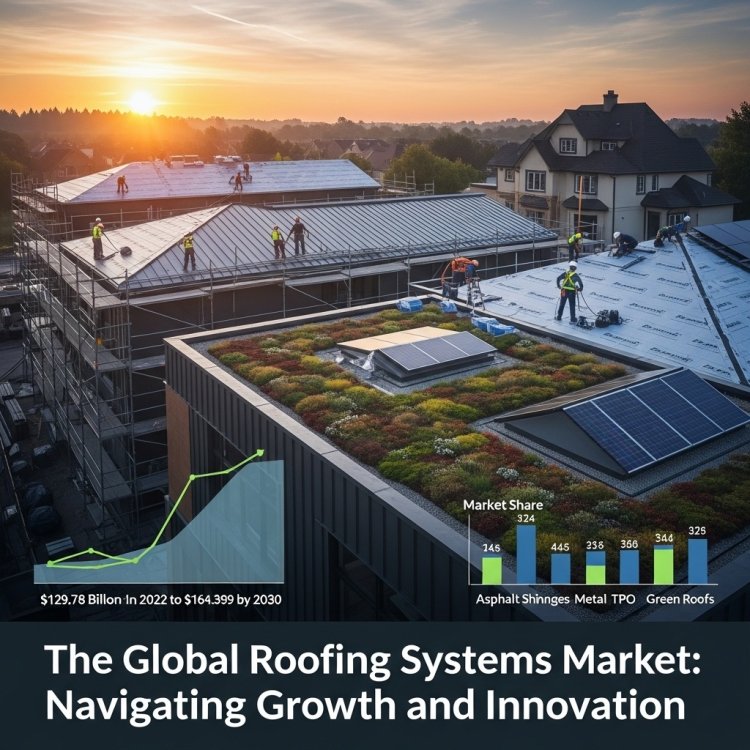

Roofing Systems Market Size, Trends & Forecast 2023-2030 | $164.39B by 2030

Global Roofing Systems Market analysis revealing USD 129.78 Billion valuation in 2022, projected to reach USD 164.39 Billion by 2030 at 3% CAGR. Comprehensive insights on trends, regional markets, key players & growth drivers.

The roofing systems industry represents a fundamental cornerstone of global construction and infrastructure development, encompassing an extensive array of materials, technologies, and installation methods designed to protect buildings from environmental elements while enhancing structural integrity and energy efficiency. As urbanization accelerates worldwide and climate considerations become increasingly paramount, the roofing systems market has evolved into a sophisticated sector that balances traditional craftsmanship with cutting-edge innovation, sustainable practices, and advanced material science.

According to analysts at Vantage Market Research, the Global Roofing Systems market is valued at USD 129.78 Billion in 2022 and is projected to attain a value of USD 164.39 Billion by 2030 at a CAGR of 3.00% during the forecast period, 2023–2030. This substantial market valuation reflects the critical role that roofing systems play in both residential and commercial construction sectors, as well as the ongoing transformation driven by technological advancement and environmental consciousness.

The Roofing Systems Market encompasses a comprehensive ecosystem of products, services, and technologies that collectively serve to protect buildings from weather elements while providing insulation, structural support, and aesthetic appeal. This dynamic industry has undergone remarkable transformation over recent decades, evolving from traditional materials and methods to incorporate advanced composites, smart technologies, and sustainable solutions that address contemporary challenges in construction and environmental stewardship.

Modern roofing systems extend far beyond simple weather protection, incorporating sophisticated features such as solar energy integration, advanced thermal management, and intelligent monitoring systems that optimize building performance. The industry's evolution reflects broader trends in construction technology, sustainability initiatives, and changing consumer preferences that prioritize long-term value, energy efficiency, and environmental responsibility. As climate patterns become more extreme and energy costs continue to rise, the importance of advanced roofing systems in building performance and occupant comfort has never been more pronounced.

The convergence of multiple factors including rapid urbanization, infrastructure modernization, and increasing awareness of energy conservation has created unprecedented opportunities for innovation within the roofing systems sector. Manufacturers are investing heavily in research and development to create products that not only meet basic protective requirements but also contribute to building energy efficiency, reduce urban heat island effects, and support renewable energy generation. This multifaceted approach to roofing system development has transformed what was once a purely functional building component into a strategic element of sustainable construction and smart building design.

Our comprehensive Roofing Systems Market report is ready with the latest trends, growth opportunities, and strategic analysis. View Sample Report PDF.

