Breast Pump Market Size, Trends & Forecast 2024-2035 | VMR

Explore the booming Breast Pump Market—valued at USD 3.23 Billion in 2024 and set to hit USD 8.12 Billion by 2035 (8.75 % CAGR). Discover key drivers, wearable tech breakthroughs, regional insights, and top brands like Medela, Willow, and Elvie in this comprehensive industry analysis.

Breast Pump Market Insights

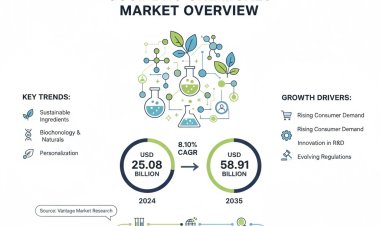

The global Breast Pump Market is valued at USD 3.23 Billion in 2024 and is projected to reach USD 8.12 Billion by 2035, expanding at a robust CAGR of 8.75% between 2025 and 2035. Analysts at Vantage Market Research attribute this surge to a perfect storm of social, economic, and technological forces: rising breastfeeding awareness, record-high female labor-force participation, rapid urbanization, generous reimbursement policies, and an e-commerce boom that puts hospital-grade technology one click away from every new parent. According to the National Institutes of Health, more than 85 % of U.S. mothers with healthy newborns express milk within the first four months postpartum, and the majority rely on a breast pump to do so—proof that pumping has quietly become the new normal in modern infant feeding.

Get a Sample Copy:- https://www.vantagemarketresearch.com/breast-pump-market-1643/request-sample

Report Overview

Macro trends are converging to accelerate demand. The Economic Survey 2025 shows India’s female labor-force participation rate jumped 18.4 % in five years, while Statistics Canada reports 9.6 million Canadian women were employed in September 2023—up 2.7 % year-over-year. Governments are translating these numbers into action: the WHO/UNICEF Baby-Friendly Hospital Initiative (BFHI) now guides more than 150 countries in evidence-based breastfeeding support, and in August 2024 Momcozy teamed up with the American College of Nurse-Midwives to run a 10-part webinar series that reached 120 000 new and expectant parents. Sarah O’Leary, CEO of Willow and mother of two, sums up the cultural shift: “It’s time for our breastfeeding conversations to be more inclusive of pumping and align with real experiences.”

Coverage is improving as well. In the United States, Medicare Part B reimburses 80 % of the cost of a breast pump (excluding disposables), while the U.K.’s National Health Service offers pumps on loan through 15 milk banks coordinated by the European Milk Bank Association. These safety nets remove cost barriers and reinforce the medical consensus that human milk is a public-health imperative.

Market Dynamics

Driver – Increasing Number of Women Employed

The single biggest catalyst is the global rise in working mothers. From Berlin to Bangalore, companies now provide lactation rooms, flexible schedules, and even subsidized wearable pumps to retain female talent. The International Labour Organization estimates the global female workforce has grown 50 % in the past two decades, turning time-pressed professionals into the core customer segment for efficient, discreet pumping solutions.

Restraint – Risk of Injuries

Yet growth is not frictionless. Improper flange sizing, aggressive suction settings, and inadequate sterilization can lead to mastitis, cracked nipples, or thrush—outcomes that still carry a stigma and can deter first-time users. Education campaigns and smarter product design (auto-shutoff sensors, soft-fit flanges, hospital-grade silicone) are emerging to mitigate these risks.

Opportunity – Wearable Pumps

The next frontier is wearable, hands-free technology. Devices such as Willow 360 and Elvie Stride slip inside a bra, collect milk in spill-proof bags, and sync with smartphone apps to track volume and feeding patterns in real time. Analysts forecast wearables will command 35 % of the electric segment by 2030, driven by millennial and Gen-Z mothers who refuse to choose between career momentum and breastfeeding goals.

Competitive Landscape

Medela AG, Koninklijke Philips N.V., Lansinoh, Pigeon, Spectra Baby USA, Willow Innovations, Elvie (Chiaro Technology), Motif Medical, Ameda (Magento Inc.), and Hygeia Health dominate the field. Their playbooks include:

- Heavy R&D: Medela’s Sonata SmartConnect and Philips Avent’s Natural Motion technology cut pumping time by up to 50 %.

- Portfolio expansion: Ameda now offers both hospital-grade Platinum pumps and pocket-size manual options.

- Strategic alliances: Boots UK + Momcozy (March 2024) and Walmart + Willow (October 2024) widen retail footprints overnight.

