North American Medical Plastics Prices Edge Higher as Feedstock Volatility and Single-Use Device Demand Drive Market Momentum

Stay informed on North American medical plastics price trends for February 2026. Explore how feedstock volatility and single-use demand are shaping the market.

For the current week of February 2026, the North American medical plastics market is experiencing a modest upward price movement. This trend is largely attributed to fluctuating petrochemical feedstock costs and tightened regional supply for high-performance resins. While commodity-grade polymers remain relatively stable, medical-grade specialty resins are commanding increased premiums due to stringent quality control, sterilization requirements, and logistical bottlenecks affecting the broader chemical supply chain.

The primary catalyst for market growth in 2026 is the demographic shift toward an aging population in the United States and Canada. This shift results in a higher prevalence of chronic conditions (such as diabetes and cardiovascular diseases) which necessitates frequent medical interventions.

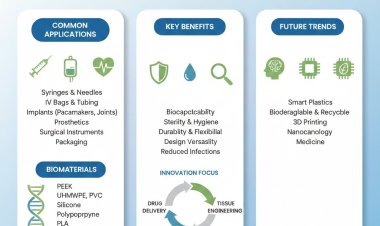

- Home Healthcare Expansion: A significant "hospital at home" trend is driving demand for hygiene-related plastics and self-administration tools (e.g., insulin pens, continuous glucose monitor housings, and wearable infusion pumps).

- Infection Control: Hospitals continue to prioritize single-use disposables to minimize cross-contamination risks, which ensures consistent, high-volume demand for medical-grade polyethylene and polypropylene.

- Surgical Innovation: The rise in minimally invasive surgical procedures requires high-precision, biocompatible polymer components that can replace traditional metal or glass materials.

Supply and Production

Regional resin availability is currently constrained by planned maintenance shutdowns at major North American steam crackers. These outages, combined with sporadic logistics bottlenecks in the Gulf Coast region, have reduced the immediate spot availability of medical-grade Polyvinyl Chloride (PVC) and Polyethylene (PE).

|

Polymer Category |

Current Price Trend |

Key Production Insight |

|

PVC (Medical Grade) |

Upward Pressure |

Westlake Corporation is expanding capacity with a new plant in Texas. |

|

Polypropylene (PP) |

Stable to Firm |

Supply is balanced, but feedstock costs remain sensitive to oil volatility. |

|

Engineering Plastics (PEEK/PC) |

Elevated |

High-margin specialty polymers face longer lead times for validation. |

|

Thermoplastic Polyurethane (TPU) |

Increasing |

Driven by rapid adoption in wearable diagnostic devices. |

Leading producers such as Lubrizol and Dow Inc. are focusing on scaling production for specialty resins that offer enhanced chemical resistance and sterilization compatibility (specifically for gamma radiation and ethylene oxide processes).

The demand outlook for the North American sector remains robust through the first half of 2026. Healthcare providers are increasingly incorporating sustainability metrics into their procurement contracts, which is creating a secondary market for bio-based polymers (like polylactic acid) in non-critical applications. Furthermore, the integration of antimicrobial additives into plastic formulations is becoming a standard requirement for hospital equipment and patient-contact surfaces.

Over the next quarter, medical plastic prices are expected to remain elevated but will likely reach a plateau as cracker operations return to full capacity. Analysts project a $7.3\%$ Compound Annual Growth Rate (CAGR) for the North American segment through the fiscal year. Any additional volatility in crude oil or natural gas markets may prompt resin producers to implement temporary energy surcharges. However, the steady volume of elective surgeries and the continued rollout of advanced diagnostic kits will provide a solid demand floor, preventing any significant price retreats in the near term.