Premium Insights

The global roofing systems market represents a mature yet dynamically evolving industry characterized by steady growth, technological innovation, and increasing emphasis on sustainability and energy efficiency. The market encompasses diverse product categories ranging from traditional materials such as asphalt shingles and clay tiles to advanced solutions including solar-integrated systems, green roofing technologies, and high-performance synthetic materials that offer superior durability and environmental benefits.

Market dynamics are influenced by multiple factors including construction industry trends, regulatory requirements for energy efficiency, climate considerations, and evolving consumer preferences for sustainable building solutions. The industry serves both new construction and replacement markets, with the latter representing a significant portion of demand driven by aging building stock, weather-related damage, and proactive maintenance requirements. Regional variations in climate, building codes, and construction practices create distinct market characteristics across different geographic areas, necessitating tailored product offerings and marketing strategies.

The competitive landscape of the roofing systems market features a mix of global corporations with extensive product portfolios and regional specialists focused on specific materials or market segments. Major players including Atlas Roofing Corporation, CSR Limited, Carlisle Companies Incorporated, Berkshire Hathaway, Inc., The Siam Cement Public Company Limited and Owens Corning dominate market share through comprehensive product lines, strong distribution networks, and continuous innovation. These industry leaders are complemented by numerous smaller companies that contribute to market diversity through specialized products, local expertise, and innovative solutions targeting specific customer needs.

The roofing systems market is experiencing transformative trends that are reshaping industry dynamics and creating new opportunities for growth and innovation. Energy efficiency has emerged as a paramount consideration, with increasing demand for roofing materials that reduce energy consumption and carbon footprints. This trend is reinforced by government incentives and regulations promoting green buildings, which have accelerated adoption of cool roofing technologies, reflective coatings, and solar-integrated systems that contribute to building energy performance.

Technological advancement continues to drive product innovation, with manufacturers developing materials that offer enhanced durability, improved installation efficiency, and superior performance characteristics. The integration of smart technologies into roofing systems represents an emerging trend, with sensors and monitoring systems providing real-time data on roof condition, moisture levels, and thermal performance. These technological innovations enable predictive maintenance, extend roof lifespan, and optimize building management strategies.

Sustainability considerations are fundamentally reshaping product development and material selection within the roofing industry. Manufacturers are increasingly focusing on recyclable materials, reduced environmental impact during production, and end-of-life disposal considerations. The growing popularity of green roofing systems, which incorporate vegetation and contribute to urban biodiversity, reflects broader environmental consciousness among consumers and regulatory bodies. Additionally, the trend toward solar panel installations has created synergies between roofing and renewable energy sectors, with integrated photovoltaic roofing systems gaining market traction.

The roofing systems market demonstrates robust growth potential driven by sustained construction activity, infrastructure development, and increasing emphasis on building performance optimization. According to Vantage Market Research analysis, the market's progression from USD 129.78 Billion in 2022 to a projected USD 164.39 Billion by 2030 represents a compound annual growth rate of 3.00%, reflecting steady expansion aligned with global construction trends and economic development patterns.

The market's expansion is underpinned by several structural factors including global population growth, urbanization trends, and the ongoing need for infrastructure modernization in both developed and emerging economies. Residential construction continues to represent the largest application segment, accounting for approximately 56.2% of global revenue, driven by housing demand, single-family home preferences, and renovation activities. The non-residential sector, encompassing commercial, industrial, and institutional buildings, provides additional growth momentum through new construction projects and mandatory roof replacement cycles.

For Roofing Systems Market Research Report and updates detailed: View Full Report Now!

Market Concentration & Characteristics

The roofing systems market exhibits moderate to high concentration characteristics, with leading manufacturers commanding significant market share through extensive product portfolios, established distribution networks, and strong brand recognition. The industry structure reflects a combination of global consolidation trends and persistent regional fragmentation, creating a complex competitive landscape where scale advantages coexist with opportunities for specialized players.

Market concentration varies significantly across product categories and geographic regions, with certain segments such as commercial roofing systems showing higher concentration due to technical complexity and capital requirements. The residential roofing market demonstrates greater fragmentation, with numerous regional and local manufacturers competing alongside global brands. This structural diversity reflects varying customer requirements, distribution channels, and technical specifications across different market segments.

The industry's characteristics include high capital intensity for manufacturing operations, significant research and development investments, and the critical importance of distribution networks and contractor relationships. Product differentiation occurs through material innovation, performance characteristics, warranty offerings, and brand reputation, with manufacturers continuously seeking competitive advantages through technological advancement and service enhancement. The market's cyclical nature, influenced by construction industry trends and economic conditions, creates both opportunities and challenges for market participants.

