive spine portfolio allows for integrated treatment approaches that combine artificial disc replacement with other spinal technologies when appropriate.

Johnson & Johnson's DePuy Synthes division represents another major market participant, leveraging the company's extensive orthopedic expertise and global reach. Their Charite artificial disc system was among the first FDA-approved lumbar disc replacements in the United States, providing valuable market experience and clinical data. The company's competitive strategy focuses on surgeon education, clinical research, and strategic partnerships with leading spine centers to drive adoption and market penetration.

Zimmer Biomet has established significant market presence through organic growth and strategic acquisitions, offering both cervical and lumbar artificial disc solutions. The company's competitive advantage lies in comprehensive spine portfolios that enable surgeons to address various spinal pathologies using integrated treatment approaches. Their focus on surgeon training programs and clinical research initiatives helps maintain strong relationships with key opinion leaders in the spine surgery community.

NuVasive represents a dynamic player in the artificial disc replacement market, known for innovative surgical approaches and advanced procedural technologies. The company's focus on minimally invasive spine surgery aligns well with artificial disc replacement procedures, creating synergies that benefit both surgeons and patients. NuVasive's competitive strategy emphasizes technology integration, including navigation systems and surgical robotics that enhance procedural precision and outcomes.

Emerging companies and specialized manufacturers continue to enter the market with innovative technologies and differentiated product offerings. These companies often focus on specific market segments or technological approaches, such as patient-specific implants, advanced bearing surfaces, or novel surgical techniques. While smaller in market share, these companies drive innovation and competition that benefits the overall market through technological advancement and competitive pricing pressure.

Strategic initiatives within the competitive landscape include extensive merger and acquisition activity as larger companies seek to expand their artificial disc replacement portfolios and market presence. Recent acquisitions focus on acquiring innovative technologies, expanding geographic reach, and integrating complementary product lines. Partnership agreements between device manufacturers and healthcare systems create opportunities for collaborative research, surgeon training, and market development initiatives that advance the overall field.

The competitive landscape also features increasing collaboration between device manufacturers and technology companies developing surgical robotics, navigation systems, and artificial intelligence applications for spine surgery. These partnerships aim to integrate artificial disc replacement procedures with advanced surgical technologies that improve precision, reduce complications, and enhance patient outcomes.

Challenges Affecting Market Expansion

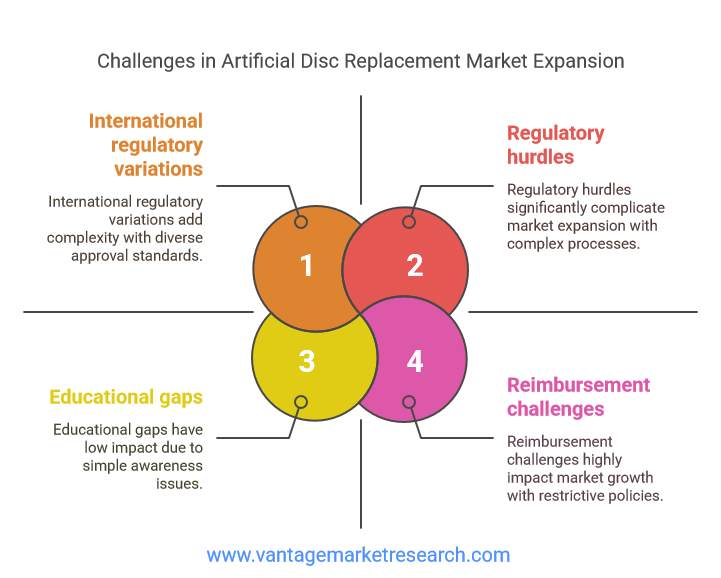

Regulatory hurdles present significant challenges for artificial disc replacement market expansion, with complex approval processes that require extensive clinical data demonstrating safety and efficacy over extended time periods. The FDA's rigorous premarket approval process for Class III medical devices necessitates comprehensive clinical trials comparing artificial disc replacement outcomes to established treatments like spinal fusion. These studies typically require multi-year follow-up periods to demonstrate long-term safety and effectiveness, creating substantial time and cost barriers for market entry of innovative technologies.

