Investment Opportunities in the Glaucoma Surgery Devices Market: What Investors Need to Know

Explore lucrative investment opportunities in the rapidly growing Glaucoma Surgery Devices Market. Discover key drivers, market forecasts, emerging technologies, and insights investors need to make informed decisions in this high-potential healthcare segment.

Introduction

The global glaucoma surgery devices market is experiencing a significant transformation, driven by technological advancements, demographic shifts, increasing prevalence of glaucoma, and rising healthcare awareness. With the number of people affected by glaucoma projected to exceed 110 million by 2040, the demand for innovative, efficient, and accessible surgical devices is surging. This growing demand, combined with the integration of cutting-edge technologies like artificial intelligence (AI) and minimally invasive surgical techniques, is opening up substantial investment opportunities in this market.

For investors looking to diversify their portfolios in the medical technology or ophthalmology space, the glaucoma surgery devices market presents a promising and high-growth segment. This blog explores key investment drivers, current trends, technological developments, regional opportunities, and essential considerations for stakeholders.

Understanding the Glaucoma Surgery Devices Market

What Are Glaucoma Surgery Devices?

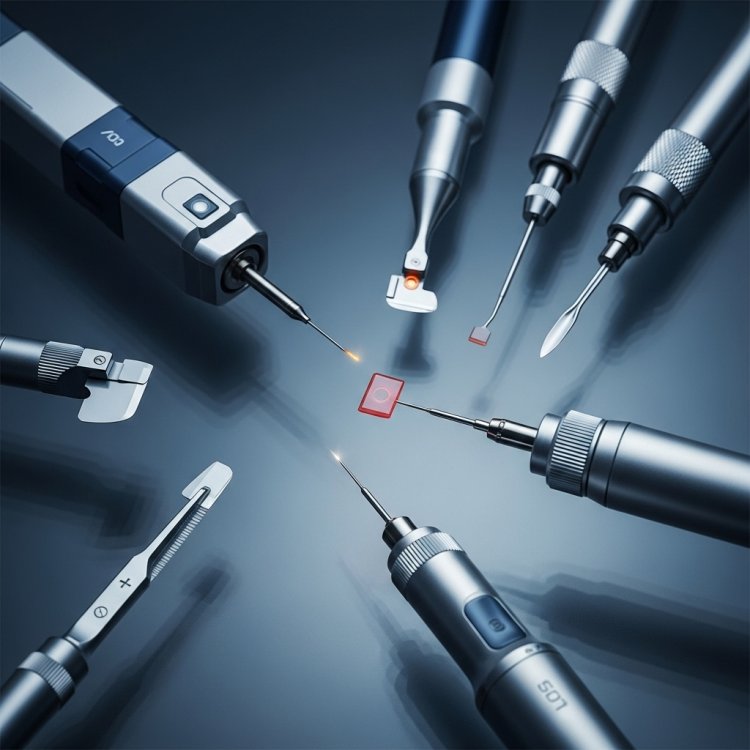

Glaucoma surgery devices are medical tools used in procedures to relieve intraocular pressure (IOP) in patients with glaucoma. These devices include:

- Drainage implants

- Trabeculectomy tools

- Minimally Invasive Glaucoma Surgery (MIGS) devices

Among these, MIGS devices have emerged as a game-changer in recent years due to their lower complication rates, shorter recovery periods, and compatibility with cataract surgery.

Why Now Is the Time to Invest

- Aging Global Population

Glaucoma incidence is closely linked to age. As the global population ages rapidly, especially in developed nations such as the U.S., Japan, and Germany, the number of patients requiring surgical intervention is set to climb sharply.

- Increasing Prevalence of Glaucoma

An estimated 80 million people were affected by glaucoma in 2020, and this figure is expected to rise dramatically due to aging, genetic predispositions, and rising incidence of diabetes. The escalating burden is creating strong demand for reliable, long-term surgical solutions.

- Technological Advancements

Tech-driven innovation is a central growth driver. Companies are developing smart implants, AI-enabled diagnostics, and robotic surgical assistance tools, creating new avenues for growth and differentiation in a competitive landscape.

- Strong Pipeline and R&D Investment

Large players and emerging startups alike are investing in research and development. With several next-gen MIGS devices in the pipeline, the market is poised for a wave of innovation over the next 5–7 years.

- Supportive Reimbursement and Regulatory Landscape

Government initiatives and insurance support for glaucoma surgeries in regions such as North America and Europe are creating a favorable reimbursement landscape that encourages both providers and patients to adopt new devices.

Key Segments Worth Watching

- MIGS (Minimally Invasive Glaucoma Surgery) Devices

MIGS devices are among the fastest-growing segments. Designed to reduce IOP with minimal tissue disruption, these devices are especially appealing to elderly patients who may be unable to withstand invasive procedures.