Type Product Insights:

The roofing systems market encompasses diverse product categories, each offering distinct characteristics, performance attributes, and application suitability. Concrete and clay tiles represent the largest product segment, accounting for 30.6% of market revenue, driven by superior aesthetics, exceptional durability, and recyclability benefits. These traditional materials continue to dominate in regions with Mediterranean climates and areas where architectural aesthetics prioritize classic roofing styles.

Asphalt shingles maintain strong market presence, particularly in North American residential markets, due to cost-effectiveness, ease of installation, and widespread contractor familiarity. The segment is projected to grow at a CAGR of 3.9% in volume terms, supported by continuous product improvements including enhanced wind resistance, extended warranties, and improved aesthetic options. Manufacturers are developing premium asphalt shingle lines that incorporate advanced granule technology, improved adhesion systems, and enhanced color retention to compete with higher-end roofing materials.

Metal roofing systems represent the fastest-growing product category, anticipated to achieve the highest revenue CAGR through 2030. The segment's expansion reflects multiple advantages including exceptional longevity, energy efficiency through reflective properties, lightweight construction reducing structural requirements, and versatility in design applications. Metal roofing's ability to accommodate various architectural styles through diverse profile options, color selections, and coating technologies has broadened market appeal beyond traditional industrial applications to residential and commercial sectors.

Emerging product categories including solar-integrated roofing systems, green roofing solutions, and advanced synthetic materials are gaining market traction as sustainability considerations and technological innovation reshape product preferences. TPO (Thermoplastic Polyolefin) roofing membranes, valued at USD 3.2 billion globally in 2023, exemplify specialized product segments experiencing rapid growth driven by specific performance requirements in commercial applications. These innovative products address evolving market needs for energy efficiency, environmental sustainability, and enhanced building performance.

Type Application Insights:

Application segmentation within the roofing systems market reveals distinct patterns of demand, product preferences, and growth dynamics across residential, commercial, and industrial sectors. Each application category presents unique requirements regarding performance specifications, installation methods, and lifecycle considerations that influence product selection and market development strategies.

The residential application segment dominates market revenue, driven by substantial housing stock requiring periodic replacement, new construction activity, and increasing consumer investment in home improvement. Residential roofing decisions typically prioritize aesthetic appeal, cost-effectiveness, and warranty coverage, with homeowners increasingly considering energy efficiency and environmental impact. The segment benefits from demographic trends including household formation, geographic mobility, and the aging of existing housing stock requiring roof replacement.

Commercial applications encompass diverse building types including office complexes, retail centers, hospitality facilities, and institutional structures, each presenting specific roofing requirements. Commercial roofing systems emphasize durability, minimal maintenance requirements, and compliance with building codes and energy standards. The segment increasingly adopts advanced roofing technologies including cool roof systems, green roofing solutions, and integrated photovoltaic systems that contribute to building certification programs and corporate sustainability objectives.

Industrial applications require specialized roofing solutions capable of withstanding harsh environmental conditions, supporting equipment loads, and accommodating specific operational requirements. Industrial facilities prioritize functional performance over aesthetic considerations, with emphasis on chemical resistance, thermal management, and structural integrity. The segment's growth correlates with manufacturing sector expansion, warehouse construction driven by e-commerce growth, and infrastructure modernization initiatives.

Type End-Use Insights:

End-use analysis reveals nuanced demand patterns across different customer categories and decision-making processes that influence product selection, purchasing behavior, and market dynamics. Understanding end-user requirements and preferences is essential for manufacturers developing targeted product offerings and marketing strategies.

New construction represents a fundamental demand driver, with roofing systems specified during design phases based on architectural requirements, building codes, and performance specifications. This segment offers opportunities for premium products and integrated systems that optimize building performance from initial construction. New construction demand correlates with economic growth, population expansion, and urbanization trends, creating predictable patterns of market opportunity aligned with construction cycles.

The reroofing and replacement market constitutes a substantial portion of industry demand, driven by aging building stock, weather-related damage, and proactive maintenance strategies. This segment typically involves more immediate decision-making compared to new construction, with factors such as contractor availability, warranty considerations, and cost-benefit analysis influencing product selection. The replacement market benefits from relatively stable demand patterns less susceptible to economic fluctuations than new construction activity.

Repair and maintenance activities provide consistent demand for roofing materials and services, particularly in regions experiencing severe weather events or with aging infrastructure. This segment emphasizes rapid response capabilities, material availability, and contractor expertise in addressing specific roofing problems. The growing emphasis on preventive maintenance and asset management strategies has expanded opportunities for ongoing service relationships and predictive maintenance solutions.

