Breast Imaging Market Size, Trends & Growth Forecast 2024-2035 | Global Insights

Explore the global breast imaging market, including size, share, trends, and growth forecasts from 2024 to 2035. Learn about key drivers, technologies, leading companies, and regional insights shaping the future of breast cancer diagnostics.

Breast Imaging Market: Insights, Trends, and Future Prospects

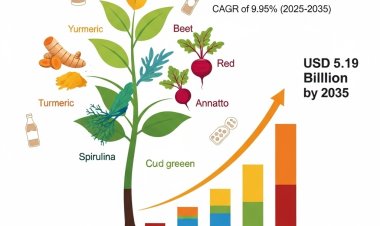

The global breast imaging market is undergoing a significant transformation, driven by technological advancements, increased awareness, and a growing focus on early detection of breast cancer. According to Vantage Market Research, the market is valued at USD 5.68 billion in 2024 and is projected to reach USD 15.86 billion by 2035, expanding at a robust CAGR of 9.85% from 2025 to 2035. This impressive growth is fueled by a surge in research grants, a heightened emphasis on contrast-based diagnostic solutions, and rising awareness in developing economies. As breast cancer remains one of the most prevalent cancers among women worldwide, the demand for advanced imaging solutions is expected to soar, making breast imaging a critical component of modern healthcare.

Get a Sample Copy:- https://www.vantagemarketresearch.com/breast-imaging-market-1390/request-sample

Key Takeaways

- The global breast imaging market is valued at USD 5.68 billion in 2024 and is projected to reach USD 15.86 billion by 2035, growing at a CAGR of 9.85%.

- Rising prevalence of breast cancer worldwide is a major driver for the increased demand for advanced breast imaging technologies.

- Technological advancements, such as hybrid imaging systems and AI-powered mammography, are revolutionizing breast cancer diagnostics.

- Government initiatives and awareness campaigns are significantly boosting early detection and screening rates, especially in developed countries.

- High equipment costs and concerns over radiation exposure remain key restraints for market growth, particularly for smaller healthcare providers.

- North America currently dominates the market, but Asia-Pacific is expected to experience the fastest growth due to rising cancer rates and healthcare investments.

- Hospitals are the leading end-users of breast imaging technologies, but diagnostic imaging centers are rapidly expanding their market share.

- Key market players include Hologic, GE Healthcare, Siemens Healthineers, Philips, Fujifilm, and Canon, among others.

- Emerging economies present significant growth opportunities due to increasing awareness, large population bases, and supportive government policies.

- Ongoing research and product innovation are expected to further enhance the accuracy, sensitivity, and patient comfort of breast imaging modalities.

Report Overview

The breast imaging market is shaped by several key factors, including the rising prevalence of breast cancer, continuous technological breakthroughs, and substantial investments in screening programs. The World Cancer Research Fund projects that by 2030, global breast cancer cases will reach approximately 2.1 million. The World Health Organization reported over 2.3 million new cases and 685,000 deaths in 2020 alone. Early and accurate diagnosis through breast imaging is essential for improving survival rates, prompting governments and organizations to launch awareness campaigns and screening initiatives.

For example, Australia’s Breast Screen program offers free mammograms to women aged 50-74, while the U.S. National Breast Cancer Foundation provides free mammography and diagnostic services. In Canada, collaborative efforts between the Canadian Cancer Society and Stand Up to Cancer Canada have led to significant funding for clinical trials and awareness campaigns. These initiatives have proven effective in saving lives and are expected to further drive market growth.

Technological innovation is another major catalyst. Hybrid imaging systems that combine modalities such as CT, MRI, and PET scans are enhancing diagnostic accuracy, patient comfort, and safety. Manufacturers are increasingly focused on developing products that improve sensitivity and precision, as seen with Seno Medical Instruments’ recent FDA-approved technology for differentiating malignant and benign breast lesions. However, challenges such as high equipment costs and concerns over radiation exposure remain barriers to widespread adoption.

Geopolitical events, such as the Russia-Ukraine war, have also impacted healthcare infrastructure, disrupting primary care and screening programs. International organizations, including the WHO, are mobilizing resources to support affected regions, highlighting the need for resilient healthcare systems and continued investment in diagnostic technologies.

Key Companies & Market Share Insights

The breast imaging market is highly competitive, with major players like Hologic, GE Healthcare, Siemens Healthineers, Philips, Fujifilm, and Canon leading the way. These companies are investing heavily in research and development to maintain their market share and introduce innovative products. Meanwhile, mid-size and smaller firms are gaining traction by offering cost-effective solutions and reducing procedural side effects. The competitive landscape is characterized by rapid technological advancements and a focus on reducing costs, which is expected to benefit end-users and accelerate market growth.

Latest News and Developments:

- November 2024: GE HealthCare introduced the Pristina Via mammography system, enhancing patient and technologist experience with vendor-neutral prior image comparison and lower radiation doses for all breast thicknesses.

- November 2024: Hologic, Inc. launched the Envision Mammography Platform at RSNA, offering a high-speed 3D mammogram with an industry-leading scan time of 2.5 seconds.

- June 2024: FUJIFILM's India Healthcare Division, in collaboration with NM Medical Mumbai, established the first Skill Lab to provide advanced training in full-field digital mammography technologies for radiologists and radiographers.

- May 2022: The QUSTom project, coordinated by the Barcelona Supercomputing Center, was launched to develop a new ultrasound and supercomputing-based imaging modality as an alternative to X-ray mammograms.