- Digital ecosystems: Apps that pair pumps with tele-lactation consults, AI-driven flange-fit quizzes, and subscription-based replacement-part deliveries.

Technology Insights

Electric pumps captured 49 % of unit sales in 2022 and are forecast to post the fastest CAGR. Double-electric models such as Spectra S1 and Ameda Mya Joy reduce expression time to 10–15 minutes, while noise-dampening motors make bedside or office pumping less intrusive. Manual pumps, meanwhile, remain popular as low-cost back-ups and for occasional use.

Product Insights

Closed-system designs—where a physical barrier prevents milk from entering the tubing or motor—generated the highest revenue in 2022 and are expected to outpace open systems through 2035. Products like the Ameda HygieniKit and Spectra Backflow Protector virtually eliminate contamination risk and simplify cleaning, a decisive advantage for hospitals and hygiene-conscious parents.

Application Insights

Hospital-grade pumps (multi-user, FDA-cleared, >250 mmHg suction) accounted for 60 % of revenue in 2022. NICUs, birth centers, and milk banks rely on these workhorses to initiate and maintain lactation in critically ill or preterm infants. Personal-use pumps are catching up quickly, however, as insurers now cover double-electric models for home use and as telehealth lactation support normalizes early discharge.

Regional Insights

North America – 52.41 % of global revenue in 2024

The U.S. leads with high disposable income, strong insurance mandates, and a 3.3 % female unemployment rate in 2023. Amazon, Target, and Walmart each list more than 50 pump SKUs, and 46 states have adopted the PUMP Act, requiring employers to provide break time and private space for lactation.

Europe – Fastest-growing developed region

Germany’s 73 % female employment rate and generous 14-month parental leave create a sweet spot for premium wearables. The U.K. Baby Friendly Initiative and 15 milk banks underpin steady demand, while France and the Nordics subsidize pumps through national health services.

Asia-Pacific – Highest absolute growth

China’s 60.5 % female labor-force participation and exploding middle class make it the region’s profit engine. Local disruptors like KISSBOBO (M1 pump, 19 suction levels) and Horigen are undercutting Western prices by 30–40 %. India’s LFPR rose 23 percentage points from 2017-18 to 2023-24, and government programs such as Pradhan Mantri Matru Vandana Yojana now provide nursing mothers with â‚ą5 000 ($60) vouchers redeemable for pumps.

Latin America – Brazil and Argentina lead urban adoption, aided by MercadoLibre’s same-day delivery and public-health campaigns like “Amamenta e Alimenta Brasil.”

Middle East & Africa – Saudi Arabia’s Vision 2030 mandates female workforce expansion, while South Africa’s Netcare hospitals rolled out hospital-grade pump rentals in 2023, seeding long-term demand.

The breast pump market is no longer a niche segment hidden in the back aisle of a pharmacy; it is an $8-billion-plus intersection of women’s health, workplace equity, and cutting-edge med-tech. As wearables get quieter, smarter, and smaller, and as governments and employers double down on breastfeeding support, the question is not whether the market will grow—it is how quickly innovators can keep pace with the real, messy, beautiful lives of modern mothers.

Market Segmentation

| Parameter | Details |

|---|---|

| Segment Covered | By Product

By Technology

By Application

By Region

|

| Companies Covered |

|

| Customization Scope | Enjoy complimentary report customization—equivalent to up to 8 analyst working days—with your purchase. Customizations may include additions or modifications to country, regional, or segment-level data. |

| Pricing and purchase options | Access flexible purchase options tailored to your specific research requirements. Explore purchase options |

Frequently Asked Questions (FAQs)

- What is the current global market size of the breast pump industry and what is its projected value by 2035?

- What is the expected compound annual growth rate (CAGR) of the breast pump market between 2025 and 2035?

- Which key factors are driving the rapid expansion of the breast pump market worldwide?

- How does rising female labor-force participation influence breast pump demand across different regions?

- What role do government initiatives and insurance reimbursement policies play in accelerating market growth?

- How are wearable, hands-free breast pumps reshaping consumer preferences and market dynamics?

- What are the main technological differences between open-system and closed-system breast pumps?

- Why do hospital-grade pumps currently account for the largest revenue share, and will this trend continue?

- Which geographic regions are expected to witness the highest growth in breast pump adoption and why?

- What risks or challenges—such as injury or infection—are associated with breast pump use, and how are manufacturers addressing them?