Regional Insights

Geographic analysis of the roofing systems market reveals distinct regional characteristics influenced by climate conditions, construction practices, regulatory frameworks, and economic development patterns. Understanding regional dynamics is crucial for market participants developing expansion strategies and optimizing product portfolios for specific geographic markets.

The global roofing systems market demonstrates significant regional variation in growth rates, product preferences, and competitive dynamics. Asia-Pacific emerged as the most attractive market region, driven by rapid infrastructure development, construction activity expansion, and improving economic stability. The region's growth trajectory reflects massive urbanization trends, rising disposable incomes, and government infrastructure investments that create sustained demand for roofing systems across residential and commercial sectors.

Regional market characteristics are shaped by multiple factors including climate patterns that influence material selection, building traditions that affect aesthetic preferences, and regulatory requirements that mandate specific performance standards. Cultural factors also play significant roles in product adoption, with certain regions maintaining strong preferences for traditional materials while others readily embrace innovative solutions. Economic development levels influence market sophistication, with developed markets typically featuring higher adoption rates for premium products and advanced technologies.

North America in Roofing Systems Market Trends

North America represents a mature yet dynamic roofing systems market characterized by sophisticated demand patterns, established distribution networks, and continuous innovation in products and installation methods. The region benefits from substantial replacement demand driven by aging housing stock, severe weather events, and increasing consumer focus on energy efficiency and home value enhancement.

The United States roofing market, valued at USD 23.35 Billion in 2024 and expected to grow at a CAGR of 6.60%, demonstrates robust growth potential driven by residential renovation activity, commercial construction, and infrastructure modernization. Increasing consumer preference for luxurious buildings and rising disposable income support demand for premium roofing products and comprehensive system solutions. The market benefits from well-developed contractor networks, sophisticated distribution channels, and strong emphasis on product innovation and warranty protection.

Weather-related factors significantly influence North American roofing demand, with hurricane activity in southeastern states, hailstorms in central regions, and winter conditions in northern areas creating periodic replacement needs. Climate change considerations are reshaping product preferences, with increased adoption of impact-resistant materials, enhanced wind-resistance ratings, and improved thermal performance characteristics. Government incentives for energy-efficient construction and solar installations further stimulate market growth and product innovation.

Europe in Market Roofing Systems Trends

The European roofing systems market exhibits sophisticated characteristics reflecting stringent regulatory requirements, strong environmental consciousness, and diverse architectural traditions across member states. The market is expected to grow at a CAGR of 3.5% through 2030, driven by renovation of aging building stock, energy efficiency mandates, and sustainable construction initiatives.

Germany represents a major market within Europe, with government planning for continued construction activity recognizing the industry's importance to domestic economic stability. The German market emphasizes high-quality products, advanced installation techniques, and compliance with strict energy efficiency standards. Environmental regulations and green building certifications significantly influence product selection and market development strategies.

The United Kingdom roofing materials market is projected to grow at 4.0% CAGR, benefiting from favorable regulatory environments and continued construction activity. Brexit implications have created market adjustments, yet fundamental demand drivers remain strong supported by housing requirements and commercial development. European markets generally demonstrate strong preferences for durable materials, with clay and concrete tiles maintaining significant market share alongside growing adoption of metal roofing and integrated solar solutions.

Asia Pacific in Roofing Systems Market Trends

Asia-Pacific represents the fastest-growing regional market for roofing systems, driven by unprecedented urbanization, infrastructure development, and economic expansion across multiple countries. The region's diverse markets range from highly developed economies such as Japan to rapidly emerging markets including India and Southeast Asian nations, creating varied opportunities and challenges for market participants.

China's roofing materials market is expected to grow at 4.4% CAGR, propelled by continued urbanization, demographic shifts, and improving living standards. The Chinese market's scale and growth potential attract significant investment from global manufacturers while supporting domestic industry development. Government infrastructure initiatives, residential construction programs, and commercial development projects create sustained demand across multiple roofing system categories.

India's market expansion reflects massive infrastructure requirements, urban development programs, and government initiatives such as the Smart Cities Mission that incorporates energy-efficient roofing systems in government buildings. Southeast Asian markets benefit from rapid economic development, foreign investment in manufacturing facilities, and growing middle-class populations demanding improved housing quality. The region's tropical climate conditions create specific product requirements emphasizing weather resistance, thermal performance, and durability under extreme conditions.

Latin America in Roofing Systems Market Trends

Latin America contributes growing market share to global roofing systems demand, supported by economic development, urban expansion, and infrastructure modernization across key markets including Brazil, Mexico, and Argentina. The region's market dynamics reflect diverse economic conditions, varying construction practices, and distinct climate zones that influence product preferences and market development patterns.

