Bancassurance Market Trends in Market Growth: Size, Demand, and Key Players Analysis for 2032

Explore the global bancassurance market, including market size, share, trends, and key players driving industry growth.

The global Bancassurance market research report discovers the current outlook in global and key regions from the viewpoint of Major Players, Countries, Product Types, and end industries. This report studies top players in the global market and divides the Market into several parameters.

This Bancassurance Market research report pinpoints the competitive landscape of industries to understand the competition at the International level. This report study describes the projected growth of the global market for approaching years from 2024 to 2032. This research report has been accumulated based on static and dynamic views of the businesses.

Click the link to GET a Free Sample Copy of the Report:

https://www.vantagemarketresearch.com/bancassurance-market-1686/request-sample

Key players featured in this report include ABN AMRO Bank N.V., The Australia and New Zealand Banking Group Limited, Banco Bradesco SA, The American Express Company, Banco Santander S.A., BNP Paribas S.A., The ING Group, Wells Fargo & Company, Barclays plc, Intesa Sanpaolo S.p.A., Lloyds Banking Group plc, Citigroup Inc., Crédit Agricole Group, HSBC Holdings plc, NongHyup Financial Group, Société Générale S.A., Nordea Group and others.

Bancassurance Market: Bancassurance, the partnership between banks and insurance firms to offer insurance products, is growing due to the accessibility and wide reach of banking networks. Demand for bancassurance is particularly high in regions with underpenetrated insurance markets. Innovations in digital platforms are enhancing customer experience and streamlining the distribution of insurance products through banks.

Scope of the Bancassurance Market:

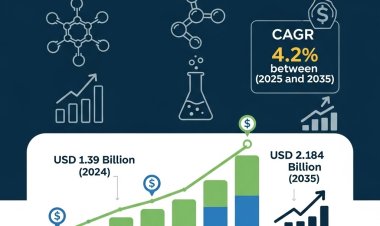

The Global Bancassurance Market is anticipated to rise at a considerable rate during the forecast period, between 2024 and 2032.In 2024, the market is growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

The global Bancassurancemarket segmentation and market data are broken down as follows:

By Product Type

- Life Bancassurance

- Non-Life Bancassurance

By Model Type

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

Reporting objectives

-Carefully analyze and forecast the size of Bancassurance market by value and volume.

– Estimated market share of major Bancassurance market segments

-To showcase the development of Bancassurance market in different regions of the world.

-Analyse and study the micro market contribution, prospects and individual growth trends of the Bancassurance market.

-Provides precise and useful details on factors affecting Bancassurance growth

-Detailed assessment of key business strategies used by leading companies in the Bancassurance market, including R&D, collaborations, agreements, partnerships, acquisitions, mergers, new developments and product launches.

Hurry! Exclusive Deal Alert: Enjoy a Flat 40% Black Friday Discount on This Report. Buy Now!

https://www.vantagemarketresearch.com/buy-now/bancassurance-market-1686/0

Bancassurance Market Growth Impact:

Growth in the bancassurance market allows insurance providers to leverage banking networks, increasing customer access to insurance products. This contributes to higher insurance penetration, especially in underinsured regions, and fosters financial inclusivity. Additionally, it opens revenue streams for banks, strengthening their role in the financial services ecosystem.

Geographically, detailed analysis of consumption, revenue, market share and growth rate in:

– Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

– North America (United States, Mexico and Canada)

– South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

– Europe (Turkey, Spain, Turkey, Netherlands, Denmark, Belgium, Switzerland, Germany, Russia, United Kingdom, Italy, France, etc.)

– Asia Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, South Korea, Thailand, India, Indonesia and Australia).

Key market trends in the bancassurance market include:

- Increasing Consumer Demand for Convenience: The integration of banking and insurance services under one platform is appealing to customers seeking convenient, one-stop financial solutions, boosting bancassurance adoption.

- Digital Transformation: The rise of digital banking and online insurance platforms is driving the adoption of bancassurance, as digital channels enable seamless policy sales, renewals, and claim processing.

- Growth in Emerging Markets: Emerging economies, particularly in Asia-Pacific, Latin America, and Africa, are experiencing significant growth in bancassurance due to rising financial inclusion, increasing disposable incomes, and expanding banking networks.

- Product Diversification: Bancassurance providers are offering a broader range of insurance products, including life, health, property, and travel insurance, to cater to diverse customer needs and enhance cross-selling opportunities.

- Regulatory Support and Evolving Frameworks: Regulatory changes in many regions are fostering bancassurance growth by enabling flexible partnership models and encouraging insurance penetration through banks.

- Adoption of AI and Analytics: Banks and insurers are leveraging artificial intelligence and advanced data analytics to personalize offerings, improve risk assessment, and optimize customer targeting, enhancing overall service delivery.

- Emphasis on Cross-Selling and Upselling: Banks are focusing on cross-selling insurance products to their existing customer base, utilizing their extensive customer relationships and data insights to drive growth.

- Partnership Expansion and Alliances: Collaboration between banks and insurance companies is becoming more dynamic, with partnerships evolving to include co-branded products and exclusive distribution agreements.

- Increased Focus on Retirement and Health Products: As aging populations grow and healthcare costs rise, bancassurance channels are increasingly emphasizing retirement planning and health insurance products.

Contents of the table:

Chapter 1: Bancassurance market Overview

Chapter 2: The impact of the global economy on industry

Chapter 3: global market Competition of Major Players

Chapter 4: global Production, Revenue (Value) by Region

Chapter 5: global supply (production), consumption, export, import (by region)

Chapter 6: global Production, Revenue (Value), Price Trend by Type

Chapter 7: global market Analysis by Application

Chapter 8: Manufacturing Cost Analysis

Chapter 9: Industrial chain, procurement strategy and downstream buyers

Chapter 10: marketing Strategy Analysis, Distributors/Traders

Chapter 11: Analysis of market influencing factors

Chapter 12: global Bancassurance market Forecast

….

Accepting our comments and subscribing to our reports will help you with follow-up questions:

– Future Uncertainty of Bancassurancemarket: Our research and insights help our clients predict the upcoming revenue and growth areas.

– Understand market sentiment: A fair understanding of market sentiment is important for your strategy. Our insights will help you understand Bancassurance market sentiment with every pair of eyes. We maintain this analysis by working with key opinion leaders across the value chain in each industry we track.

– Understand the most reliable investment centers: Our research evaluates the investment centers on the market, considering future demand, profits and returns. Clients can focus on the most prestigious investment centers through Bancassurance market research.

– Evaluate potential business partners: Our research and insights help our clients identify compatible business partners.

We offer report customization based on our clients’ specific requirements:

– Country-level analysis for 5 countries of your choice.

– Competitive analysis of 5 key market players.

– 40 free analyst hours to cover any additional data points.

Thank you for taking the time to read our article…!!

About Vantage Market Research:

We, at Vantage Market Research, provide quantified B2B high-quality research on more than 20,000 emerging markets, in turn helping you map out a constellation of opportunities for your businesses. We, as market intelligence, market research and consulting firm provide end-to-end solutions to our client enterprises to meet their crucial business objectives. Our clientele base spans 70% of Global Fortune 500 companies.

☎ Contact Us:

224 W 35th St Ste 500 New York,

NY 10001 United States

United States Tel: +1 202 380 9727

✉ Email: [email protected]

???? Website: https://www.vantagemarketresearch.com

Shruti

Shruti