- March 2022: University of Notre Dame researchers designed the NearWave Imager, a novel non-invasive imaging device for breast cancer detection.

- June 2022: GE Healthcare partnered with the National Cancer Centre Singapore (NCCS) to explore personalized cancer treatment options using artificial intelligence and text processing.

- 2022: Siemens Healthcare GmbH expanded its ultrasound portfolio with the refreshed Acuson family systems, offering enhanced clinical adaptability for routine use.

- 2021: Hologic launched the SuperSonic MACH 20 ultrasound system, improving diagnostic accuracy and efficiency with superior image quality and innovative imaging modes.

- November 2020: Densitas, Inc. partnered with Mammography Educators, LLC to develop an AI-powered telehealth technician training platform for mammography clinics.

- 2020: GE HealthCare introduced Serena Bright, the industry’s first contrast-enhanced guided biopsy solution, enabling clinicians to perform breast biopsy exams with contrast guidance using standard mammography equipment.

Global Breast Imaging Market Dynamics

Driver: Rising Incidence of Breast Cancer

The increasing incidence of breast cancer globally is the primary driver of the breast imaging market. Governments and healthcare organizations are prioritizing early detection, leading to greater demand for advanced imaging equipment. According to the American Cancer Society, breast cancer is the second-leading cause of cancer-related deaths among women, with over 2.2 million new cases and nearly 685,000 deaths reported in 2020. This trend underscores the urgent need for effective diagnostic tools.

Restraint: High Equipment Costs

Despite technological progress, the high cost of breast imaging equipment remains a significant barrier, particularly for smaller healthcare providers. Advanced features, automation, and AI integration have driven up prices, making it difficult for some facilities to invest in the latest technologies without external funding.

Opportunity: Growth Potential in Emerging Countries

Emerging economies such as India, China, Brazil, and South Africa present substantial growth opportunities due to their large populations and increasing awareness of breast cancer. Government initiatives, such as India’s Ayushman Bharat insurance scheme, are improving access to diagnostic imaging and driving market expansion in these regions.

Challenges:

While imaging technologies have improved, challenges such as lower sensitivity in dense breast tissue, false positives, and patient discomfort persist. Overdiagnosis and unnecessary treatments remain concerns, highlighting the need for continued innovation and improved accuracy in breast imaging modalities.

Technology Insights

Ionizing technologies, including mammography, currently dominate the breast imaging market, accounting for over 63% of the market share in 2022. Ongoing advancements and significant investments in ionization-based technologies are expected to drive further growth. Mammography remains the gold standard for breast cancer screening due to its accuracy and widespread adoption. Innovations such as AI-powered mammography systems, like Fujifilm’s ASPIRE Cristalle, are enhancing diagnostic capabilities and reducing the workload for healthcare professionals. These technological advancements are expected to further boost the market in the coming years.

End-use Insights

Hospitals are the primary end-users of breast imaging technologies, holding a 42.2% revenue share in 2022. The availability of advanced imaging facilities within hospitals improves patient outcomes and reduces overall healthcare costs. However, the high cost and maintenance requirements of imaging equipment can be a barrier for some hospitals, leading to partnerships with diagnostic imaging centers. These centers are experiencing significant growth, particularly in developed and developing countries, as awareness of breast cancer and the need for early detection increases.

Regional Insights

North America leads the global breast imaging market, accounting for 37.8% of revenue in 2022. The high prevalence of breast cancer, supportive screening guidelines, and rapid adoption of new technologies are key factors driving growth in this region. The U.S. alone is expected to see nearly 288,000 new cases of invasive breast cancer in 2022. Companies are investing in R&D to develop innovative imaging solutions, such as iSono Health’s portable 3D breast imaging system, which received FDA approval in 2022.

Asia-Pacific is poised for the fastest growth, driven by rising breast cancer rates, increased R&D investments, and advancements in imaging modalities. Countries like China, Japan, and India are at the forefront of this expansion, supported by improving healthcare infrastructure and efforts by key market players to enter these emerging markets.

The breast imaging market is set for robust growth, propelled by rising breast cancer incidence, technological innovation, and expanding awareness and screening programs worldwide. While challenges such as high equipment costs and diagnostic limitations persist, ongoing research, government initiatives, and the entry of new players are expected to drive the market forward. As healthcare systems continue to prioritize early detection and improved patient outcomes, breast imaging will remain a cornerstone of cancer diagnostics and care, offering significant opportunities for stakeholders across the globe.

Market Segmentation

| Parameter | Details |

|---|---|

| Segment Covered | By Type of Imaging Technique

By End Users

By Regions

|

| Companies Covered |

|

| Customization Scope | Enjoy complimentary report customization—equivalent to up to 8 analyst working days—with your purchase. Customizations may include additions or modifications to country, regional, or segment-level data. |

| Pricing and purchase options | Access flexible purchase options tailored to your specific research requirements. Explore purchase options |

FAQ

- What is the current size and projected growth rate of the global breast imaging market?

- What are the main factors driving the growth of the breast imaging market?

- Which technologies are most commonly used in breast imaging, and how are they evolving?

- Who are the leading players in the breast imaging market, and what are their market shares?

- How does the prevalence of breast cancer impact the demand for breast imaging solutions?

- What are the major challenges and restraints faced by the breast imaging market?

- Which regions are expected to witness the fastest growth in the breast imaging market?

- How are government initiatives and screening programs influencing market growth?

- What opportunities exist for market players in emerging economies?

- How is artificial intelligence (AI) transforming breast imaging technologies and diagnostics?