Brazil's market leadership within Latin America reflects the country's economic scale, substantial construction sector, and ongoing infrastructure development programs. Residential construction driven by housing deficits and government programs creates consistent demand for cost-effective roofing solutions. Commercial and industrial development, particularly in major urban centers, supports adoption of advanced roofing technologies and premium products.

Market challenges in Latin America include economic volatility, currency fluctuations, and varying regulatory standards across countries. However, long-term growth prospects remain positive supported by demographic trends, urbanization pressures, and increasing focus on sustainable construction practices. The region's vulnerability to extreme weather events including hurricanes and heavy rainfall creates specific product requirements and replacement demand patterns.

Middle East & Africa in Roofing Systems Market Trends

The Middle East & Africa region presents diverse market opportunities characterized by substantial infrastructure investment in Gulf Cooperation Council (GCC) countries, emerging market development in Africa, and unique climate considerations requiring specialized roofing solutions. Saudi Arabia accounts for 17.9% of regional market share, driven by government spending on hospitals, leisure projects, and educational facilities.

GCC markets benefit from substantial government investment in construction projects, economic diversification initiatives, and preparation for major events that stimulate construction activity. The region's extreme climate conditions necessitate roofing systems capable of withstanding high temperatures, UV exposure, and occasional sandstorms. Growing emphasis on sustainable construction and energy efficiency drives adoption of cool roofing technologies and integrated solar solutions.

African markets demonstrate significant growth potential driven by urbanization, population growth, and infrastructure development needs. However, market development faces challenges including limited purchasing power, infrastructure constraints, and varying regulatory frameworks. Successful market strategies typically emphasize cost-effective solutions, local manufacturing or assembly operations, and products adapted to specific regional conditions.

Key Roofing Systems Company Insights

The competitive landscape of the roofing systems market features established global corporations with comprehensive product portfolios competing alongside specialized manufacturers focused on specific materials or market segments. Industry leaders maintain competitive advantages through technological innovation, extensive distribution networks, strong brand recognition, and comprehensive service offerings that extend beyond product supply to include technical support and warranty programs.

Market leaders invest substantially in research and development to advance product performance, develop sustainable solutions, and address evolving customer requirements. Innovation efforts focus on multiple areas including material science advancement, manufacturing process optimization, installation efficiency improvements, and integration of smart technologies. Companies increasingly emphasize sustainability throughout product lifecycles, from raw material sourcing through manufacturing processes to end-of-life recyclability.

Strategic initiatives among key players include geographic expansion through acquisitions and partnerships, vertical integration to control supply chains, and development of comprehensive solution offerings that combine products with services. Digital transformation initiatives are reshaping customer engagement, with companies developing online tools for product selection, visualization, and contractor connectivity. The industry's evolution toward integrated building solutions creates opportunities for companies to expand beyond traditional roofing products to encompass related building envelope components.

Key Roofing Systems Companies:

Leading companies in the global roofing systems market have established dominant positions through diverse product portfolios, technological leadership, and extensive market presence. GAF, Inc. maintains market leadership in North American residential roofing through comprehensive shingle offerings, strong contractor relationships, and innovative warranty programs. The company's success reflects continuous product innovation, effective marketing strategies, and development of digital tools that enhance contractor efficiency and homeowner engagement.

Owens Corning leverages its expertise in fiberglass technology and composite materials to offer diverse roofing solutions spanning residential and commercial applications. The company's integrated approach combining roofing products with insulation and composite solutions creates synergies across building material categories. Owens Corning's commitment to sustainability includes development of recycled-content products and energy-efficient roofing systems that contribute to green building certifications.

CertainTeed Corporation, a subsidiary of Saint-Gobain, offers comprehensive roofing solutions backed by extensive technical expertise and manufacturing capabilities. The company's product portfolio spans multiple material categories including asphalt shingles, polymer roofing, and solar solutions. Carlisle Companies Incorporated dominates commercial roofing segments through advanced membrane systems, comprehensive warranty programs, and strong contractor training initiatives. The company's focus on single-source solutions for commercial roofing projects creates competitive advantages in large-scale applications.

Additional key players including Atlas Roofing Corporation, CSR Limited, Berkshire Hathaway, Inc. (through multiple building material subsidiaries), The Siam Cement Public Company Limited, Johns Manville, Wienerberger AG, Boral Limited, Compagnie de Saint Gobain SA, Braas Monier Building Group SA, and Etex Group NV contribute to market competition through specialized capabilities, regional market strength, and innovative product offerings. These companies collectively shape industry dynamics through competitive strategies, technological advancement, and market expansion initiatives.