Notable Products:

- iStent Inject® W (Glaukos)

- XEN® Gel Stent (Allergan/AbbVie)

- Hydrus® Microstent (Ivantis/Alcon)

- Smart Glaucoma Implants

These are sensor-enabled implants capable of providing real-time data on intraocular pressure, alerting clinicians to complications and aiding in remote patient monitoring. Their integration with teleophthalmology platforms is an attractive future opportunity.

- AI-Powered Diagnostics & Surgical Planning Tools

AI is transforming glaucoma management by enhancing early detection, improving treatment outcomes, and enabling surgical precision. Startups focusing on AI-augmented tools present unique investment opportunities.

Regional Market Insights

North America

- Dominates the global market

- Driven by a high aging population, strong reimbursement policies, and early adoption of innovative technologies

- Home to major players such as Alcon and Glaukos

Europe

- Germany, UK, and France are key markets

- Advanced healthcare infrastructure and proactive R&D investment

- Harmonized EU regulations provide market predictability

Asia Pacific

- Fastest-growing region

- Countries like China and India witnessing an increase in glaucoma prevalence

- Increasing healthcare expenditure and government focus on vision health

- High-volume market for affordable surgical solutions

Latin America & Middle East

- Underpenetrated but emerging as high-potential regions

- Strategic alliances with local healthcare providers can open doors for market entry

Key Players and Competitive Landscape

Leading Companies:

- Glaukos Corporation – Pioneer in MIGS devices

- Alcon Inc. – Diversified ophthalmic solutions

- AbbVie (Allergan) – Strong portfolio and R&D capabilities

- New World Medical – Trabecular bypass devices

- Nova Eye Medical – Focused on laser technologies and MIGS

Investment Activity:

- M&A activity is on the rise

- Venture capital funding is pouring into AI-based ophthalmology startups

- Strategic partnerships between medtech firms and academic institutions are catalyzing innovation

Emerging Startups to Watch

- iSTAR Medical

Developer of MINIject, a biocompatible MIGS device with long-term IOP reduction benefits.

- Eyenuk

AI-based diagnostic tools for glaucoma and diabetic retinopathy detection.

- Innovega

Augmented reality-enabled smart contact lenses with future potential for glaucoma monitoring.

Key Considerations for Investors

- Regulatory Risk

Glaucoma surgery devices are classified as high-risk medical devices. Investors must evaluate how companies navigate complex regulatory pathways (FDA, CE, etc.).

- Reimbursement Coverage

The ability of a device to gain inclusion under insurance and Medicare is vital for market penetration. Examine reimbursement strategies before investing.

- Intellectual Property (IP) Strength

Strong IP positions offer a competitive moat. Review patent portfolios and licensing agreements to assess IP defensibility.

- Clinical Trial Data

A robust pipeline must be supported by strong clinical evidence. Assess efficacy, safety, and comparative data for FDA/EMA-approved or investigational devices.

- Exit Strategy and Liquidity

Consider potential exit strategies:

- IPOs

- Strategic acquisitions

- Licensing deals with major players

A clear path to liquidity is essential for venture capital and private equity investors.

Future Outlook and Trends

Personalized Glaucoma Treatment

Data-driven platforms are enabling customized treatment strategies based on a patient’s genetic and physiological profile, enhancing surgical success and patient satisfaction.

Robotics and Image-Guided Surgery

Integration of robotic systems and augmented reality imaging is on the horizon, especially in premium healthcare markets.

Teleophthalmology and Remote Monitoring

Post-operative care and intraocular pressure monitoring via connected devices is emerging as a promising niche for startups and investors.

Sustainability and ESG Investing

Sustainable device design and ethical medical practices are gaining attention. ESG-compliant startups may gain favor with institutional investors.

How to Approach Investment in This Market

- Venture Capital & Angel Investment

Ideal for early-stage AI diagnostics, wearable sensors, and smart implants. Focus on clinical viability, IP, and scalability.

- Private Equity

Mid-sized firms developing scalable MIGS solutions are ideal targets for PE investment and expansion funding.

- Public Markets

Established players like Alcon and Glaukos offer stable returns with upside potential as the market expands.

- Strategic Partnerships

Investors can explore co-development, licensing, or technology commercialization with academic institutions or medtech incubators.

Conclusion

The glaucoma surgery devices market is poised for sustained growth and technological disruption. Investors who understand the complex interplay of demographics, innovation, regulation, and clinical demand will find significant value creation opportunities in this space.

Whether through venture capital, private equity, or public market investments, the market offers a range of entry points with strong future potential. From smart implants to AI-powered diagnostics and MIGS innovations, the glaucoma surgery devices sector is evolving into a high-tech, high-impact arena.