Global Chronic Obstructive Pulmonary Disease (COPD) Treatment Market Size, Share, Report 2032

The global chronic obstructive pulmonary disease (COPD) treatment market is valued at USD 18.2 billion in 2023 and is projected to reach USD 28.4 billion by 2032, representing a CAGR (compound annual growth rate) of 4.9% between 2024 and 2032. The market is driven by four key factors: an aging population, rising pollution levels, the prevalence of smoking, and increasing healthcare awareness.

The most important takeaways

- In 2023, the chronic obstructive pulmonary disease market was led by North America.

- In terms of regional growth, the Asia-Pacific market is expected to expand at the fastest rate during the forecast period of 2023 to 2032.

- In terms of disease type, the chronic bronchitis segment was the market leader in 2024.

- In terms of treatment type, the drugs segment accounted for the largest share of the market in 2024.

- The oxygen therapy segment is projected to experience the most rapid growth in the forecast period between 2023 and 2032.

- In terms of end-user, the hospital and clinics segment were the dominant force in the market in 2024.

Analysts at Vantage Market Research estimate the Global Chronic Obstructive Pulmonary Disease (COPD) Market Size at USD 18.2 million in 2023, with a projected growth to USD 28.4 million by 2032. This represents a compound annual growth rate (CAGR) of 4.9% between 2024 and 2032. The market is driven by four key factors: an aging population, advances in treatment options, rising air pollution, and increasing patient awareness regarding early diagnosis and care.

Market Overview

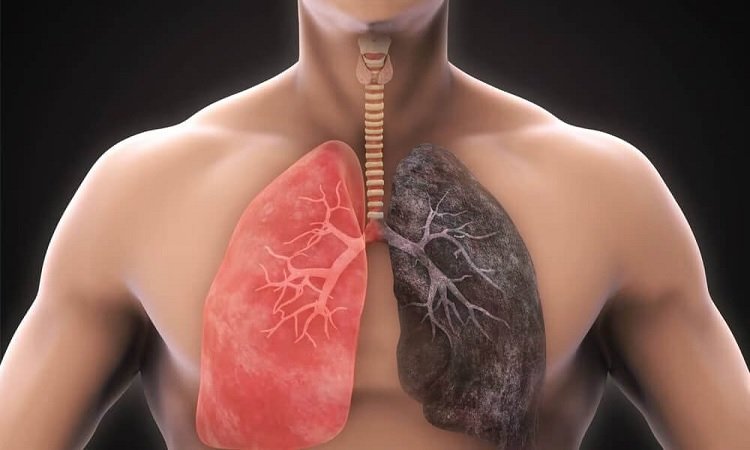

Chronic obstructive pulmonary disease (COPD) is a long-term respiratory condition that presents with breathing difficulties, coughing, wheezing, and other symptoms. The disease is frequently precipitated by prolonged exposure to irritants such as cigarette smoke, air pollution, and dust. The World Health Organization (WHO) reports that COPD is currently the third leading cause of death worldwide and is projected to become the fifth leading cause of death by 2030. The prevalence of COPD is on the rise globally, particularly in developing countries with high smoking rates, and air pollution represents a significant challenge.

The growing collaboration between key players in the chronic obstructive pulmonary disease (COPD) market is reshaping the research, development, and patient care environment. Pharmaceutical companies, healthcare providers, and research institutions are establishing strategic partnerships to capitalize on their collective expertise and resources. These collaborations facilitate the exchange of knowledge and best practices, driving innovation in treatment options and accelerating the development of new therapies.

AstraZeneca is pleased to announce the commencement of THARROS, a Phase III clinical trial investigating the potential of Breztri to enhance cardiopulmonary outcomes in individuals diagnosed with COPD.

- In March 2024, AstraZeneca announced the launch of a Phase III trial to explore the potential impact of its inhaled triple combination therapy, Breztri/Trixeo Aerosphere (budesonide/glycopyrron the objective is to evaluate the impact of BGF (formoterol fumarate orium/formoterol fumarate) on serious cardiopulmonary outcomes, including mortality, in individuals with COPD who are at an elevated risk of cardiopulmonary complications, irrespective of their history of exacerbations.