Recent Developments

Recent developments in the roofing systems market reflect accelerating technological innovation, sustainability initiatives, and evolving market dynamics driven by changing customer expectations and regulatory requirements. Manufacturers are introducing advanced products incorporating recycled materials, enhanced performance characteristics, and smart technology integration that transforms traditional roofing into intelligent building systems.

The integration of solar technology with roofing systems represents a significant development trend, with manufacturers developing aesthetically pleasing solar roofing products that seamlessly integrate energy generation with weather protection. These innovations extend beyond traditional rack-mounted solar panels to include solar shingles and tiles that maintain architectural aesthetics while generating renewable energy. Market developments include partnerships between roofing manufacturers and solar technology companies to create integrated solutions that simplify installation and optimize performance.

Digital transformation initiatives are reshaping industry operations, with companies developing sophisticated online platforms for product selection, project visualization, and contractor management. Artificial intelligence and machine learning applications enable predictive maintenance, optimize inventory management, and enhance customer service capabilities. The development of drone technology for roof inspections and measurements represents another technological advancement improving industry efficiency and safety. Sustainability initiatives continue to drive product development, with manufacturers introducing products featuring increased recycled content, improved recyclability, and reduced environmental impact during production.

Roofing Systems Industry Scope

The comprehensive analysis of the roofing systems market encompasses multiple dimensions including product categories, application segments, end-use sectors, and geographic regions to provide holistic understanding of industry dynamics and growth opportunities. Market assessment incorporates quantitative analysis of market size, growth rates, and segment performance complemented by qualitative insights into competitive dynamics, technological trends, and strategic developments.

Product scope includes diverse roofing materials ranging from traditional options such as asphalt shingles, concrete and clay tiles, and metal roofing to advanced solutions including solar-integrated systems, green roofing technologies, and high-performance synthetic membranes. Analysis considers both residential and commercial product categories, recognizing distinct requirements, decision-making processes, and market dynamics across segments. Geographic coverage spans global markets with detailed regional analysis encompassing North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, acknowledging regional variations in market characteristics and growth patterns.

Temporal scope extends from historical analysis establishing market evolution patterns through current market assessment to future projections typically extending to 2030 or 2032, enabling comprehensive understanding of market trajectories and growth opportunities. The analysis framework incorporates multiple data sources including primary research with industry participants, secondary research from published sources, and quantitative modeling to develop robust market insights and forecasts.

Market Dynamics

Understanding the complex interplay of factors driving, restraining, and shaping the roofing systems market is essential for stakeholders developing strategic plans and investment decisions. Market dynamics reflect the convergence of technological advancement, regulatory evolution, economic conditions, and changing customer preferences that collectively influence industry development and competitive positioning.

Driver:

The primary growth driver for the roofing systems market is the continuous expansion of global construction activity fueled by population growth, urbanization trends, and economic development. Increasing expenditures in renovation and redevelopment of commercial and residential buildings create sustained demand for roofing products across both new construction and replacement markets. The aging building stock in developed markets necessitates periodic roof replacement, providing predictable demand patterns independent of new construction cycles.

Energy efficiency requirements and sustainability mandates represent powerful market drivers as governments worldwide implement regulations promoting green building practices and energy conservation. The increasing demand for energy-efficient roofing solutions reflects both regulatory requirements and economic incentives as building owners seek to reduce operational costs through improved thermal performance. Climate change considerations further amplify demand for resilient roofing systems capable of withstanding extreme weather events while contributing to building energy efficiency and urban heat island mitigation.

Technological innovation enables product differentiation and market expansion through development of advanced materials offering superior performance, extended lifespans, and enhanced functionality. The integration of smart technologies, renewable energy systems, and advanced coatings creates value propositions that justify premium pricing and accelerate market adoption. Rising disposable incomes in emerging markets expand the addressable market for quality roofing products as consumers prioritize home improvement and building quality.

Restraint:

Market growth faces constraints from multiple factors including raw material cost volatility, skilled labor shortages, and economic uncertainties that affect construction activity and consumer spending. Fluctuations in petroleum prices directly impact asphalt-based products, while metal price volatility affects metal roofing costs, creating pricing pressures that can constrain demand particularly in price-sensitive market segments.

The availability of skilled roofing contractors represents a significant market constraint, particularly in developed markets experiencing labor shortages in construction trades. Installation quality significantly impacts roofing system performance, making contractor expertise crucial for market development. Labor constraints can limit market growth, increase installation costs, and affect product adoption rates for technically complex roofing systems.