International regulatory variations further complicate market expansion efforts, as manufacturers must navigate different approval requirements, clinical trial standards, and post-market surveillance obligations across various countries and regions. European CE marking processes, while generally faster than FDA approval, still require comprehensive clinical evidence and ongoing quality management systems. Emerging markets often lack established regulatory frameworks for complex spinal implants, creating uncertainty and delays for companies seeking to expand into these high-growth regions.

Reimbursement challenges significantly impact market growth, as many healthcare systems and insurance providers maintain restrictive coverage policies for artificial disc replacement procedures. Despite growing clinical evidence supporting superior outcomes compared to spinal fusion, many payers continue to view artificial disc replacement as experimental or investigational, limiting patient access and surgeon adoption. The higher upfront costs of artificial disc implants compared to fusion hardware create additional reimbursement barriers, even when long-term cost-effectiveness data supports artificial disc replacement.

Educational gaps among both patients and surgeons limit market expansion potential, as many individuals remain unaware of artificial disc replacement as a treatment option for degenerative disc disease. Patient education challenges include limited public awareness campaigns, complex medical terminology, and insufficient information available through primary care physicians who often represent the first point of contact for individuals experiencing back pain. Many patients learn about artificial disc replacement only after consulting spine specialists, potentially missing opportunities for earlier intervention when outcomes may be more favorable.

Surgeon education represents an equally significant challenge, as artificial disc replacement procedures require specialized training, experience, and ongoing skill development that differs substantially from traditional spinal fusion techniques. Many spine surgeons completed their training before artificial disc replacement became widely available, necessitating additional education and certification programs. The learning curve associated with artificial disc replacement procedures can deter surgeons from adopting these technologies, particularly in regions with limited training opportunities or case volumes.

The COVID-19 pandemic created substantial disruptions to elective surgical procedures, including artificial disc replacement surgeries, resulting in procedure deferrals, reduced hospital capacity, and altered patient care patterns. While pandemic-related impacts have largely subsided, the experience highlighted healthcare system vulnerabilities and accelerated changes in surgical care delivery models that continue to influence market dynamics. Patient hesitancy regarding elective procedures, changes in healthcare utilization patterns, and ongoing staffing challenges in many healthcare systems continue to impact market growth.

Long-term outcome data limitations present ongoing challenges for market acceptance, as artificial disc replacement represents a relatively newer technology compared to spinal fusion procedures with decades of clinical experience. While available data generally supports favorable outcomes, questions regarding implant longevity, revision surgery rates, and patient selection criteria continue to influence surgeon and patient decision-making processes.