The following are the key findings from the report.

- In 2023, North America held a dominant position in the market, accounting for 38.60% of the total share. In the region, the market is driven by the presence of major pharmaceutical companies engaged in research and development of innovative drugs and devices for the treatment of COPD.

- Bronchodilators represent 32.60% of the market share within the drug class. The prevalence and severity of symptoms among COPD populations have positioned bronchodilators as a primary therapeutic option.

- The inhalation segment dominates the market based on route of administration, with a market share of 51.30%. Inhaled therapies offer a significant advantage over oral medications due to their ability to bypass the digestive system, resulting in a much faster onset of therapeutic effects.

- Based on distribution channel, the wearable segment is the market leader with a market share of 36.20%.

The most successful companies.

- Astrazeneca

- alkem

- Mylan NV

- Novartis ag

- Hoffman-La Roche Ltd.

- Genentech Inc.

- Theravance Biopharma

- Sunovion Pharmacologic Inc. (Sunovion Drugs Inc.)

- Sanofi

- Verona Pharmacy

Coverage Report

Our market research reports provide comprehensive insights that are essential for strategic decision-making. Our reports provide comprehensive insights into all key aspects of the market, including an analysis of the market dynamics, such as drivers, restraints, opportunities, and challenges, along with the latest industry trends. Our analysis includes an in-depth technology roadmap, product life cycle assessment, and PESTLE analysis, ensuring a comprehensive understanding of the market environment. Furthermore, we assess GDP growth prospects, examine regional market landscapes, and evaluate the impact of major events such as the global pandemic caused by the SARS-CoV-2 virus. Furthermore, our reports present a comprehensive competitive landscape, including market shares and company profiles, to provide actionable insights that can enhance your business strategies.

Latest news

- The US Food and Drug Administration has approved Dupixent as the first biologic drug for patients with COPD.

- In September 2024, the U.S. Food and Drug Administration (FDA) approved Dupixent (dupilumab) as a maintenance therapy for adults with poorly controlled chronic obstructive pulmonary disease (COPD) who have an eosinophilic phenotype. This makes Dupixent the first biologic medication to be approved in the United States for use in this patient population.

Market Segmentation:

By Drug Class

- Bronchodilators

- Beta 2- Agonists

- Anticholinergics

- Theophylines

- Phosphodiesterase Type 4 Inhibitors

- Corticosteroids

- Others

By Route of Administration

- Oral

- Inhalation

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Regional Segmentation:

North America

- United States

- Canada

- Mexico

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

Below, you will find answers to some of the most frequently asked questions.

Q. What is the current size of the market for treatments for chronic obstructive pulmonary disease (COPD)?

- The global market for chronic obstructive pulmonary disease (COPD) treatments is projected to reach USD 28.4 billion by 2032, up from USD 18.2 billion in 2023.

Q.What will be the compound annual growth rate (CAGR) of the global COPD treatment market?

- The global market for chronic obstructive pulmonary disease (COPD) treatments is projected to grow at a rate of 4.9% between 2024 and 2032.

Q.Which companies are the most prominent players in the COPD treatment market?

- The leading companies in the chronic obstructive pulmonary disease (COPD) treatment market include Astrazeneca, Alkem, Mylan N.V., Novartis AG, F. Hoffman-La Roche Ltd., Genentech Inc., Theravance Biopharma, Sunovion Pharmaceuticals Inc., Sanofi, Verona Pharmaceuticals, and others.

Q.Which factors are driving the COPD treatment market?

- The driving forces behind the treatment market for chronic obstructive pulmonary disease (COPD) are the rising rates of COPD, advances in treatment options, rising healthcare spending, and government initiatives and technological developments.

Q.Which region will lead the global COPD treatment market?

- The North American region is expected to spearhead the global chronic obstructive pulmonary disease (COPD) treatment market during the forecast period of 2023 to 2032.