Economic cyclicality inherent in construction markets creates periods of reduced demand that challenge industry participants and limit investment in capacity expansion and innovation. Market maturity in developed regions results in replacement-driven demand patterns that provide stability but limit growth potential compared to emerging markets. Regulatory complexity and varying building codes across jurisdictions create barriers to market entry and increase compliance costs for manufacturers.

Opportunity:

Emerging opportunities in the roofing systems market arise from technological convergence, sustainability imperatives, and evolving customer expectations that create space for innovation and differentiation. The integration of renewable energy generation with roofing systems represents a transformative opportunity as building owners seek to maximize roof utility beyond weather protection. Development of building-integrated photovoltaics (BIPV) and aesthetic solar roofing products addresses market demand for sustainable solutions without compromising architectural design.

Green roofing systems incorporating vegetation provide multiple benefits including stormwater management, thermal insulation, and urban biodiversity enhancement, creating opportunities in urban markets prioritizing environmental sustainability. The growing emphasis on circular economy principles creates opportunities for manufacturers developing recyclable products and implementing take-back programs for end-of-life roofing materials.

Digital transformation presents opportunities for service innovation, customer engagement enhancement, and operational efficiency improvement throughout the value chain. Development of predictive maintenance solutions using IoT sensors and data analytics creates recurring revenue opportunities and strengthens customer relationships. Emerging markets experiencing rapid urbanization and infrastructure development offer substantial growth opportunities for companies capable of adapting products and business models to local market conditions.

Challenges:

The roofing systems market faces significant challenges from intensifying competition, technological disruption, and evolving stakeholder expectations that require continuous adaptation and investment. Price competition particularly in commodity product segments pressures margins and limits investment capacity for innovation and market development. Differentiation becomes increasingly challenging as product performance converges and customers struggle to perceive value differences among competing offerings.

Supply chain complexity and vulnerability exposed during recent global disruptions highlight risks associated with extended global supply networks and just-in-time inventory strategies. Raw material availability, transportation constraints, and geopolitical tensions can disrupt production and limit market service capabilities. Managing supply chain risks while maintaining cost competitiveness requires sophisticated planning and risk management capabilities.

Environmental regulations and sustainability expectations create compliance challenges and investment requirements for manufacturers adapting products and processes to meet evolving standards. The transition toward sustainable products and circular economy principles requires fundamental changes in product design, manufacturing processes, and business models. Balancing sustainability objectives with cost competitiveness and performance requirements represents an ongoing challenge for industry participants.

Segmentation Insights

Comprehensive market segmentation enables detailed analysis of distinct market segments, revealing specific growth patterns, competitive dynamics, and strategic opportunities within each category. The roofing systems market's complexity necessitates multiple segmentation approaches to fully understand market structure and dynamics.

Product segmentation distinguishes among material categories including asphalt shingles, metal roofing, concrete and clay tiles, synthetic products, and specialized systems, each exhibiting unique market characteristics and growth trajectories. Application segmentation separates residential, commercial, and industrial markets, recognizing fundamental differences in decision-making processes, product requirements, and market dynamics. End-use segmentation differentiates between new construction and reroofing markets, acknowledging distinct demand drivers and competitive factors.

Geographic segmentation reveals regional market variations influenced by climate conditions, building traditions, economic development levels, and regulatory frameworks. Analysis at country and sub-regional levels provides granular insights essential for market entry strategies and resource allocation decisions. Temporal segmentation examining historical patterns, current dynamics, and future projections enables comprehensive understanding of market evolution and identification of emerging trends that will shape future industry development.

The roofing systems market's continued evolution reflects the convergence of traditional building practices with advanced technologies and sustainability imperatives, creating a dynamic industry landscape characterized by innovation, competition, and substantial growth opportunities. As the market progresses toward its projected valuation of USD 164.39 Billion by 2030, stakeholders must navigate complex market dynamics, embrace technological advancement, and respond to evolving customer expectations to capture value in this essential component of global construction infrastructure.

Market Segmentation

| Parameter | Details |

|---|---|

| Segment Covered | By Roofing Material

By Application

By Roofing Type

By Region

|

| Companies Covered |

|

| Customization Scope | Enjoy complimentary report customization—equivalent to up to 8 analyst working days—with your purchase. Customizations may include additions or modifications to country, regional, or segment-level data. |

| Pricing and purchase options | Access flexible purchase options tailored to your specific research requirements. Explore purchase options |

FAQ‘s

- How do I know if my roof needs to be replaced?