Future Trends and Innovations

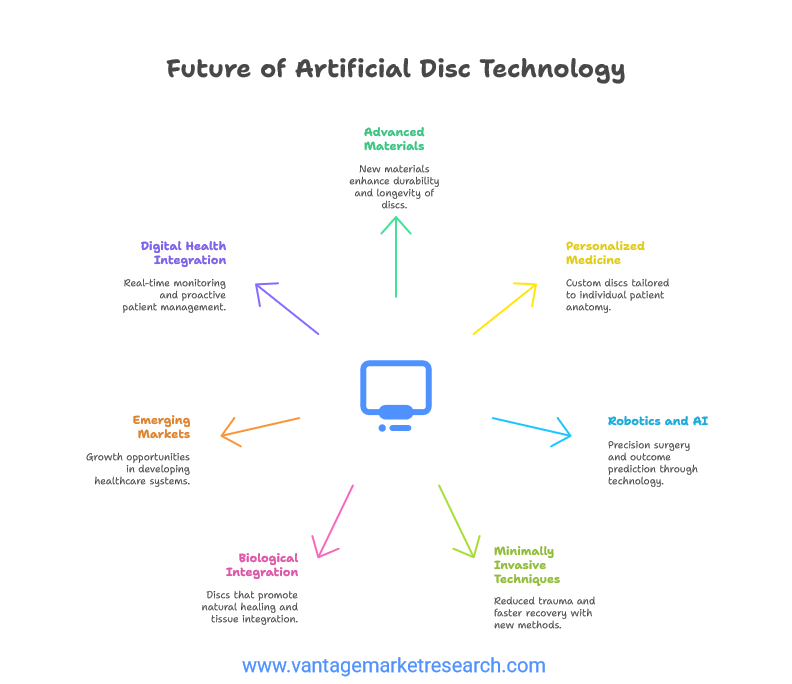

The evolution of artificial disc technologies promises to revolutionize spinal care through advanced materials science, improved surgical techniques, and integration with emerging medical technologies. Next-generation artificial discs incorporate breakthrough materials including ultra-high molecular weight polyethylene, advanced ceramic composites, and bioactive coatings that promote bone integration while maintaining optimal wear characteristics. These material innovations address historical concerns about implant durability and longevity, potentially expanding artificial disc replacement to younger patients and more active individuals who previously may not have been considered ideal candidates.

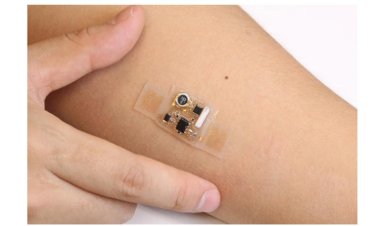

Personalized medicine approaches are transforming artificial disc replacement through patient-specific implant design and surgical planning technologies. Advanced imaging techniques, including high-resolution CT and MRI, combined with computer modeling and 3D printing capabilities, enable the creation of custom artificial discs tailored to individual patient anatomy. This personalization extends beyond implant dimensions to include optimized bearing surfaces, specific biomechanical properties, and integrated sensors that monitor implant performance and patient outcomes over time.

The integration of robotics and artificial intelligence represents perhaps the most significant technological advancement affecting artificial disc replacement procedures. Robotic surgical systems provide enhanced precision during implant positioning, reducing the risk of complications and improving long-term outcomes. AI-powered surgical planning systems analyze patient imaging data to optimize implant selection, predict surgical outcomes, and identify potential complications before they occur. These technologies promise to standardize surgical excellence and expand access to artificial disc replacement by reducing the technical demands on surgeons.

Minimally invasive surgical techniques continue to evolve, with focus shifting toward outpatient artificial disc replacement procedures that reduce healthcare costs while improving patient satisfaction. Advanced surgical approaches, including endoscopic and percutaneous techniques, minimize tissue trauma and accelerate recovery times. Same-day discharge protocols for selected patients represent a significant advancement in surgical care delivery, making artificial disc replacement more accessible and cost-effective.

Biological integration technologies are emerging as a crucial innovation area, with researchers developing artificial discs that promote natural healing and integration with surrounding tissues. Bioactive coatings, stem cell therapies, and tissue engineering approaches aim to create hybrid biological-artificial disc systems that combine the durability of engineered materials with the regenerative capacity of natural tissues. These technologies may eventually lead to artificial discs that actually improve over time rather than simply maintaining their initial performance characteristics.

Emerging markets represent substantial growth opportunities as healthcare infrastructure develops and patient populations gain access to advanced spinal care technologies. Countries in Asia-Pacific, Latin America, and Africa are investing heavily in healthcare modernization, creating opportunities for artificial disc replacement market expansion. Local manufacturing partnerships, surgeon training initiatives, and technology transfer programs will likely accelerate adoption in these high-growth regions.

Digital health integration is transforming post-surgical monitoring and long-term patient management through connected artificial disc systems that provide real-time data on implant performance, patient activity levels, and potential complications. These smart implant technologies enable proactive patient management, early intervention for potential problems, and optimization of rehabilitation protocols based on objective performance data.

FAQs

- What factors are driving the growth of the Artificial Disc Replacement Market?

- How is the market for Artificial Disc Replacement expected to evolve by 2030?

- What is the significance of a CAGR of 12.3% in the context of the Artificial Disc Replacement Market?

- What are the implications of the projected increase in the market value of Artificial Disc Replacement?