Several signs indicate the need for roof replacement. Look for curled, cracked, or missing shingles, water leaks or stains on interior ceilings, and consider the age of your roof - particularly if it's over 20 years old. Other warning signs include excessive granule loss from asphalt shingles, sagging roof deck, daylight visible through roof boards, and significant moss or algae growth. Full replacement becomes necessary when over 25 percent of the roof is flawed, or when property owners want to utilize the latest technological developments in roofing systems for a long-term solution.

- How long do different roofing systems typically last?

The lifespan of roofing systems varies significantly by material type. Asphalt shingle roofs, the most common residential option, typically last 20-30 years, while metal roofs can last 30-70 years depending on the specific metal and coating used. Clay and concrete tiles often exceed 50 years with proper maintenance, and slate roofs can last over a century. The longevity depends on factors including material quality, installation proficiency, climate conditions, and regular maintenance.

- What factors affect the cost of a new roof?

Multiple factors influence roofing costs. Roof size is primary - larger roofs require more materials and labor. Roofing materials vary widely in price, with asphalt shingles being generally less expensive while metal, tile, and slate cost significantly more. Labor costs can account for up to 60% of the total expense, with complex installations or steep-pitch roofs requiring skilled labor that increases costs. Additional factors include necessary repairs to underlying structures, geographic location affecting labor rates and material availability, required permits, and the complexity of the roof design.

- Should I repair or replace my roof?

The decision depends on the extent of damage and your long-term goals. Minor repairs are suitable for extending roof life when damage is localized and affects less than 25% of the roof surface. Recovering an existing roof is an option if good insulation is in place and can be far less expensive than full replacement, though it can only be done once. Full replacement is recommended when damage exceeds 25% of the roof area, when multiple layers already exist, or when you want to upgrade to more energy-efficient or durable materials.

- Can I install a new roof over my existing one?

While it's possible to layer a new roofing system over an existing one in some cases, it's often better to remove the old roof to inspect and address any underlying issues. Asphalt shingles can often be applied directly over existing roofs, but new shingles cannot be properly applied over hard or brittle materials, uneven surfaces, or roof decks with warped, rotted, or unsound support. Some local ordinances forbid reroofing over two or more layers of shingles, making removal necessary.

- How does geographic location impact roofing choices?

The geographic location of your building plays a significant role in roof choice. Buildings in different regions experience variations in annual rainfall, wind velocity, and potential snowfall that affect material selection. In Texas, for example, high winds and hail are primary concerns, requiring products tested to ASTM D 3161 with 110 mph wind resistance or higher and UL 2218 Class 4 impact-resistant ratings. The direction your building faces and roof orientation also influence optimal system selection.

- Are energy-efficient roofing options available?

Yes, numerous energy-efficient options exist. Reflective roof systems and cool roofing technologies help reduce cooling costs by reflecting UV rays away from the building. Increasing insulation in the roofing system is an alternate method to help meet energy goals. Metal roofs with reflective coatings, tile systems with natural thermal mass, and specialized asphalt shingles with reflective granules all contribute to energy efficiency. Some systems may qualify for ENERGY STAR certification, providing additional cost savings through utility rebates.

- What type of roofing system is right for my building?

Roofing options can be extensive, and selection depends on building type and usage. Common commercial options include built-up roofing (BUR) with multiple layers bonded together, TPO roofs that are fire-resistant and durable, single-ply roofing for exceptional weatherability, and tapered insulation systems ideal for flat roofs without adequate slope. Retail businesses, shopping centers, or hospitals have different roofing needs than warehouse facilities - warehouses require solid roofs to protect valuable goods, while retail buildings may prioritize aesthetics alongside functionality.

- How often should I inspect my roof?

Regular roof inspections are crucial for identifying problems early and extending roof life. Professional inspections should be conducted at least annually, with additional checks after severe weather events. Homeowners should perform visual inspections from the ground seasonally, looking for obvious damage like missing shingles or sagging areas. Immediately inspect your roof for visible damage after severe storms, and contact a roofing professional if you notice any issues for thorough inspection and necessary repairs.

- What should I ask roofing contractors before hiring them?

Essential questions include verifying the company's insurance and licensing status, requesting references and reviews from past clients, and understanding warranty offerings. Ask about their business experience and how long they've been operating, ensure they use trained and certified installers, and obtain multiple quotes for comparison. Inquire about workmanship warranties that cover installation issues separate from manufacturer material warranties. Also confirm whether your old roof needs removal, what happens if additional repairs are discovered during installation, and the expected timeline for project completion.